Binance Elliott Wave technical analysis [Video]

![Binance Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/Coins/BinanceCoin/binance_coin_logo_XtraLarge.jpg)

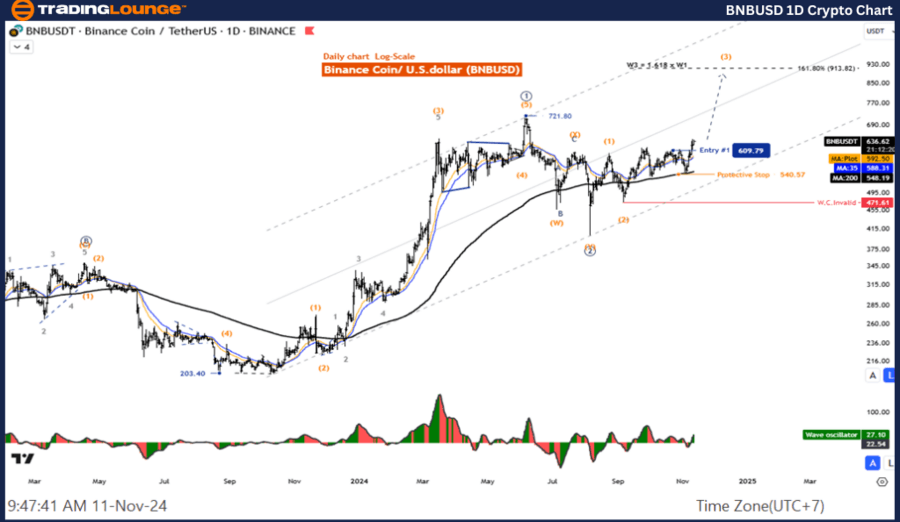

BNB/USD Elliott Wave technical analysis

Function: Follow Trend.

Mode: Motive.

Structure: Impulse.

Position: Wave (3).

Direction next higher degrees: wave ((3)) of Impulse.

Details: Wave 3 is likely to be 161.8% of wave 1.

Binance/ U.S. dollar (BNB/USD) Trading Strategy: The correction in wave 2 seems to be over so we focus on the five-wave rally of wave 2 and The price action remains in an uptrend, and we are looking for a re-entry into the trend.

Binance/ U.S. dollar (BNB/USD) Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bullish Momentum.

BNB/USD Elliott Wave technical analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave (3)

Direction next higher degrees: Wave ((3)) of Impulse

Details: Wave 3 is likely to be 161.8% of wave 1.

Binance/ U.S. dollar (BNB/USD) Trading Strategy: The correction in wave 2 seems to be over so we focus on the five-wave rally of wave 2 and The price action remains in an uptrend, and we are looking for a re-entry into the trend.

Binance/ U.S. dollar (BNB/USD) Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bullish Momentum.

Binance Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.