Binance Coin price slips as Binance partners with Mastercard to launch crypto card in Brazil

- Binance and Mastercard will join efforts to launch a prepaid card in Brazil.

- Binance card will allow receiving and sending cryptocurrencies as well, supporting 14 coins, including Bitcoin and Ethereum.

- Binance Coin price is engaged in a sideways momentum, struggling to maintain its value above $310.

Binance has made its presence as a key player in the crypto industry felt over the last few months since the FTX collapse. Continuing to build on the opportunity, Binance is expanding its operations to different parts of the world.

Binance launches crypto card in Brazil

Binance, in an announcement on Monday, revealed its plans to launch the Binance Card in Brazil. Created in partnership with Mastercard, the prepaid crypto card will allow Binance users to make purchases and pay bills using cryptocurrencies.

Supporting 14 cryptocurrencies, the card will allow users to make crypto payments at 90 million Mastercard merchants.

Issued by Dock, the Binance Card will also allow users to receive and send cryptocurrencies in any of the 14 crypto assets, which includes Bitcoin, Ethereum and Solana.

Expected to arrive over the next few weeks, the Binance Card will be the second such launch by Binance in the last few months. Back in August 2022, Binance launched a similar card in partnership with Mastercard in Argentina.

Commenting on the choice of expanding in Brazil, General Manager at Binance for Brazil said,

“Brazil is an extremely relevant market for Binance, and we will continue to invest in new services for local users, as well as contribute to the development of the blockchain and crypto ecosystem in the country.

According to the 2022 Mastercard New Payments Index, Brazil is among the top markets when it comes to crypto interest. A survey of 35,000 individuals brought forward,

“49% of Brazilian consumers have done at least one crypto related activity in the past year in comparison with the global average of 41%.”

Binance Coin price is not soaring

Binance Coin price performance has been relatively disappointing despite having rallied by over 30% in the span of a few days. However, even the 30% rise has managed to bring BNB back to its pre-November 2022 crash levels to trade at $308.

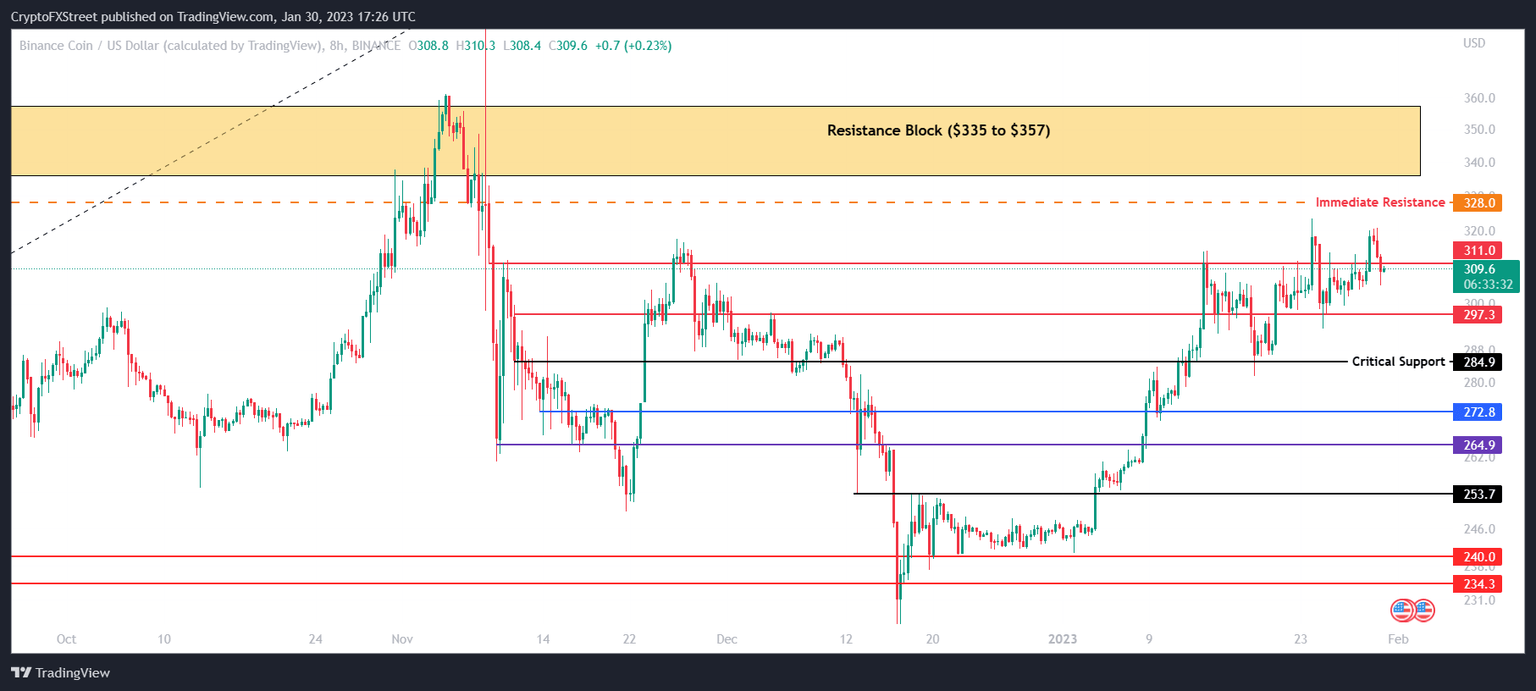

Tagging the $311 level, the Binance Coin price is gradually making its way back up. In order to completely recover the FTX-induced losses, BNB must breach the immediate resistance at $328. Flipping it into a support level will allow the altcoin to rally further and test the resistance block from $335 to $357.

BNB/USD 8-hour chart

Nevertheless, Binance Coin price is equally vulnerable to a drop as it is currently trading below the $311 area. Continuing down this path would bring BNB to tag the support at $297.3. Losing this would give the altcoin one last chance before slipping toward the critical level at $284. A daily close below the latter will invalidate the bullish thesis, potentially causing a decline to $272.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.