- Binance Coin price stabilizes at $560, with a 5% decline representing the smallest loss among top five crypto assets on Tuesday.

- Since Trump’s crypto strategic reserve announcement, BNB Social Volume has plunged 103% from last month's peak.

- Binance trading volumes remain elevated, with BNB attracting demand from traders seeking discounts to mitigate losses in high-volume trades.

Binance Coin (BNB) price stabilized at $560 on Tuesday, with its 9% decline representing the lowest losses among the top five crypto assets. Rising trading volumes appear to be cushioning the impact of negative market sentiment following Trump’s decision to exclude BNB from the newly established Crypto strategic reserve.

BNB price shows resilience as sellers seeking Binance trading discounts nullify Trump’s snub

Binance Coin (BNB) price has been influenced by opposing market catalysts in the past week. On the bearish side, U.S. President Donald Trump excluded BNB from the list of five assets designated for the U.S. Crypto Strategic Reserve.

Trump Announces Crypto Strategic Reserve | March 2

This decision raised concerns among investors, as BNB was the only top-five-ranked crypto asset omitted.

The reserve includes Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA).

For context, at its current market capitalization of $84 billion, BNB’s market dominance is 150% higher than Cardano, which holds a $33 billion valuation.

Why did Trump exclude BNB from the Crypto strategic reserve?

Trump’s decision to exclude BNB from the Crypto Strategic Reserve signals an intent to prioritize projects with a strong corporate presence in the U.S. Binance’s early ties to China are notable, as the exchange was founded by Chinese-born Changpeng Zhao.

Two other key reasons for the exclusion could be Binance’s recent legal troubles under the Biden administration.

The firm paid over $4.6 billion in fines, and CZ was jailed.

Although CZ was released in December 2024, Binance’s U.S. subsidiary remains embroiled in litigation with the SEC.

The exchange only recently reinstated U.S. deposit and withdrawal functionality last month.

Hence, Trump’s decision to exclude BNB may be a strategic effort to avert political backlash and avoid interfering in ongoing legal proceedings involving U.S. regulators and Binance’s U.S. subsidiary.

How did the Crypto community react to Trump’s snub?

BNB has traded sideways over the past week, reflecting lukewarm market sentiment.

Following its exclusion from the crypto reserve announcement, BNB’s weekend gains were limited to single digits.

Changpeng Zhao (CZ) led the market reactions, expressing optimism that BNB could be listed in the reserve at a later stage.

Binance Co-Founder Changpeng Zhao Reacts to Trump’s Crypto Strategic Reserve Announcement | Feb 28, 2025

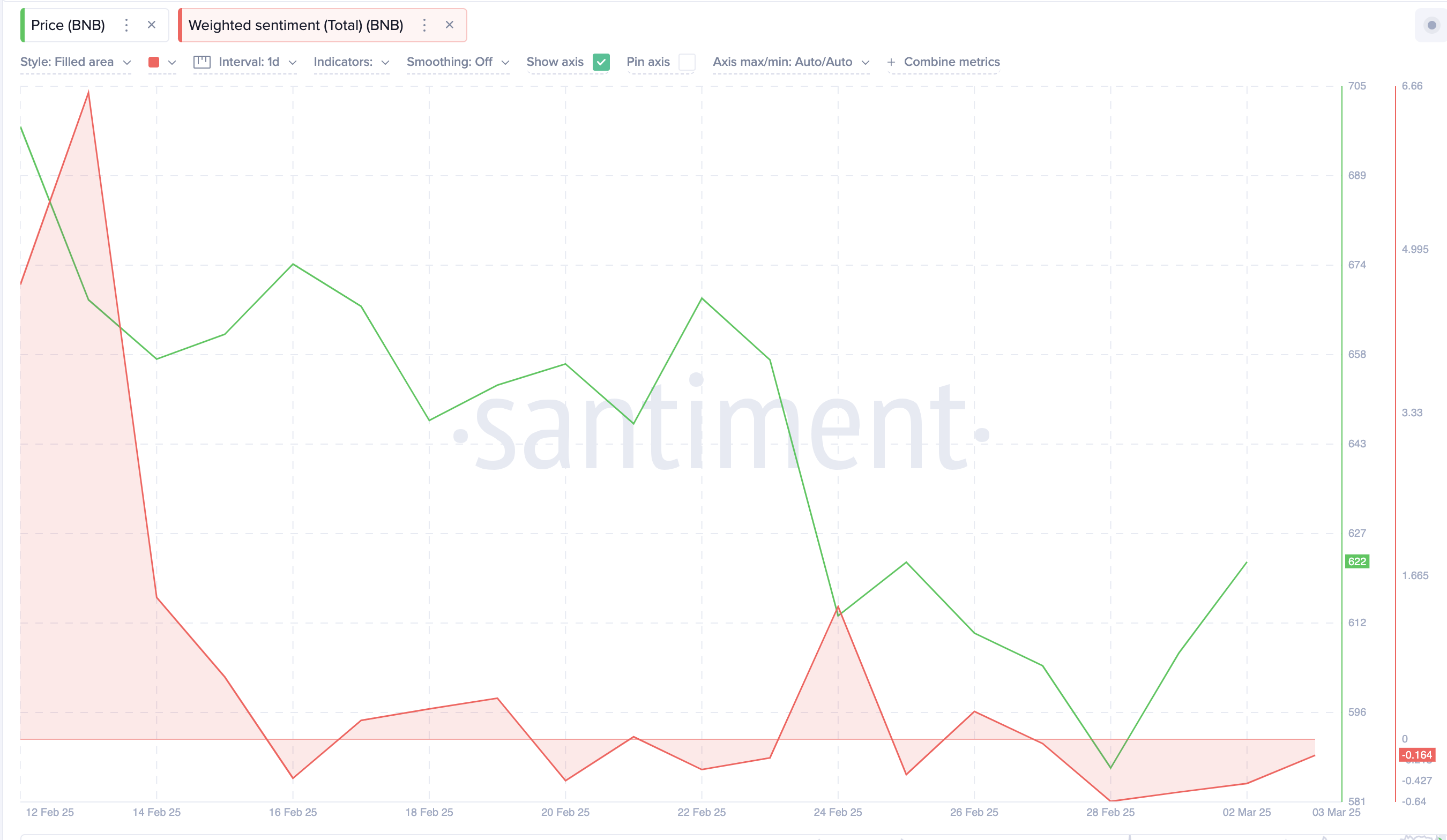

However, CZ’s optimism did not resonate across the broader market. Santiment’s Weighted Sentiment chart below tracks the balance between negative and positive comments a project receives on any given day, providing direct insights into shifts in community sentiment.

BNB Weighted Sentiment | Source: Santiment

As seen below, BNB’s weighted sentiment peaked at 6.59 on Feb. 13.

However, after Trump excluded the Binance native coin from the strategic reserve, market sentiment plunged 103%, entering negative territory at -0.16 as of March 4. This indicates that negative comments about BNB now outnumber positive discussions across various crypto media channels.

How did exclusion from the Crypto strategic reserve impact BNB price?

BNB’s exclusion from the strategic reserve has triggered a wave of negative comments, as reflected in the weighted sentiment chart.

However, another market catalyst has helped counteract the impact on BNB’s price action.

On Monday, Trump confirmed the commencement of 25% tariffs on imports from Canada and Mexico, sparking instant sell-offs across global cryptocurrency markets.

Among the top five cryptocurrencies, Binance Coin (BNB) is the only asset to post losses of less than 10% since Trump’s tariff announcement.

The rapid market sell-offs may have boosted demand for BNB as investors seek trading discounts to mitigate losses on high-volume sell orders.

BNB’s role as an exchange utility token makes it an attractive hedge during volatile periods.

Traders who hold and stake BNB receive discounts on Binance trading fees.

During periods of heightened trading activity, investors often purchase larger amounts of BNB to cover fees more efficiently while unlocking additional discounts.

This inadvertently drives up demand for exchange-native tokens like BNB during intense market sell-offs.

Supporting this stance, BNB market volumes have remained elevated in the two days following Trump’s tariff confirmation, signaling increased demand from traders leveraging Binance’s fee discount mechanisms to navigate turbulent market conditions.

BNB price forecast: Bull to maintain dominance if $550 support holds

BNB price is trading at $584.19, recovering from a recent low near $550, a critical support level that aligns with the lower boundary of the Keltner Channel.

This level has historically acted as a demand zone, preventing further downside.

If bulls defend this region, BNB could push toward the midline resistance at $618.49, with a potential extension to $685.79, where previous selling pressure emerged.

BNB price action on Tuesday shows a bullish rejection wick, signaling possible accumulation at current levels.

On the bearish side, a sustained break below $550 could open the door to further declines, with the next key support lying near $500.

The MACD indicator remains in negative territory, with the signal line below the zero mark, suggesting ongoing bearish momentum.

However, the histogram shows a reduction in selling pressure, which could hint at a reversal if bullish volume increases.

A decisive close above $618.49 would confirm strength, while failure to hold $550 may invite aggressive selling.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.