Binance exchange’s exit from Canada market could stomp BNB price 5% to mid-January lows

- Binance Exchange has announced plans to wind down operations and exit the Canadian marketplace.

- Exit follows new guidance related to stablecoins and investor limits provided to crypto exchanges, rendering Canada untenable for Binance.

- The announcement could deter BNB price's expected turnaround, with 5% losses in sight.

Binance Exchange has announced plans to wind down its Canadian operations and exit from the market, saying:

Unfortunately, today we are announcing that Binance will be joining other prominent crypto businesses in proactively withdrawing from the Canadian marketplace.

Also Read: Binance Coin price to tank 10% as Bitcoin withdrawal ban is lifted and then reinstated again

Binance to exit the Canadian market

The development diminishes and deters the vision and high hopes that Binance exchange had for the Canadian blockchain industry. Among the reasons cited for the termination include "New guidance related to stablecoins and investor limits provided to crypto exchanges." According to the giant exchange, these have made the Canadian market no longer tenable for Binance.

Unfortunately, today we are announcing that Binance will be joining other prominent crypto businesses in proactively withdrawing from the Canadian marketplace.

— Binance (@binance) May 12, 2023

We would like to thank those regulators who worked with us collaboratively to address the needs of Canadian users.…

In the exit address, Binance expressed gratitude to regulators who collaborated with the exchange to meet the country's users' needs. Notably, despite being a small market, the region held sentimental value to the largest exchange by trading volume, considering it was the home country of Binance founder Changpeng Zhao, a Chinese-born Canadian businessman, investor, and software engineer.

Based on the announcement, the exchange had been putting off the shutdown for quite some time now as it tried to "explore other reasonable avenues to protect its Canadian clientele." The move to close is, therefore, a last resort.

Binance will send an email with comprehensive information to explain the implication of the termination of the operation to user accounts moving forward. Nevertheless, the exchange has articulated that while they did not agree with the new guidance, they were open to more engagements with the Canadian regulators towards a "thoughtful, comprehensive regulatory framework."

This leaves room for a return of Binance exchange to Canada, but this will hinge upon whether Canada's regulations will allow users access to a broader suite of digital assets.

Impact of new development on BNB price

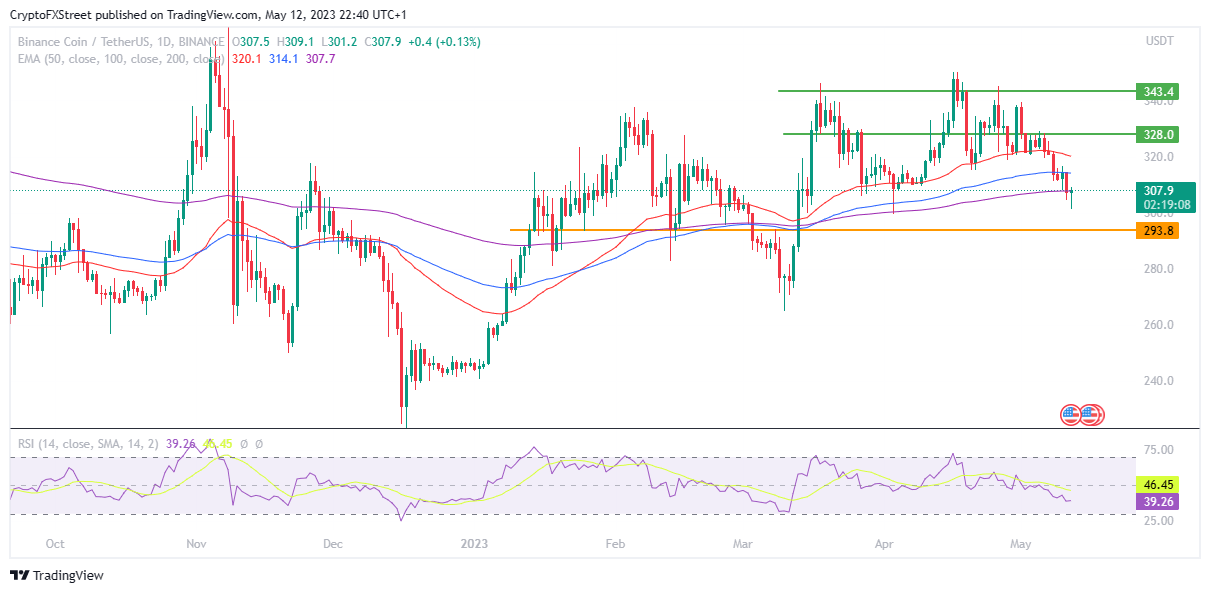

The announcement has dented the Binance Coin (BNB) price recovery, slowing the recent uptick. At the time of writing, BNB is auctioning at $307.9, a daily rise of about 0.24%. Unless buyer momentum increases, bears could recover control of the altcoin and drive a downtrend toward the $293.8 support level. Investors should place their sell-stops at this level to avoid further losses.

A sell-stop is a stock order to sell an investment once it falls below current price levels. This order reduces the risk of a falling market, as a trader's long position will close automatically at the price set.

As shown in the one-day chart below, the overall outlook for BNB price was bearish, as it was toward this direction that the price faced the least resistance.

BNB/USDT 1-Day Chart

Conversely, if buyer momentum increases, BNB price could scale a V-shaped recovery, flipping the hurdles presented by the 200-, 100-, and 50-day Exponential Moving Averages (EMA) at $307.7, $314.1, and $320.1 respectively into support before a reach higher toward the $328.0 resistance level. A decisive daily candlestick close above this level would invalidate the bearish thesis.

In a highly bullish case, BNB price could extend a neck up, tagging the $343.4 resistance level. This would denote a 10% upswing from the current position.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.