Binance to list BONK, will this Solana-based meme coin face same fate as PEPE?

- BONK price has nearly doubled in the past week and yielded 35% daily gains, hitting $0.000004501.

- PEPE listing on Binance sent the meme coin soaring to its local top, BONK holders are hopeful of a similar effect.

- BONK is the cryptocurrency with the highest 30-day return when compared to Bitcoin, Ethereum and top altcoins.

BONK, a Solana-based meme coin, has witnessed a massive spike in its price over the past month. BONK price rallied over 1,500% in the past month, doubled in the past week and climbed 32% early on Wednesday.

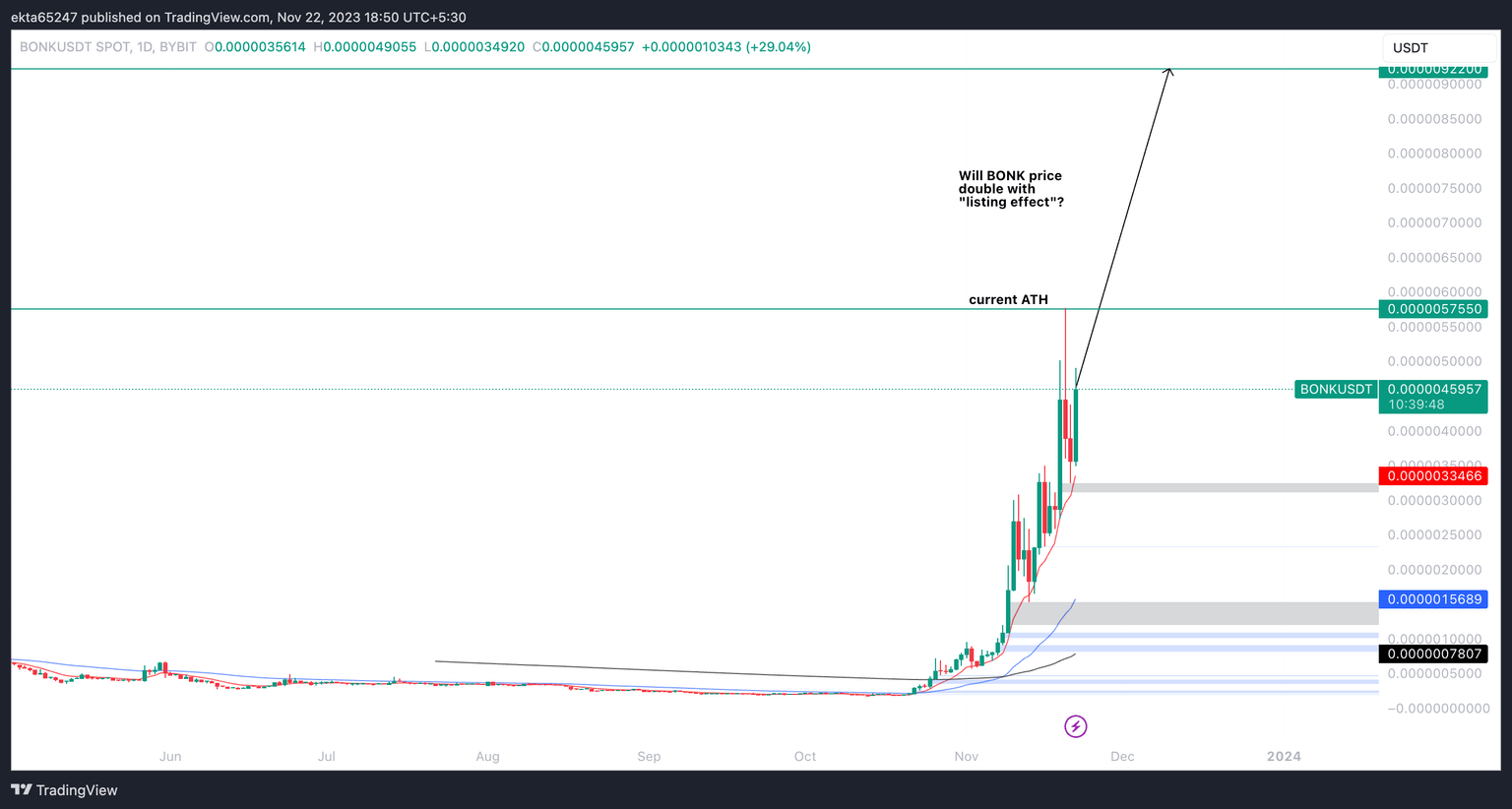

The massive surge in BONK price has fueled speculation of a larger rally with a major exchange listing. PEPE’s listing on Binance on May 5 resulted in a large spike in the meme coin’s price. Market participants expect a similar reaction from Bonk Inu.

Also read: Maker price uptrend could face headwinds as on-chain metrics flash warning signs

BONK price notes significant rise in daily timeframe

The Solana-based meme coin BONK has left Bitcoin, Ethereum, Dog-themed meme coins and altcoins in the dust with its massive returns on the monthly, weekly and daily timeframe. When compared with top cryptocurrencies, BONK has yielded the highest returns for traders in the past month.

BONK returns compared with other cryptocurrencies

One of the catalysts driving massive gains in the meme coin is the probable listing of the asset on a major cryptocurrency exchange. It is key to note that the frog-themed meme coin PEPE experienced a similar surge in its price in response to its Binance listing announcement on May 5.

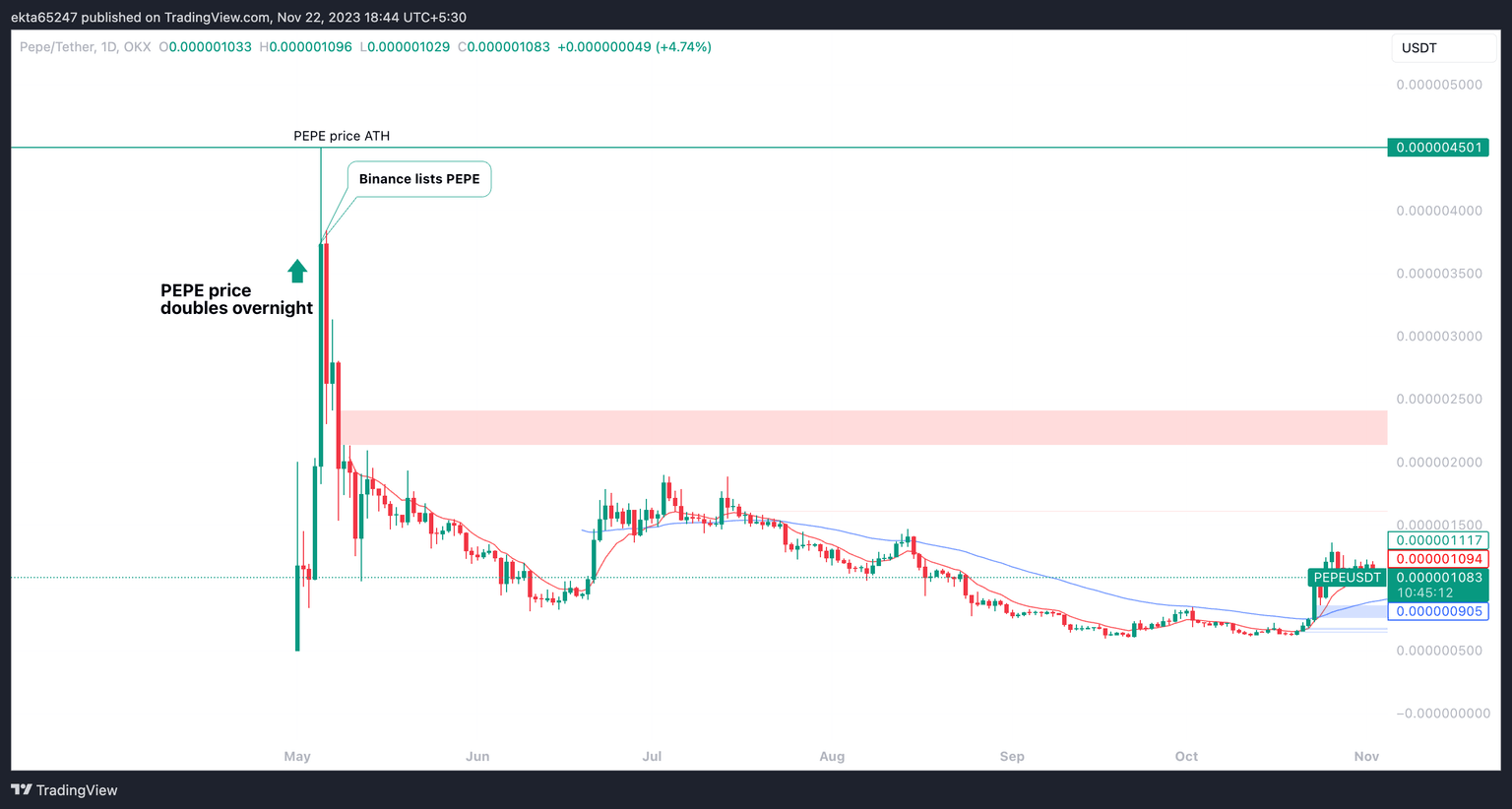

Listing announcements have acted as catalysts in the past, driving large gains for holders of cryptocurrencies. PEPE price nearly doubled, rallying 122% on May 5, climbing from $0.000002023 to $0.000004501 between May 4 and 5. The meme coin hit its cycle top and traders might see a similar reaction from BONK, as this is typical of assets listed on large cryptocurrency exchanges.

PEPE/USDT 1-day chart

Crypto analyst behind the Twitter handle @Mangyek0 expects a cycle top from BONK in the event of the meme coin’s listing on Binance. The analyst cites PEPE and SHIB’s examples to support his thesis.

if this happens, cycle top. $BONK will get bonked like $PEPE and $SHIB or will it tho? https://t.co/Az2JUDBhp2

— MAXPAIN (@Mangyek0) November 19, 2023

BONK/USDT 1-day chart

It remains to be seen whether a Binance listing sends BONK to its cycle top, market participants remain hopeful of the “listing effect” and a repetition of PEPE’s scenario, given the two cryptocurrencies are meme coins and these assets’ price rallies are typically driven by hype.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.