Binance Coin Price Analysis: BNB hits a yearly high at $33.38 and aims for $40

- BNB is currently trading at $33 after the best recovery among the major coins.

- A series of positive announcements and launches by Binance have boosted the value of BNB coins significantly.

BNB was the first major coin to recover from the crash on September 3. Not only BNB has recovered from a low of $18, but it’s getting a ton of continuation, increasing by almost 86% in value over the past nine days.

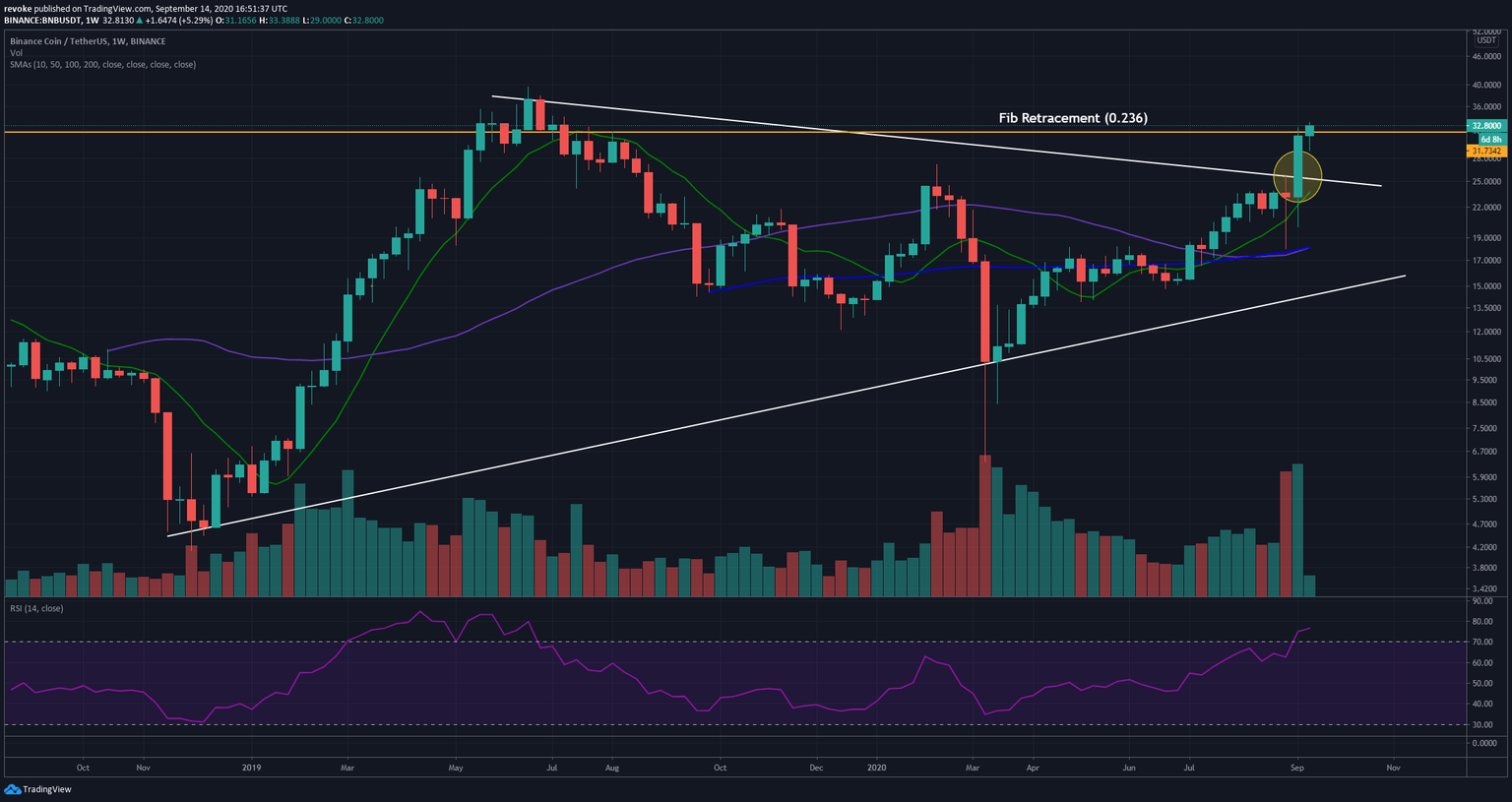

BNB/USD Weekly Chart

The Binance utility token has broken out of a long-term symmetrical triangle and faces very little resistance until the all-time high at $39.59. The next resistance point would be located at $34.83. BNB price has already surpassed the Fibonacci retracement level at $31.72, which was a significant resistance level.

BNB bulls could be concerned about the weekly overextended RSI; however, in the past, an overextension of this indicator didn’t really stop the price of BNB from surging higher.

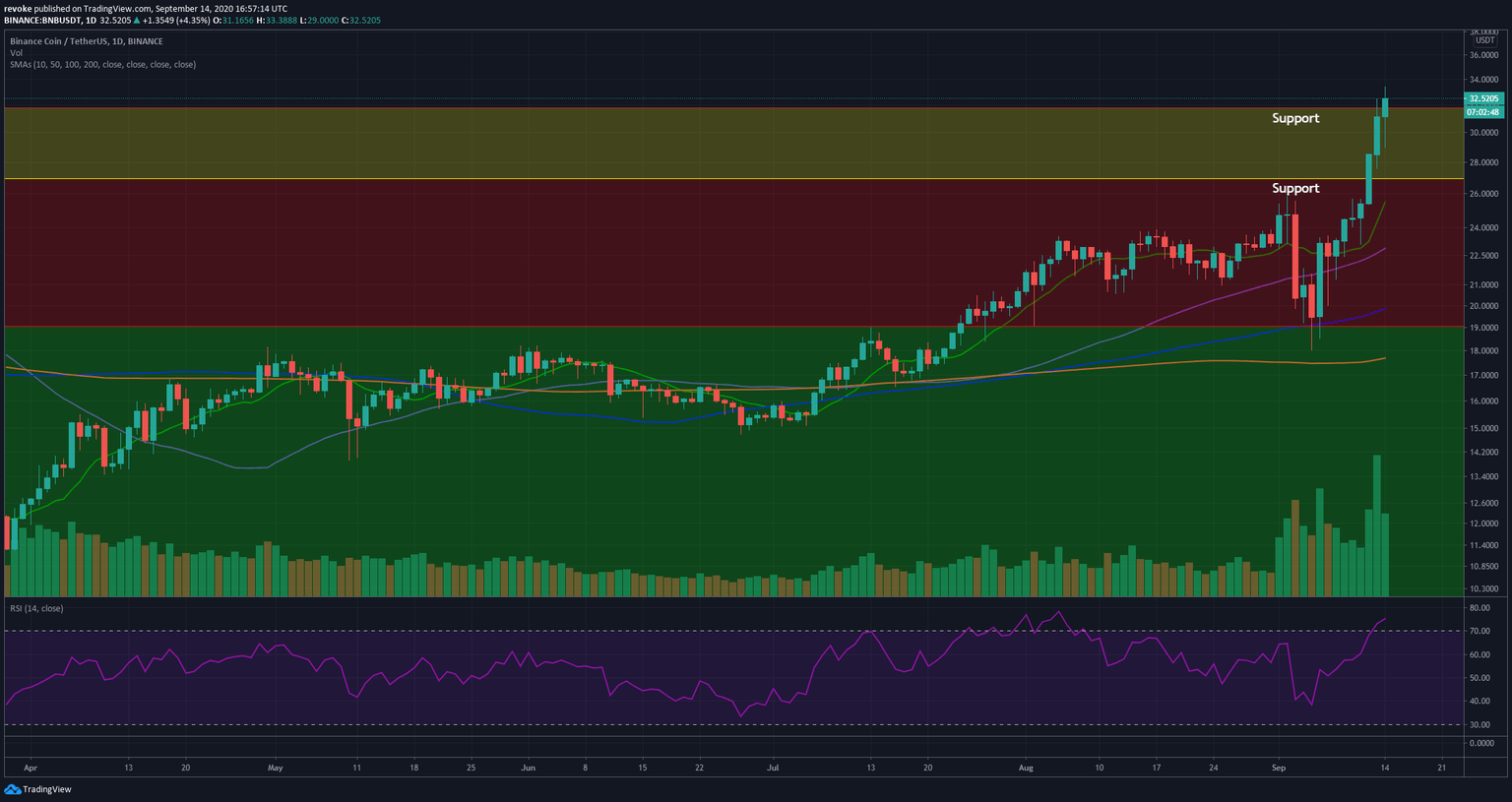

BNB/USD Daily Chart

Binance Coin managed to finally set a new 2020-high on September 12 after climbing above $27.19 and closing the day at $28.53, followed by more continuation moves towards $33.38. Of course, the RSI is overextended, and BNB could see a pullback in the short-term, perhaps towards the 0.236 Fibonacci Retracement line at $31.72. A more significant pullback would happen towards $27.19, which practically coincides with the Fib 0.382 Retracement level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.