Binance settles with US DoJ as markets anticipate official announcement, CZ steps down as CEO

- US DoJ is seeking more than $4 billion in settlement fees from Binance exchange over fraud-related charges among others.

- Negotiations include possibility of Binance CEO CZ facing criminal charges in the US, with the CFTC likely to be involved.

- US Attorney General Merrick Garland will be holding a press conference to detail separate but related crypto enforcement actions.

The US Department of Justice (DoJ) is pursuing Binance exchange for a $4 billion settlement in penalties for charges levied against the exchange and its CEO, Changpeng Zhao (CZ). The US government called out the largest cryptocurrency exchange by trading volume over allegations of money laundering, bank fraud, and sanctions violations among other charges.

Also Read: Binance moves nearly $4 billion amidst US DoJ demand to end years long investigation

Binance may have settled with US DoJ

Binance may have reached a settlement with the DoJ amid rumors of an impending announcement from the government at 15:00 EST. The news follows a report on Bloomberg, suggesting that US Attorney General Merrick Garland will be holding a press conference to detail separate but related crypto enforcement actions. The DOJ's media advisory has corroborated the news.

Statement from DoJ media advisory

Speculation has it that the announcement will involve a settlement with Binance, after an earlier announcement that the DoJ was out for at least $4 billion in settlement fees to conclude the years-long investigation.

According to unnamed sources familiar with the matter who spoke with Bloomberg, negotiations between the two parties include the possibility of Binance CEO CZ facing criminal charges in the US as part of an agreement to resolve the investigation into allegations of financial crime and violating sanctions.

The Commodities Futures Trading Commission (CFTC) is likely to be part of the arrangement, with chair Rostin Behnam and Treasury Secretary Janet Yellen likely to make an appearance during the press conference.

It is worth mentioning that no official from the US Securities and Exchange Commission (SEC) has been featured, which could indicate that the SEC’s civil lawsuit against Binance has not yet been settled.

The silence of the Binance CEO has left the matter to speculation, considering CZ’s tendency to quickly dispel any FUD. This has onlookers considering an actual settlement.

It's weird because market give green signal, but CZ didn't post, and CZ have a similar ego to sam, which if good he would have give us information ?

— Marusha (@mattomattik) November 21, 2023

The latest reports in the Wall Street Journal indicate that CZ has pled guilty, admitting to wrongdoing on charges of violating criminal anti-money laundering requirements. He will appear in Seattle court today, with the exchange agreeing to pay $4.3 billion in fines.

CZ yielding is understandable, as the settlement would allow the exchange to continue operations. The absence of a settlement, on the other hand, could see the exchange halt operations, or in the worst-case scenario, collapse. The latter would certainly have a ripple effect on the crypto ecosystem and its users.

If Binance resorted to a deferred-prosecution agreement, it would have exposed the exchange to criminal charges, culminating with the exchange paying a substantial penalty and producing a statement outlining its wrong actions. Ripple attorney John Deaton says:

Fascinating to witness the difference of opinion over CZ’s resignation and plea. Some are taking victory laps because they have been validated for calling out a criminal enterprise while others view.

According to a Reuters report, Binance will pay $1.81 billion within 15 months, and a further $2.51 billion forfeiture as part of the deal with the Justice Department, prosecutors. CZ will personally pay $50 million, with his plea agreement barring him from all involvement with Binance.

Ripple CLO Stuart Alderoty says "The Binance resolution of anti-money laundering (etc.) violations is a necessary step to bring the crypto industry into compliance with these important laws and safeguards," adding that big banks all went through some version of this years ago.

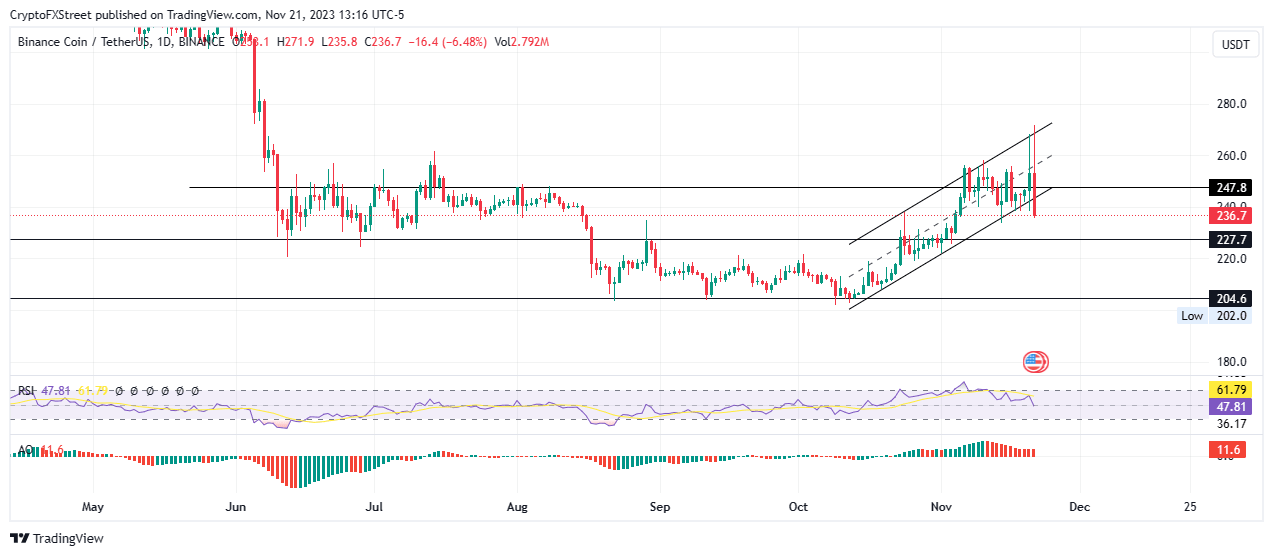

Meanwhile, Binance Coin (BNB) has crashed 8% in the last 24 hours and trading for $236.70 as of the time of writing. Trading volume for the token is up 160%, pointing to growing attention for the token.

BNB/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.