Binance goes live in India as a registered entity, nearly 100 million traders could break into crypto

- Binance registers as a reporting entity with India’s Financial Intelligence Unit, per official announcement.

- The exchange’s website and application is available again for nearly 100 million crypto traders in the nation.

- BNB hovers around $520 early on Thursday, Binance’s native token could extend gains to $600 target.

Binance, one of the largest cryptocurrency exchanges, received regulatory approval to reopen its services and serve nearly 100 million crypto traders in India. The firm has faced several challenges with regulators worldwide, including in India, where the platform had been banned for noncompliance reasons during seven months.

Binance is currently faced with litigation in US even as the firm settled lawsuit against the exchange platform and former executive Changpeng Zhao in April. The exchange agreed to pay $4.3 billion settlement to the US government and CEO CZ stepped down and faced four months in prison.

Binance pays $2.25 million in penalties, opens shop in India

Binance paid $2.25 million in penalties to register with India’s Financial Intelligence Unit (FIU), per an official announcement. This is the 19th regulatory milestone for the exchange, which stillfaces legal challenges in the US.

India has nearly 100 million crypto traders and the exchange can offer its suite of services and tools to these users as a registered entity as of August 15. A Chainalysis report from 2023 shows that India ranks in the top five countries by estimated transaction volume across centralized and decentralized exchange platforms, lending protocols, and smart contract tokens.

Binance’s BNB could extend gains by 16%

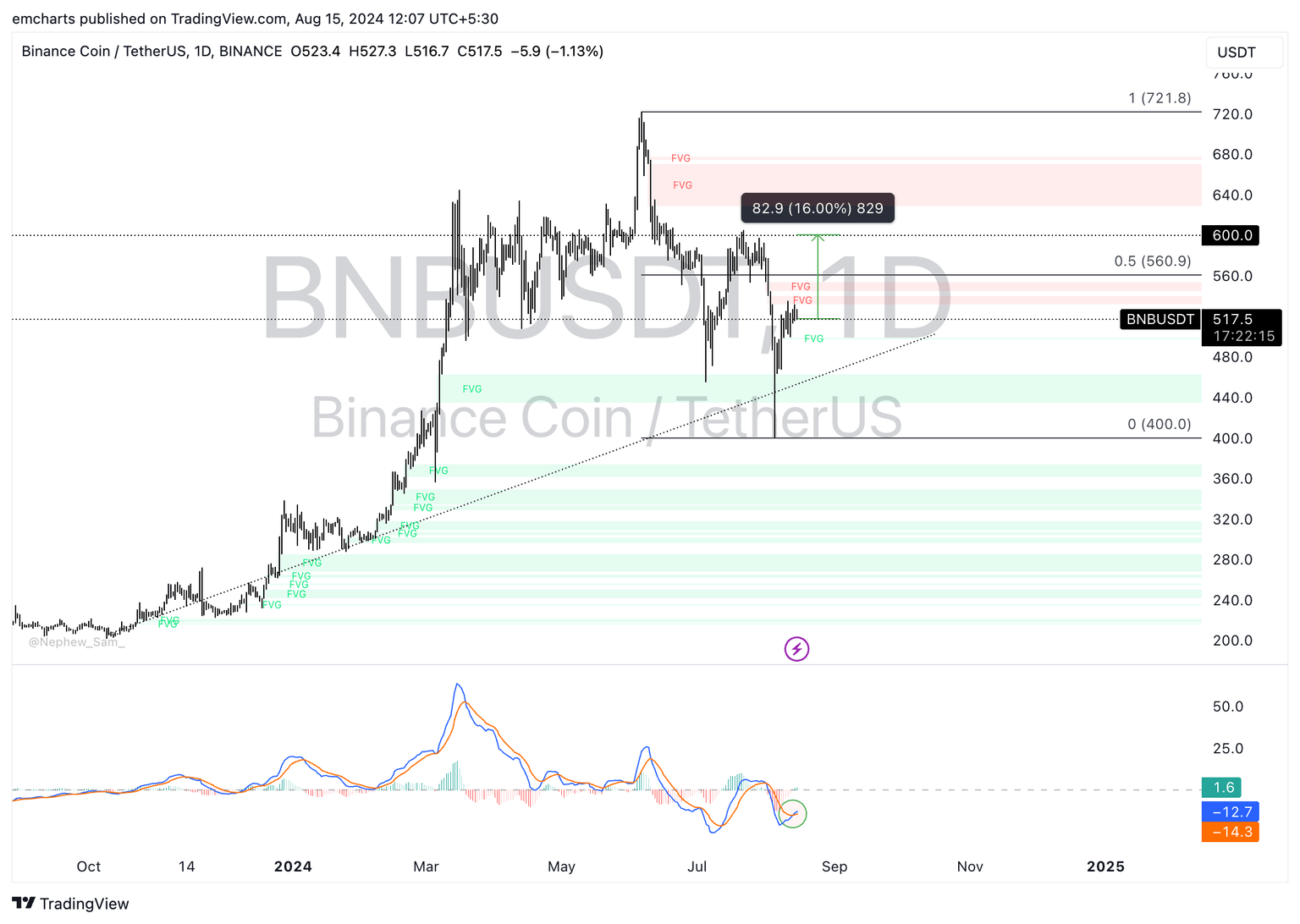

Binance’s native token BNB is in a multi-month upward trend as seen in the BNB/USDT daily chart. BNB could extend gains by 16% and rally towards its $600 target, which broadly aligns with the July 29 high. On the way to $600, BNB faces resistance at $560.90, the 50% Fibonacci retracement of the decline from June 6 high of $721.80 to the August 5 low of $400.

The Moving Average Convergence Divergence (MACD) momentum indicator shows there is underlying positive momentum in BNB uptrend. The MACD line has crossed above the signal line, supporting the bullish thesis of BNB.

BNB/USDT daily chart

Binance Coin could find support in the imbalance zone under $500, seen in the daily chart above. BNB could sweep liquidity in the Fair Value Gap between $434 and $462 if there is a correction in Binance’s native token.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.