- Binance exchange locked withdrawals on some accounts profiting off massively volatile coins.

- CZ explained on Twitter that this was normal market behavior and that sometimes these things happen in free markets.

- The altcoins in question include Sun token (SUN), Ardor (ARDR), Osmosis (OSMO), Fun Token (FUN), and Golem (GLM).

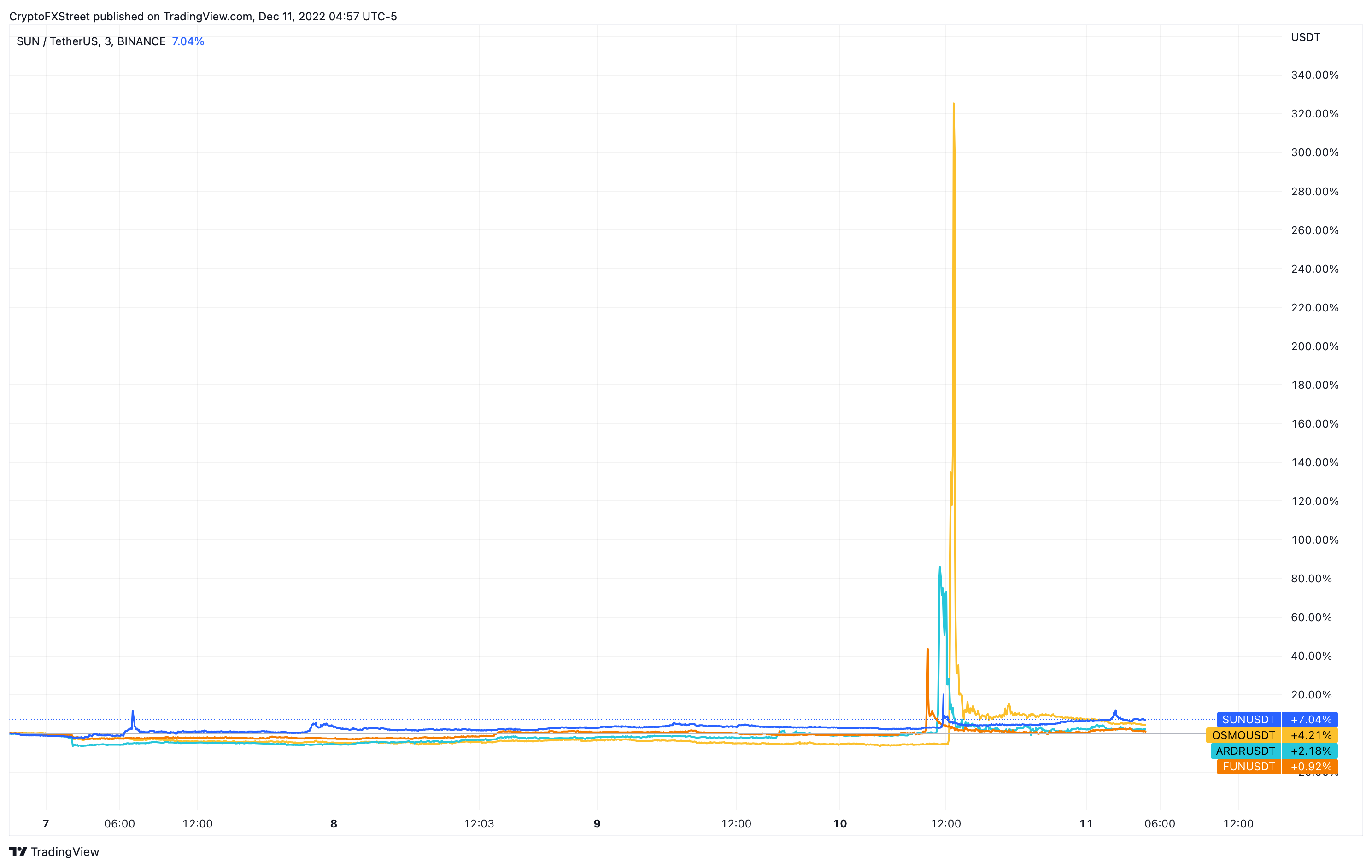

Some altcoins listed on Binance, one of the top crypto exchanges by volume, experienced massive volatility. Some of these tokens rallied as much as 90% in a few minutes.

Binance altcoins explode, but not a hack

On December 11, some of the altcoins on Binance saw a massive run-up that nearly doubled the value of the tokens in under a few minutes. Due to this unusual behaviour from Sun token (SUN), Ardor (ARDR), Osmosis (OSMO), Fun Token (FUN) and Golem (GLM), the exchange suspected it was compromised. Additionally, the centralized platform locked withdrawals of some of the accounts that profited from these altcoin pumps.

Altcoins pumping on Binance

Binance CEO and co-founder Changpeng Zhao (CZ) tweeted that they had to “temporarily lock withdrawals on some of the profiting accounts.” The exchange confirmed in a tweet that the funds were SAFU, and none of these accounts had their API keys compromised.

Shortly after, CZ released an official statement saying that the exchange or the accounts were not hacked and that this was “market behavior.” He further attests that one of the accounts that profited “deposited” into the exchange and that hackers “don’t deposit.”

Additionally, CZ clarified that they did not want to intervene too much.

We are aware of the concept of too much intervention from the platform, “too centralized” attacks, etc. There is a balance to how much we should intervene. Sometimes, these happen in free market, and we need to let it play out.

These altcoins saw an upward of 90% gains in a few minutes but are currently on a swift downtrend, indicating that this was just a short-lived rally and unlikely to last in the short-to-mid-term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Poland to adopt BTC as Hedera, Tezos rally alongside Microstrategy investing another $4.6B

While Solana’s daily time frame gains were subdued at 2.2%, the SOL price action drew attention on Monday as traders brace for a potential breakout to new all-time highs.

Bitcoin could see another parabolic run following rising institutional interest

Bitcoin (BTC) began the week positively, rising over 3% above the $91K threshold on Monday. Despite the recent rise, BTC could begin another extended bullish move as top firms are increasing their Bitcoin holdings and potentially adopting it as a reserve asset.

Ethereum Price Forecast: ETH risks decline to $2,258 as exchange reserves continue uptrend

Ethereum (ETH) is up 1% on Monday after ETH ETFs hit a record $515.5 million inflows last week. However, rising exchange reserves and realized losses could trigger bearish pressure for the top altcoin.

SOL Price Forecast: Solana nears all-time high as VanEck, BONK spark $2.9B inflow

Solana (SOL) price reached a new monthly time frame peak of $248 on Monday, November 18, up 60% within the last 14 days. Derivatives market trends signal potential for more upside as bulls set their sights on new all-time high.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.