Binance Coin Price Forecast: BNB on verge of 25% upswing

- Binance Coin price has formed a bull flag on the 4-hour chart.

- The digital asset faces just one critical resistance level before a massive 25% breakout.

- Whales have accumulated a lot of BNB lately, despite increasing prices.

Binance Coin price has been outperforming the entire market for the past two months, reaching a market capitalization of $90 billion. Many analysts believe BNB could even overtake Ethereum, which stands at a $280 billion market cap.

Binance Coin price needs to surmount key level for massive breakout

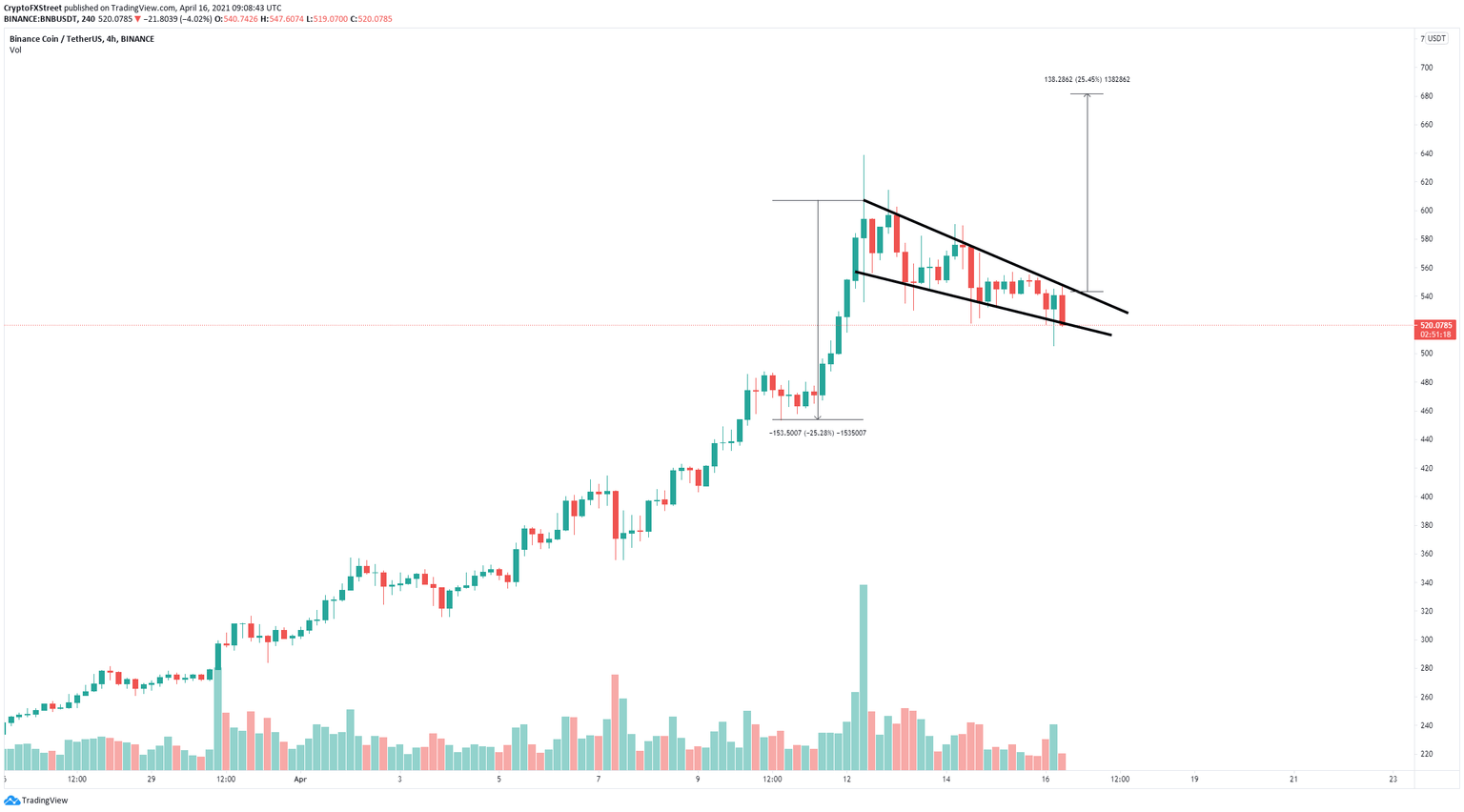

On the 4-hour chart, BNB has established a bull flag with its resistance trend line formed at $550. Binance Coin bulls currently try to defend the lower boundary support and aim for a rebound toward the upper trend line.

A breakout above $550 will drive Binance Coin price to $680, a 25% move calculated by using the height of the flagpole.

BNB/USD 4-hour chart

Surprisingly, the number of whales holding between 100,000 and 1,000,000 has increased in the past month despite BNB hitting new all-time highs. Since the beginning of April, this number jumped from 37 to a peak of 40 on April 11. This indicates that large holders believe Binance Coin could rise even higher and are accumulating.

BNB supply distribution

However, it is worth noting that a 4-hour candlestick close below the lower boundary of the pattern will invalidate the bullish outlook and could also drive Binance Coin price down by 25% toward the psychological level of $400.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B11.10.33%2C%252016%2520Apr%2C%25202021%5D.png&w=1536&q=95)