Binance releases Bitcoin Proof of Reserves, delists Serum following FTX's collapse

- Binance unveils Bitcoin reserves worth $9.59 billion in BTC against $9.48 billion of customer balance.

- The exchange also announced the delisting of Serum's pairs with Bitcoin, USD and Tether, along with 16 other pairs.

- Serum price registered an almost 10% decline in the hours following the delisting, trading at $0.265.

Binance has been pushing the envelope of transparency and support towards the crypto space and developers, respectively. In line with the same, the cryptocurrency exchange came forward with its Proof of Reserves (PoR) System. However, in the interest of protecting its investors, it also took a step in a lesser favorable direction.

Binance and its Bitcoin Proof of Reserves

Binance and its CEO Chengpang Zhao (CZ) announced the release of its Proof of Reserves System (PoR) on Friday. The PoR is Binance's way of providing evidence for the fact that the exchange covers all of its users' assets 1:1.

Initially, the PoR has only been released for Bitcoin, but the exchange stated that updates about Ethereum (ETH), Tether (USDT), USD Coin (USDC), Binance USD (BUSD) and Binance Coin (BNB) would also be provided.

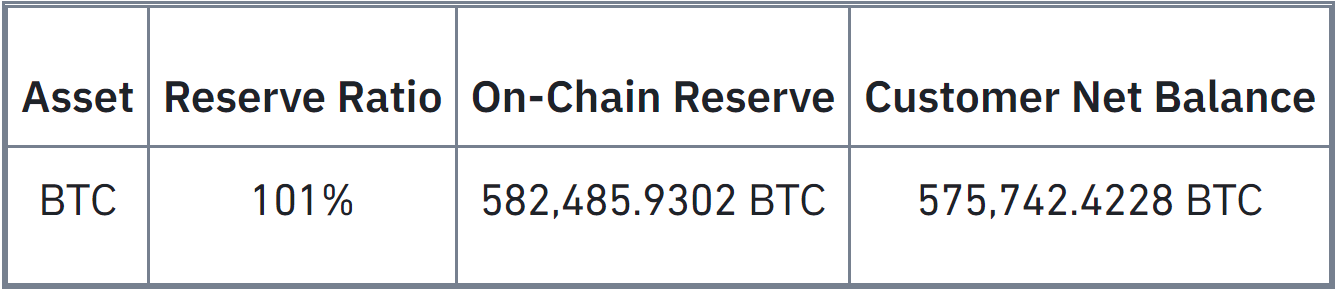

Binance’s Bitcoin Proof of Reserves

As per the data released by the exchange, Binance currently holds about $9.48 billion worth of BTC in the form of customer net balance. On the other hand, its on-chain reserves exceed $9.59 billion in value. This creates a 101% Reserve Ratio for the king coin, ensuring backup in case of a liquidity crisis that FTX faced, resulting in its eventual collapse.

Binance delists Serum

The downfall of FTX not only decimated the value of its native token FTT but also of Solana (SOL). A venture of its sister company Alameda Research, Solana hosts a ton of Decentralized Finance applications, one of which is Serum (SRM).

Earlier last week, the Solana Foundation announced that it held about 134.54 million SRM tokens, which are currently worth about $35.65 million. Soon after, the community decided to fork the project resulting in a 147% increase in price.

However, on Friday, Binance also announced the delisting of SRM pairs with BTC, USD and USDT, as well as 16 other token pairs. This led to a sudden decline in Serum price, bringing SRM's value down by almost 10% in 24 hours.

Trading at $0.265, SRM is nearing its immediate support at $0.261. A bounce off of this level would provide it with the bullishness SRM needs to flip $0.307 resistance into support and rally toward $0.34.

SRM/USDT 4-hour chart

Although, Serum price is still vulnerable to a fall due to recent developments. If SRM loses the support of $0.261, it could extend the decline to $0.193. Closing below this level would invalidate the bullish thesis, pushing the altcoin down to $0.133, resulting in an almost 50% crash.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.