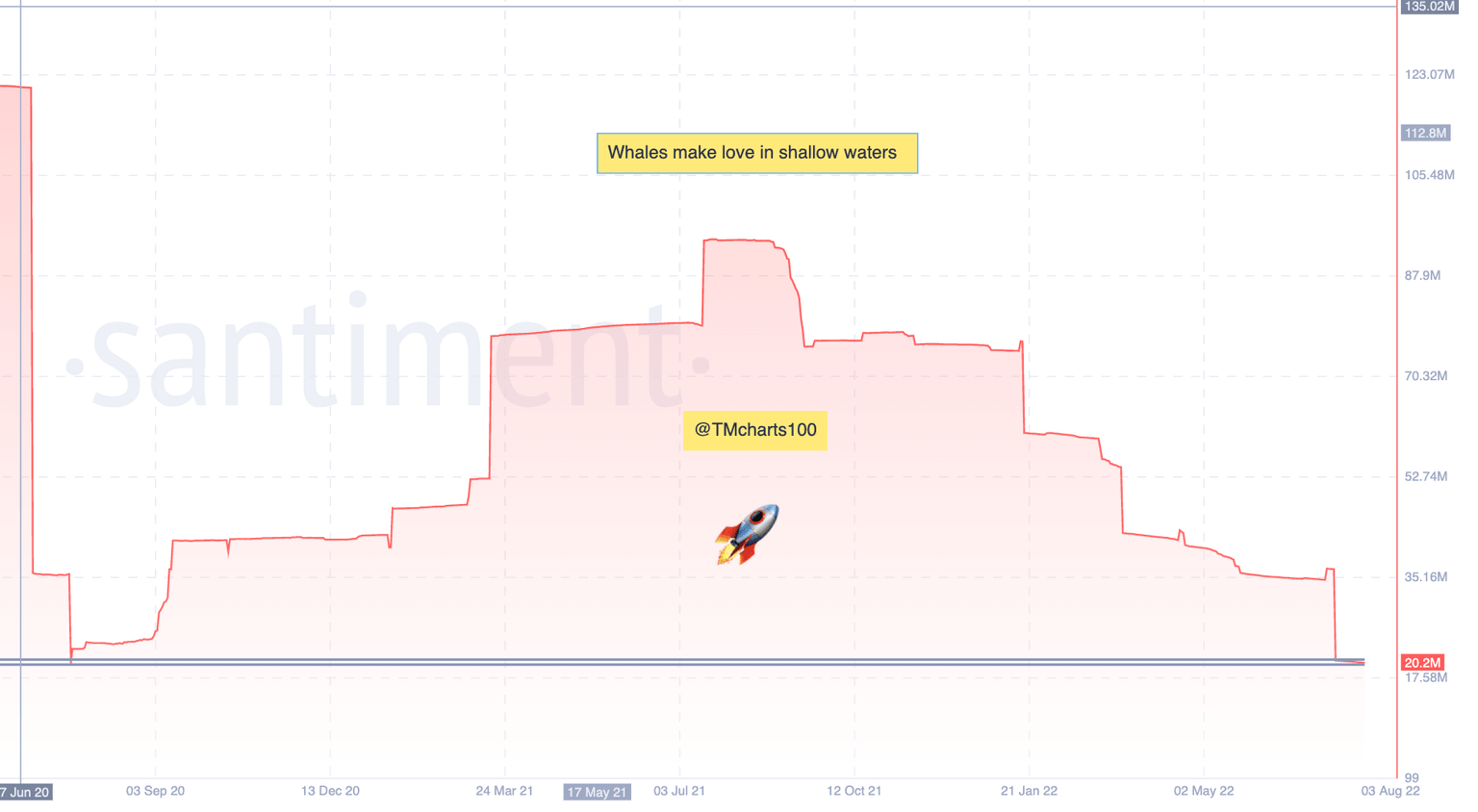

Binance Coin Price Prediction: Whales take naps at the shore

- BNB price circulating supply is 21 million coins, the most illiquid since July 2020 when BNB auctioned at $16.00".

- Binance coin has rallied 75% since the June 19 bottom.

- Invalidation of the uptrend is a breach below $180.

Binance coin shows reasons to believe in a market bottom. Traders should keep the smart contract giant on their watchlists throughout the summer.

Binance Coin price may have bottomed

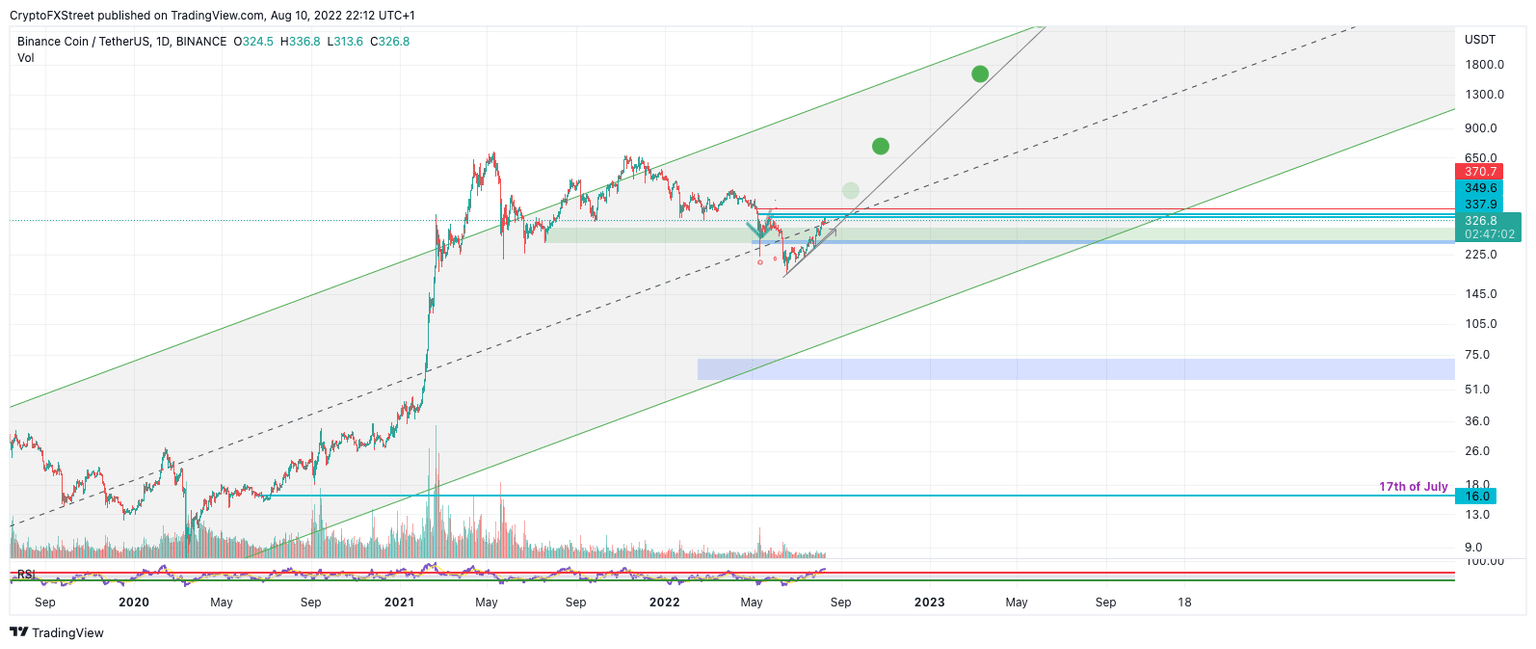

Binance coin price is beginning to show evidence of strength as the bulls have propelled towards previous highs established during the end of May. At current time, Binance Coin seems to be leading the way in terms of outperformance as most cryptos in the space have not come in such close proximity with their previous sell-off highs.

Binance Coin price currently auctions at $327, just a few dollars shy of the May 26 highs at $338. Auction market theory suggests a significant amount of liquidity has been placed above the spring-time high and market makers are likely aiming for said levels to heighten the volatility.

Furthermore, Santiment’s On Chain analysis tools confound the idea of a potential bull run. Specifically the Circulation Analyzer over the last 365 days suggests Binance coin price is coming to a significant low in terms of circulating coins. At 21 million coins, the last time BNB saw such an illiquid market was on July 17 2020 when BNB price traded at $16.00.

Binance coin price could very well be unfolding a larger wave up with a conservative target at $470. If FOMO madness gets involved, an extended target could land at and 700. It is best for investors to keep an invalidation at the $180 swing low until more evidence unfolds to support the macro thesis in the weeks to come.

BNB/USDT/8/10/22 Possible Macro

In the following video, our analysts deep dive into the price action of Binance, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.