Binance Coin price to give bullish breakout another go

- Binance Coin price is likely to provide sidelined buyers another opportunity to accumulate.

- Investors need to be careful in buying BNB dips due to the uncertain market outlook.

- A breakdown of the $596.5 support level will invalidate the bullish thesis.

Binance Coin (BNB) price exhaustion is likely to trigger a short-term correction. If the market outlook improves then the incoming pullback will be a good place to buy BNB on the dips.

Also read: Binance Coin pice poised to break all-time high after recent surge

Binance Coin price takes another shot

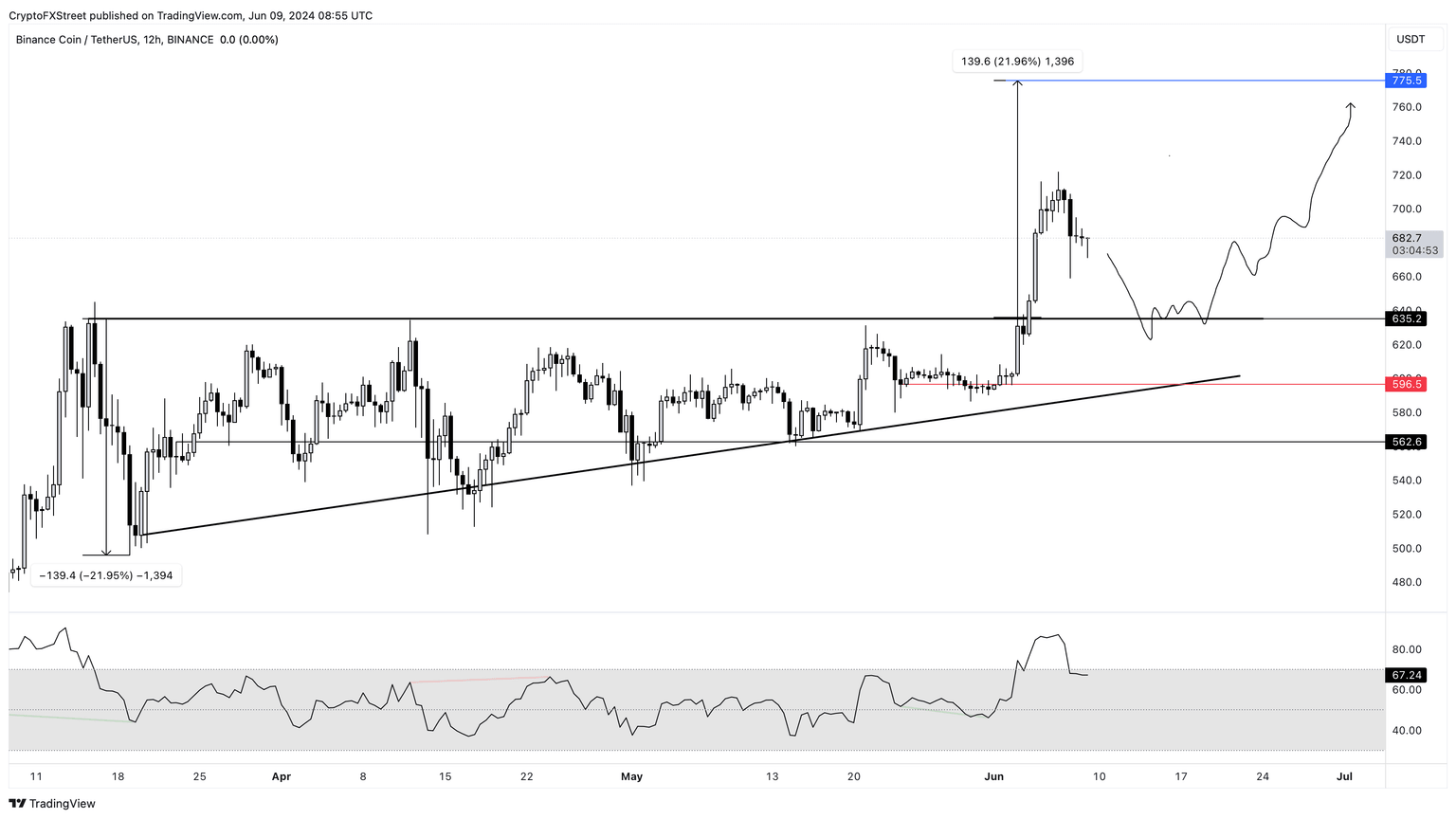

Binance Coin price broke out of the ascending triangle on June 4 and was due to retest the theoretical forecasted target of $775 after a 21% rally. However, the impulsive move stopped after a 13% rally that led to the local top formation of $721.8. This lack of momentum is likely to result in a 7% retracement that retests the ascending triangle’s base at $635.2.

Depending on how Binance Coin price reacts to the aforementioned level, investors can make their own decisions. A bounce above $635.2 will show that the buyers are in it for the long haul and are defending this key barrier. In such a case, BNB could embark on a bullish journey and target the theoretical forecasted target of $775.5.

While BNB retests the $635.2 support level, the Relative Strength Index also needs to hold above its mean level of 50. This development would further reinforce the optimistic outlook and help Binance Coin move toward $775.5.

BNB/USDT 1-day chart

On the contrary, if the market outlook continues to deteriorate, then Binance Coin price is unlikely to hold above the $635.2 support level. A reentry into the ascending triangle setup would invalidate it.

However, if Binance Coin price flips $596 into a resistance level, it would create a lower low and invalidate the bullish market structure. Such development could see BNB nearly 6% and tag the $562.6 support level.

Read more: Binance effect fades, less than 20% tokens are profitable six months after listing

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.