Binance Coin Price Prediction: BNB aiming for $1,000 if key pattern continues to develop

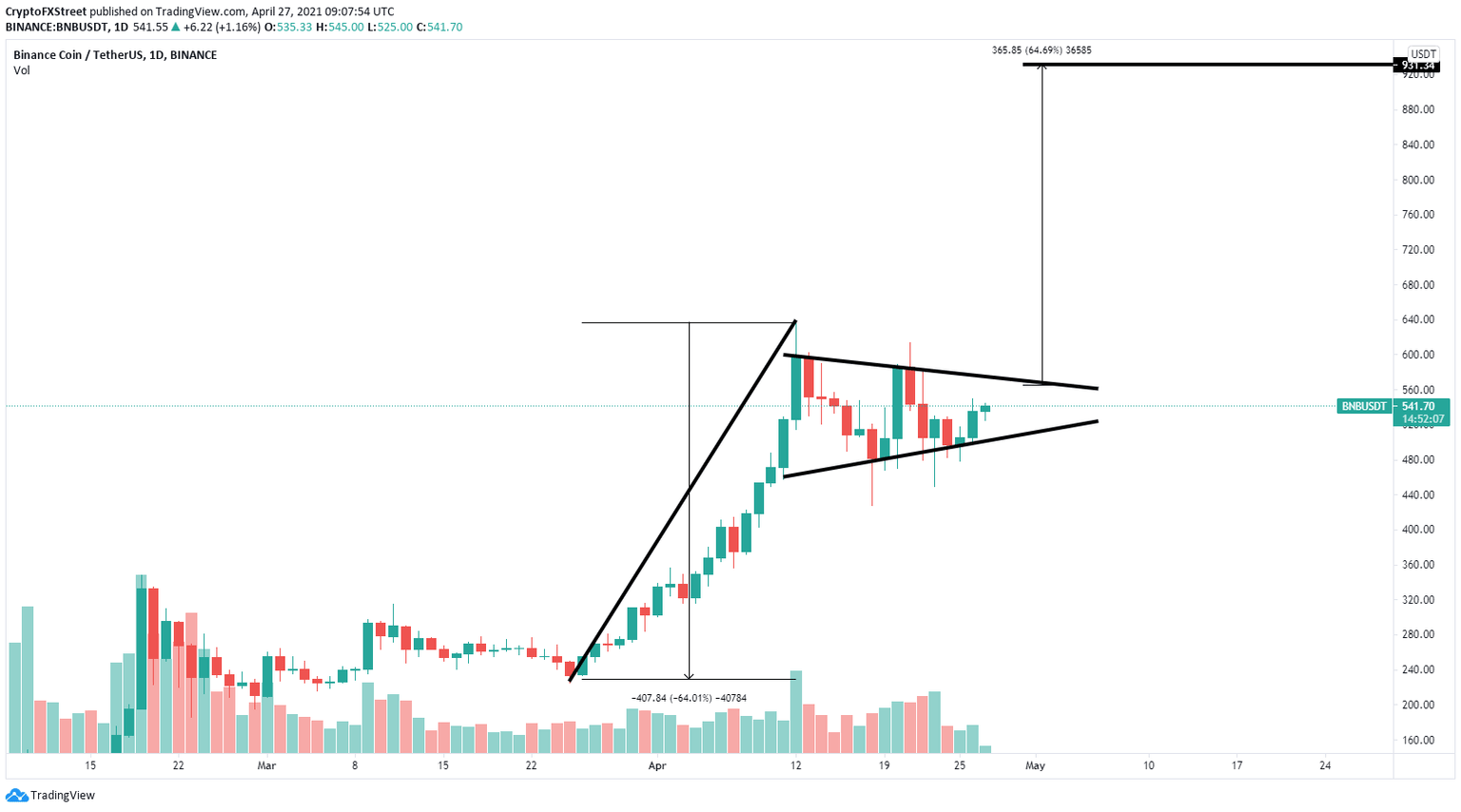

- Binance Coin price has formed a massive bull flag on the daily chart.

- The digital asset faces just one critical resistance level before a huge 65% breakout to new all-time highs.

- BNB could see a bearish breakdown in the short term.

Binance Coin price has seen a significant recovery in the last 48 hours as the entire market gained more than $100 billion in market capitalization back.

Binance Coin price on the verge of a colossal breakout

On the daily chart, BNB has formed a bull flag and could be close to a massive breakout. The most significant resistance level is formed at the psychological point of $600.

BNB/USD daily chart

A breakout above this key level has a 65% price target at $930. This target is calculated by using the height of the pole as a reference point.

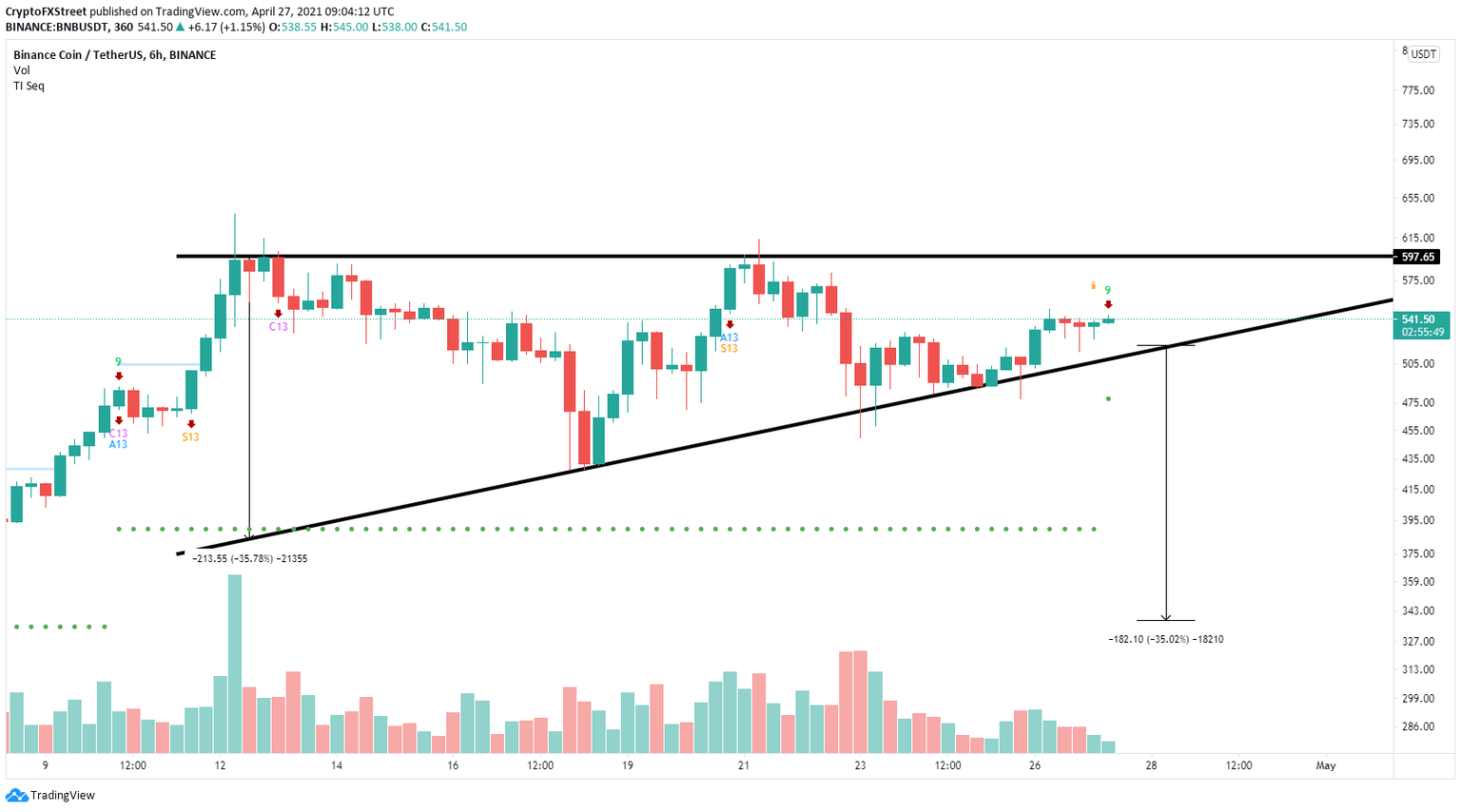

However, Binance Coin price is also trading inside an ascending triangle pattern formed on the 6-hour chart. The TD Sequential indicator has presented a sell signal here in the form of a green ‘9’ candlestick.

BNB/USD 6-hour chart

The most significant trend line support is formed at $514. A breakdown below this point, impulsed by the sell signal, would drive Binance Coin price down to $340 in the longer term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.