Binance Elliott Wave technical analysis [Video]

![Binance Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/Coins/BinanceCoin/binance_coin_logo_XtraLarge.jpg)

Elliott Wave Analysis TradingLounge Daily Chart,

BNB/USD Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Triangle.

Position: Wave ((D)).

Direction next higher degrees: wave 4.

Wave cancel invalid level: 508.

Details: Wave 4 may be complete and the Price increase again in Wave 5.

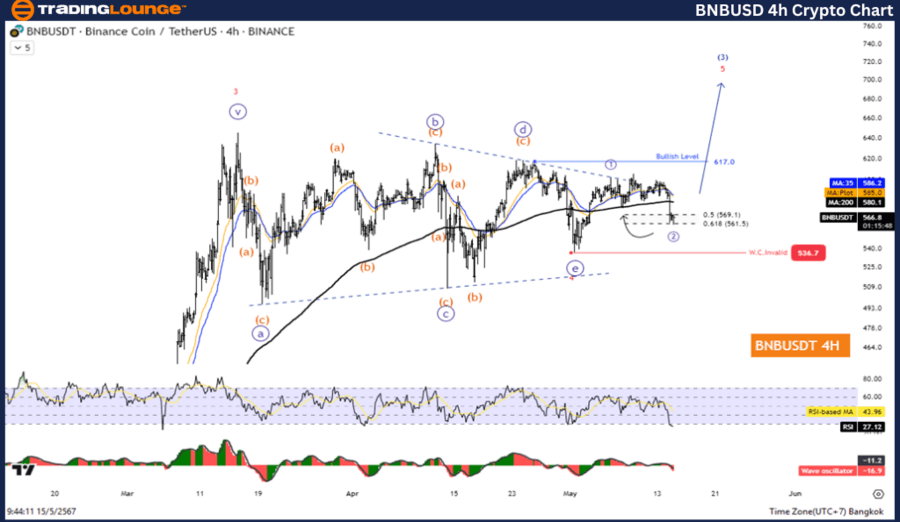

Binance/ U.S. dollar (BNBUSD) trading strategy: The rise of the fifth wave in the Impulse pattern, which is subdivided into five waves. Currently, waves ((1)) and ((2)) are completed, the price is rising in wave ((3)). Therefore, the price There is a chance of continuing to increase above the level of 617.

Binance/ U.S. dollar (TRXUSD) technical indicators: The price is above the MA200 indicating an Uptrend, The Wave Oscillator is a Bullish Momentum.

BNB/USD Elliott Wave analysis four-hour chart

Function: Counter Trend.

Mode: Corrective.

Structure: Triangle.

Position: Wave ((D)).

Direction next higher degrees: Wave 4.

Wave cancel invalid level: 508.

Details: Wave 4 may be complete and the Price increase again in Wave 5.

Binance Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.