- Binance is facing a challenge from the CME Group as the world’s biggest Bitcoin Futures market, with a difference of just $300 million.

- The increase in institutional interest is one of the biggest contributors to this phenomenon, who are more prone to trade on CME exchanges.

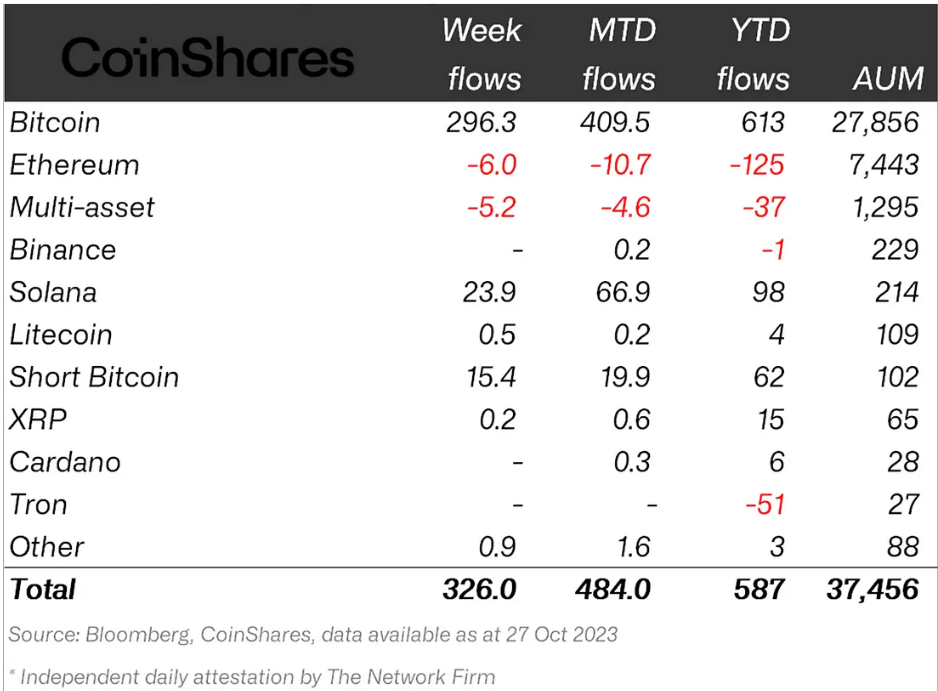

- The past week registered $326 million worth of inflows into crypto products, the highest since July 2022.

The world’s largest derivative market is now close to becoming the world’s leading Bitcoin Futures market as well, potentially replacing Binance. The CME Group is poised to overtake Changpeng Zhao’s company in this regard, given how much institutions are exhibiting interest in Bitcoin at the moment.

Bitcoin receives massive investment from institutions

Over the past week, the crypto market recorded the highest amount of inflows it has since July 2022. According to the Digital Asset Fund Flows report, for the week ending October 27, institutions poured in close to $326 million into digital asset investment products, of which most were received by Bitcoin.

Breakdown of the inflows shows that over 90% of the funds were directed toward Bitcoin, amounting to $296.3 million. The second biggest asset to note the highest inflows of $23.9 million was, surprisingly, Solana and not the second biggest cryptocurrency in the world, Ethereum. Owing to the ongoing Breakpoint conference, SOL is on every investor’s watchlist, whereas Ethereum noted outflows worth $6 million in the same duration.

Institutional investment inflows by asset

The sudden increase in institutional investment is a sign that optimism clearly plays the most important role in determining interest, and the potential of Bitcoin ETF approval is certainly a major driving factor of said optimism.

This could also mean good news for the CME Group

CME goes up against Binance

The CME Group is the world’s leading derivatives marketplace. However, Binance holds the top spot when it comes to the Bitcoin Futures market. CME Group intends to take this away from Binance as it only stands at $300 million below Binance in terms of Open Interest (OI).

Valued at $3.86 billion, Binance OI consists of 111,420 BTC, while CME holds 103,230 BTC worth $3.57 billion at the time of writing.

Total Bitcoin Futures Open Interest

While the next bull market is expected to be influenced significantly and potentially even driven by institutions, this shift in domination would be the first evidence that institutions would choose the safer option of the two since Binance continues to remain at a crossroads with the Securities and Exchange Commission (SEC) in the United States.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.