Binance trading volume hits April high despite CZ’s exit

- Binance daily trading volume has increased to a $10 billion average, suggesting no major decline in usage.

- New CEO Richard Teng suggested the company will focus on becoming a traditional financial company.

- Teng stated institutions will result in crypto users growing from 5% today to 20% of the global population soon.

Binance is going through what is known in the traditional finance world as a stress test. The recent fiasco that ended up with the resignation of Changpeng Zhao has set the exchange up for an opportunity to showcase its resilience, and against market expectations, it is standing strong.

Binance shows signs of resilience despite CZ exit

Binance was expected to lose its customer base and the total volume of assets traded on the platform after the founder and former Chief Executive Officer (CEO) Changpeng Zhao (CZ) resigned last week. The crackdown of the government of the United States and the Department of Justice on Binance and CZ was unexpected bearishness.

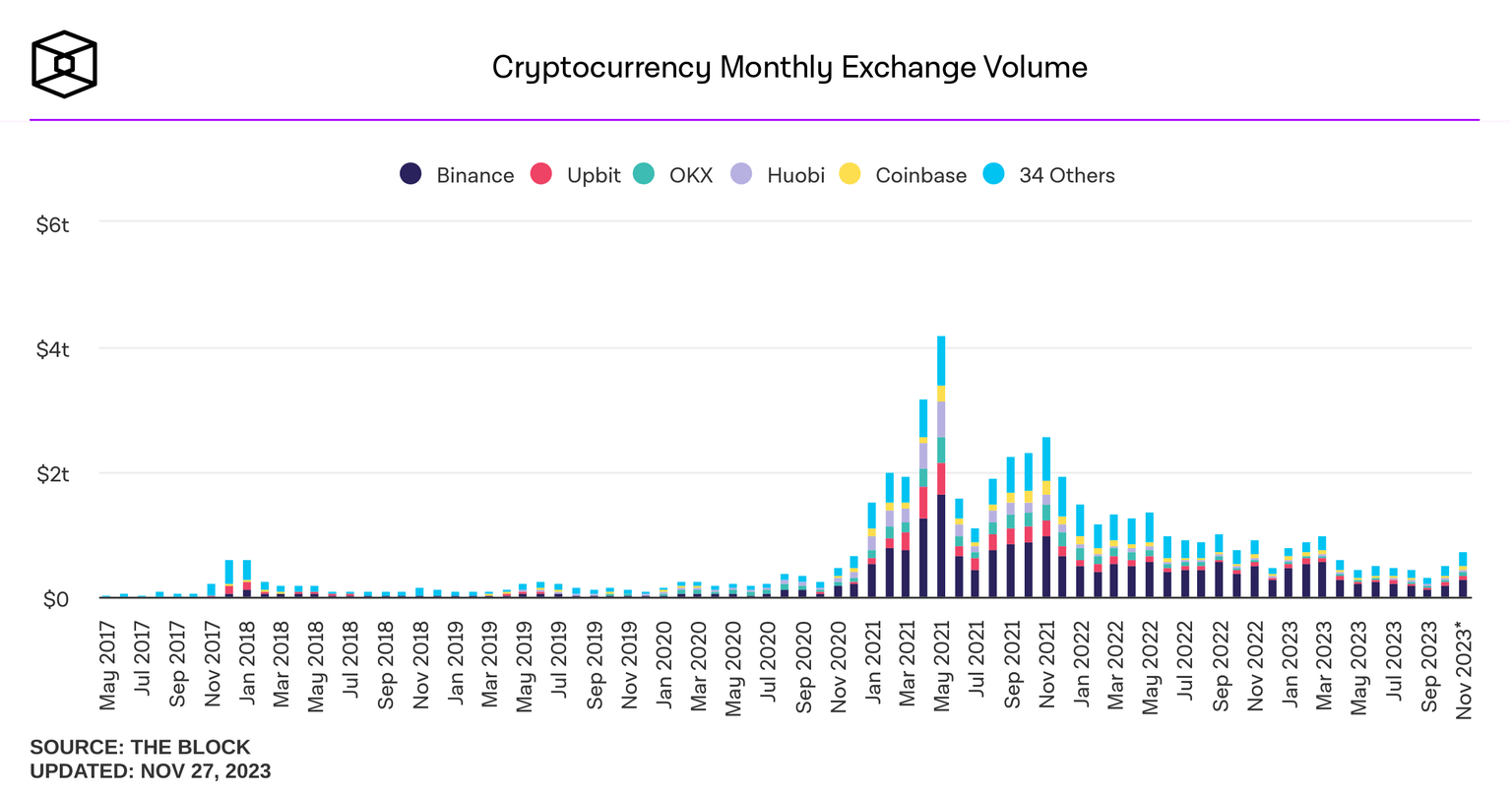

Surprisingly, however, the crypto exchange did not witness a drawdown in the activity but instead a surge. The monthly trading volume on the exchange rose from $201 billion in October to $272.5 billion month to date. This shows that the average daily trading volume has risen from $6.4 billion to $10.2 billion.

Binance trading volume

The last time Binance observed trading volume this high on average was back in April this year, marking a seven-month high.

Binance monthly trading volume

Disproving the bearish woes, Binance is proving its dominance in the industry, validating its new CEO’s words.

New Binance CEO believes in growth

Richard Teng, the person who replaced CZ following his criminal indictment and exit from Binance, made his first public post on Monday, since his appointment last week. Teng stated that the exchange will be focused on growing the adoption of web3 and, at the same time, ensuring Binance remains responsible in its efforts.

Teng added that going forward, he would engage in conversations with global policymakers as well. In a report from Fortune, the new Binance CEO stated that the exchange will transform from an unruly technology startup into a traditional financial company. He added that Binance will adopt a traditional corporate structure, including improving transparency in the board of directors, address, and finance.

Lastly, Richard Teng also said that through these measures, Binance plans on capitalizing on an industry that he believes will grow fourfold. Currently, about 5.2% of the entire global population (420 million) people are using crypto, and Teng believes that with institutional money flowing into the space, this percentage will eventually grow to 20%.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.