Binance Smart Chain now connected to Ethereum and Solana in bid to disrupt scaling solutions

- Binance Smart Chain is now supported on wormhole, Ethereum and Solana, boosting interoperability across blockchains.

- Binance doubled down on its smart chain project and injected $1 billion in a growth fund on BSC.

- Wormhole is making strides in interoperability and the metaverse.

Interoperability and NFTs are the latest trend in cryptocurrencies with the rising popularity of the metaverse. Binance Smart Chain, one of the largest smart contract platforms, has announced a new incentive to onboard Web3 dApps and DeFi projects on its network.

Binance Smart Chain adds interoperability feature to compete with Ethereum scaling solutions

The Polygon network has made consistent efforts to enhance Ethereum’s scalability and operability with other blockchains. Polygon contributes the highest to the total value locked on Ethereum bridges.

Binance has injected $1 billion into its Binance Smart Chain (BSC) project to establish its supremacy in smart contract platforms. After Avalanche and Harmony announced liquidity mining and yield farming incentives, offering millions in rewards, Binance Smart Chain revealed its plan to add $1 billion to the growth fund.

BSC is Polygon’s closest competitor in terms of total value locked. BSC infused $100 million in capital to support DeFi projects on its blockchain network a year ago.

Changpeng Zhao, Binance CEO, was quoted as saying,

BSC’s growth has attracted 100 million more DeFi users with just initial funding of $100 million. With the new contribution of $1 billion, it can disrupt traditional finance and accelerate global mass adoption of digital assets to become the first-ever blockchain ecosystem with one billion users.

Binance plans to utilize the funds for talent development in developer communities, incentivize liquidity mining projects and offer tech support at global hackathons and incubate new dApps.

Competition among layer-1 blockchain scaling solutions is intense with increased on-chain activity on Solana, Avalanche and Fantom. More cryptocurrency projects are keen on participating in the decentralized metaverse.

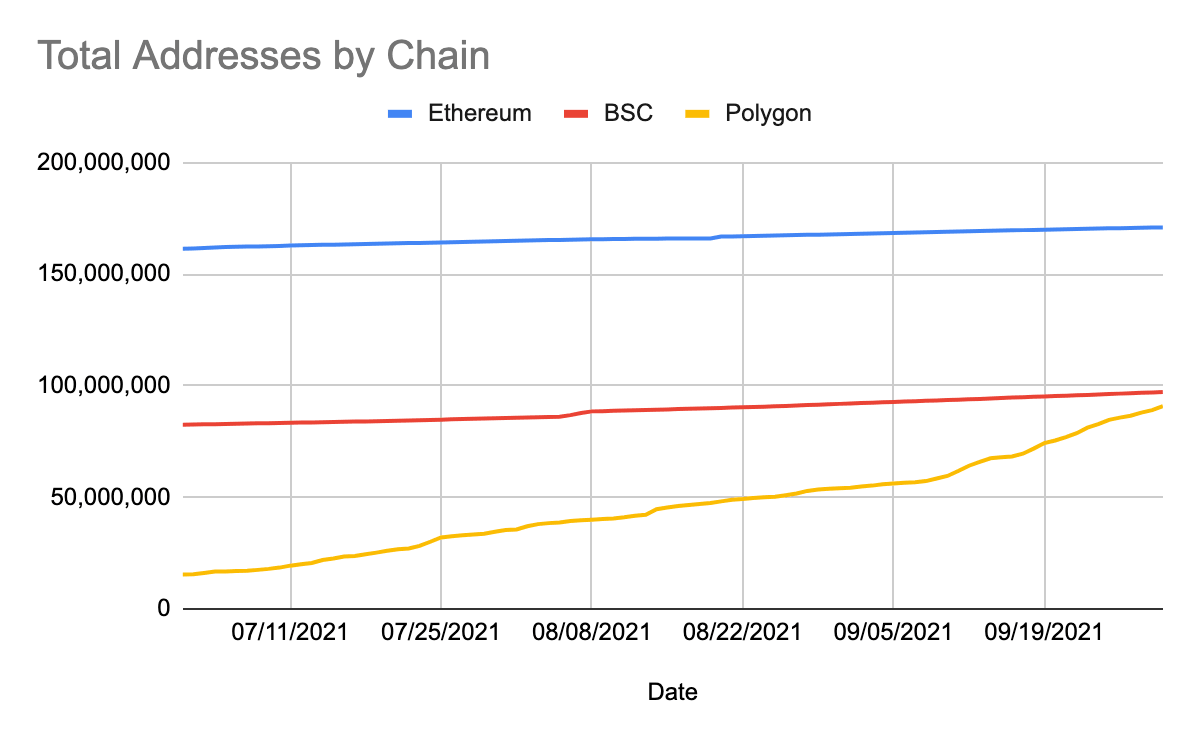

Polygon’s dominance in the DeFi ecosystem becomes clear with the total number of addresses on the network compared to BSC.

Total addresses by chain.

Gwendolyn Regina, investment director of BSC Accelerator Fund, was quoted as saying,

We’re glad to see more and more projects participate in the decentralized multiverse. BSC is a platform for all growing ecosystems, and we want everyone to be a part of it. There’s no competition here.

Binance Smart Chain is now officially supported by Ethereum, Solana and Wormhole, bridging all ecosystem assets with top layer-2 scaling solutions.

Now @BinanceChain is officially supported on the @wormholecrypto platform besides @ethereum & @solana

— BSCDaily (@bsc_daily) October 11, 2021

Users can start bridging assets seamlessly across these chains, from tokens to #NFTs.

Why #Wormhole is so on #BSC? Read this post to know: https://t.co/O3cJJrMTrC#BNB pic.twitter.com/ZbKFVy1L5d

BSC adoption is expected to drive its utility and BNB price higher. BNB has emerged as the cryptocurrency offering the highest risk-adjusted returns over the past 24 hours. Experts are bullish on the Binance ecosystem’s native token.

@HsakaTrades, a cryptocurrency analyst, commented on Binance’s $1 billion incentive and BNB’s recovery.

$BNB providing some respite to alts. pic.twitter.com/ofEdiMQanq

— Hsaka (@HsakaTrades) October 12, 2021

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.