Elliott Wave Analysis TradingLounge

Binance/ U.S. dollar(BNBUSD)

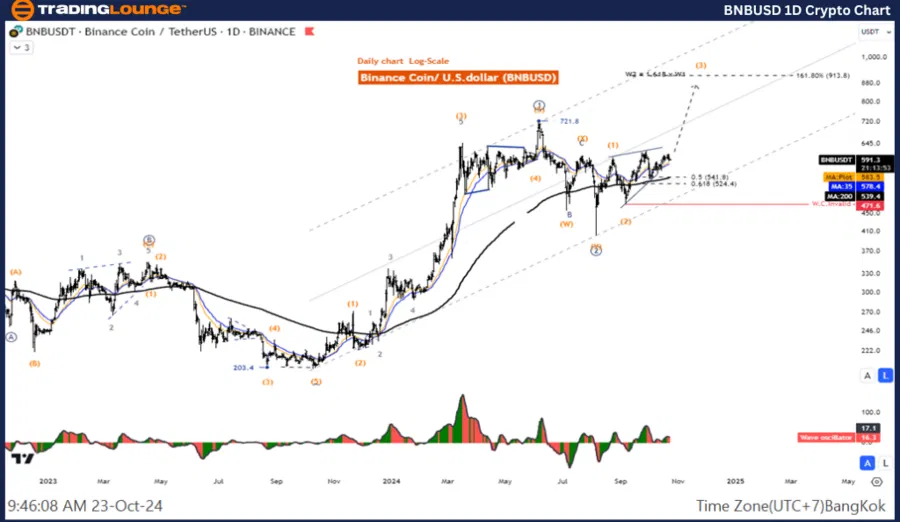

BNB/USD Elliott Wave Technical Analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Double Corrective.

Position: Wave ((Y)).

Direction next higher degrees: wave 2.

Details: The decline of wave Y is likely to end and the price is re-entering the uptrend.

Binance/ US Dollar (BNB/USD) Trading Strategy: The correction in wave ((2)) seems to be over so we focus on the five-wave rally of wave 3 and the price is likely to test the 913 level. The price action remains in an uptrend, and we are looking for a re-entry into the trend.

Binance/ US Dollar (BNB/USD) Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bullish Momentum.

BNB/USD Elliott Wave technical analysis

Function: Follow Trend.

Mode: Motive.

Structure: Impulse.

Position: Wave (3).

Direction next higher degrees: Wave ((3)) of Impulse.

Details: Wave 3 is likely to be 161.8% of wave 1.

Binance/ U.S. dollar (BNB/USD) Trading Strategy: The correction in wave ((2)) seems to be over so we focus on the five-wave rally of wave 3 and the price is likely to test the 913 level. The price action remains in an uptrend, and we are looking for a re-entry into the trend.

Binance/ U.S. dollar (BNB/USD) Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bullish Momentum.

Binance Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended Content

Editors’ Picks

Chainlink looks at $14 resistance as outflows from exchanges signal continued demand

Chainlink exchange outflows exceed $120 million in the last 30 days, hinting at increasing accumulation. The breakout from a falling wedge technical pattern and an uptrending RSI indicator signal stronger bullish momentum.

Bitcoin extends gains toward $90,000 as ETFs inflows exceed $381 million

Bitcoin is extending its gains, trading above $88,000 at the time of writing on Tuesday after rising nearly 3% the previous day. Institutional demand seems to be supporting BTC’s recent price rally, with US spot ETFs recording an inflow of $381.40 million on Monday.

Top 3 gainers Fartcoin, POL, DeepBook: Altcoins surge as Bitcoin nears $90,000

Investors in select altcoins like Fartcoin, POL and DeepBook welcome double-digit gains. Bitcoin inches closer to $90,000, potentially waking up as digital Gold amid uncertainty in the macro environment.

Hyperliquid updates validator to 21 permissionless nodes, HYPE price breaks out

Hyperliquid’s validator update allows anyone to register, with the 21 largest stakes forming the active set. Validators must lock up 10,000 HYPE for one year, whether in the active set or not.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.