Binance Coin price sees traders trying to avoid re-entry of the bear zone

- Binance Coin price got some support after it acted as market stabilisation.

- BNB faces side effects of Binance that took a stab at acting as the central bank for cryptocurrencies.

- With more regulations on the asset class, Binance and its affiliated coins are on the radar of the FBI and SEC watch dogs.

Binance Coin (BNB) price action took another leg lower after, from a purely technical point of view, receiving a firm rejection on its topside while trying to recoup the losses from last week. Normally, in any takeover, the one that walks away often gets applauded by the markets and receives a higher price valuation. Markets rather perceived the, and one almost could call it ‘arrogant,’ move of Binance acting as a crypto central bank by offering itself as ‘lender of last resort 'more than normal as it had created the mess cryptocurrencies are currently in.

BNB faces spillovers from Binance’s arrogance

Binance Coin price is facing repercussions as the overall exchange Binance itself has not received much applause from its peers. Several market participants found it even more than logical that Binance acted as a facilitator in a broken market that caused collapse. With all the spotlights on FTX and Binance, rest assured that the FBI will be following every move, and Capitol Hill is ready to continue with a set of rules and laws that will limit the freedom of Binance and peers within the markets.

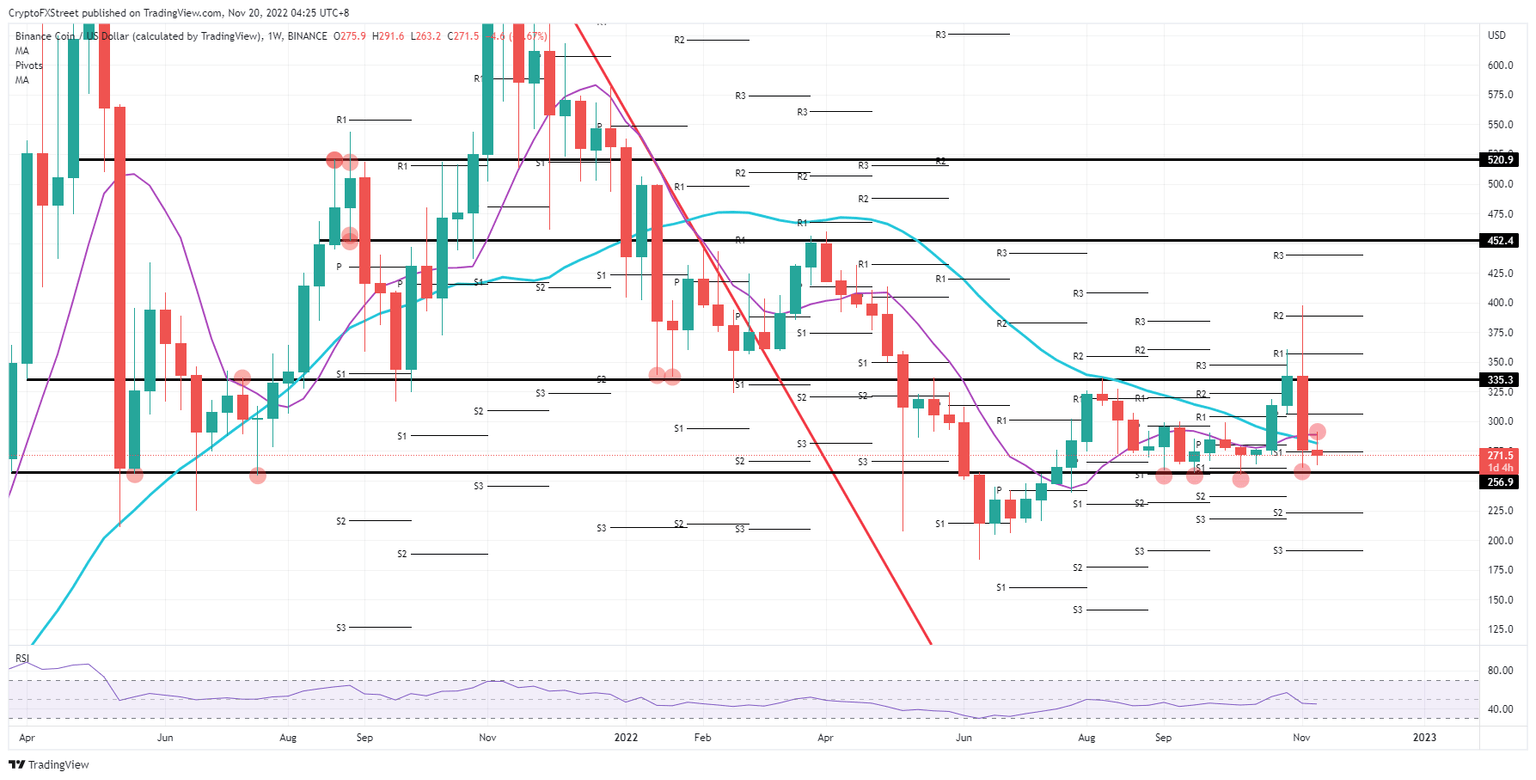

BNB was seen paring back losses from last week but got cut short early this week in a bounce off the 55-day Simple Moving Average (SMA). For now, the price action remains underpinned as bulls are defending the low at $263.2, not turning into $256.9, hitting a pivotal level from past weeks that have already provided support four times. Should more negative headlines or a breach in the headquarters by the FBI occur in the coming week, expect a nosedive move toward $200 as traders shun the coin for now.

BNB/USD weekly chart

Global markets could be set to thrive on Monday as the US dollar is weakening further and good turn risk assets into higher levels. Expect a retest on the 55-day SMA next week before a firm break above. Should more positive headlines come out with geopolitical tail risks deflating after the polish missile situation, traders will put a higher valuation on Binance Coin price. Although it looks far off, $335 could be quickly tested for a break to the upside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.