Binance Coin price pops as exchange acts as “lender of last resort”

- Binance Coin price pops as exchange acts as “lender of last resort”

- Binance Coin gets applause from traders as Binance moves to support the flailing crypto market.

- BNB price action gets pumped over 3%.

Expect to see a possible pop higher as traders rebuild and support Binance as a brand.Binance (BNB) price jumped after it tumbled further over the weekend as FTX was forced into bankruptcy. As more financial details leaked, it became clear that FTX’s total assets were no match for its monstrous liabilities against third-party traders. As the dust settles, traders can only reward Binance Coin for Binance’s solid due diligence after looking at the books of FTX before moving toward an actual takeover.

BNB price gets rewarded

Binance Coin price is getting support and is portrayed as the best example of how a takeover should be done in the crypto space. BNB price action sees its losses from the weekend being erased as traders applaud its thorough due diligence of FTX’s books prior to bankruptcy and Binance’s representation as a lender of last resort. The exchange plans to ensure that other crypto exchanges do not collapse in a domino effect. By acting as a sort of “central bank” for cryptocurrencies, BNB is taking responsibility and sticking out its neck to win back customer and trader confidence.

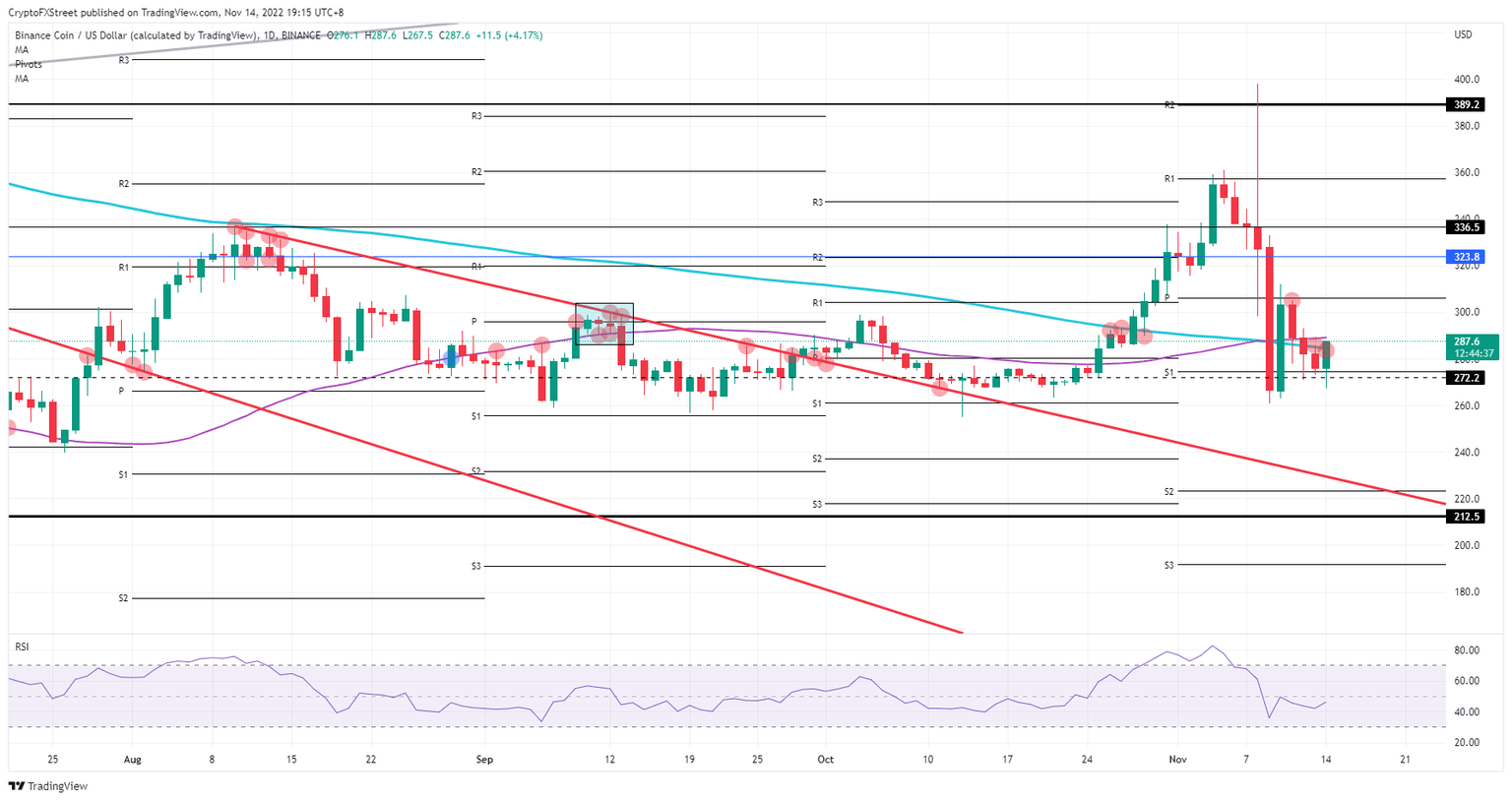

BNB price will see a ripple effect, not only by more volume being traded on its platform and more accounts being opened but also on its price action as bids go through the roof. With the 55-day Simple Moving Average at $284.70 being gobbled up by bulls, next is the 200-day SMA at $289.50. Once that hurdle is cleared, $300 is up for grabs.

BNB/USD daily chart

Over the weekend Treasury Secretary Yellen already came out in support of more regulations and a thorough investigation of what has happened with FTX and Binance. A breach by the FBI into Binance’s headquarters is still very likely, with servers, computers and high-level staff being detained to gain a clear view of what happened last week. That would coil and rattle the markets and see BNB price lose its positive image, possibly testing $260 again before breaking lower toward $220.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.