Binance Coin presents buying opportunity before BNB price hits $500

- Binance Coin price is up more than 30% from its January 24 lows.

- Today’s selling pressure is likely profit-taking, and a retest of prior resistance turned support.

- Downside risks are limited, while the upside potential is significant.

Binance Coin price is facing some selling pressure today, possibly ending a five-day winning streak. Sellers stepped in when BNB was just shy of the $450 price level but have thus far been unable to push Binance Coin below the $400 level.

Binance Coin price is looking for a return to the $500 value area

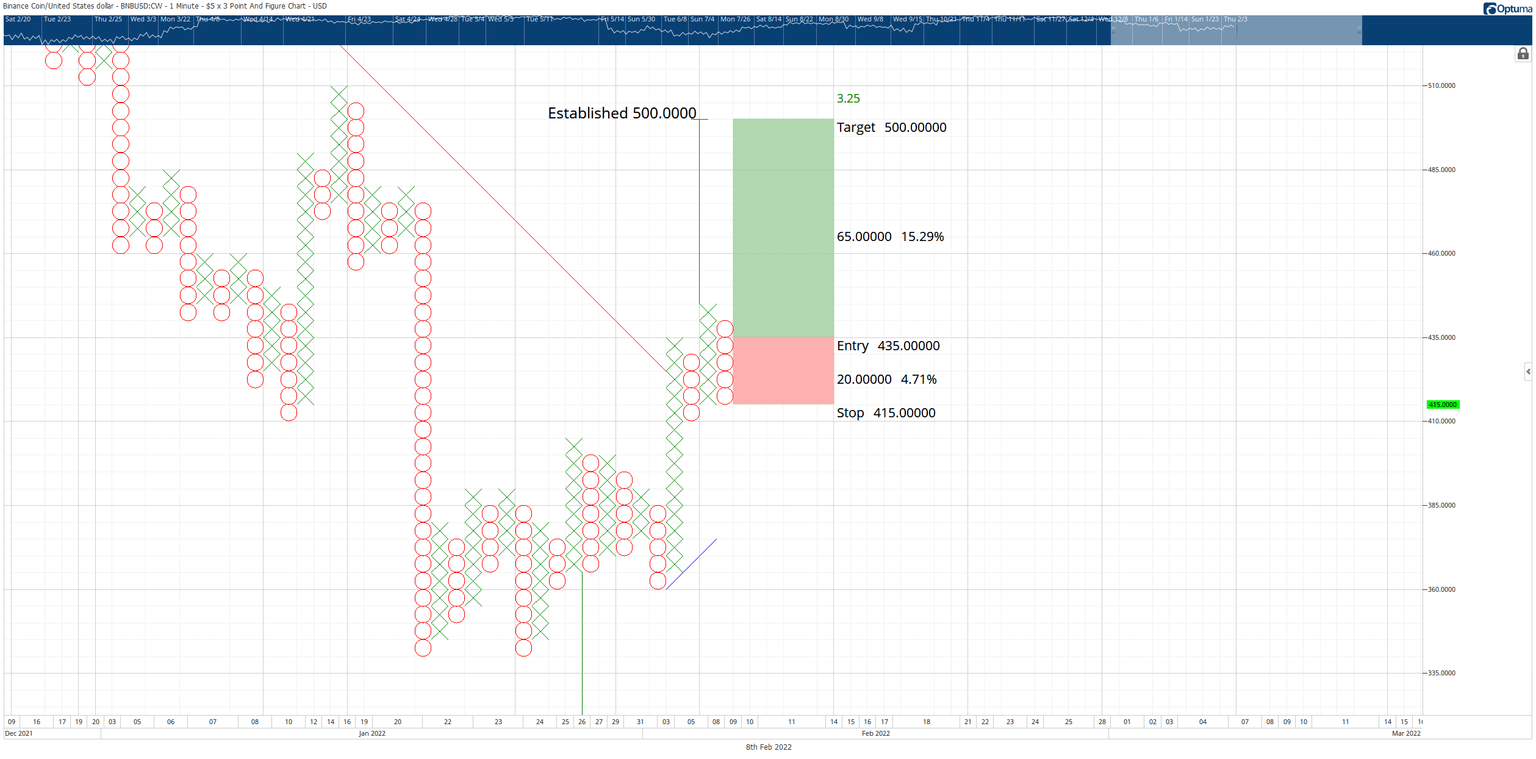

Binance Coin price recently converted into a bull market on its $5.00/3-box reversal Point and Figure chart. The initial pullback after breaking the bear market trendline (red diagonal line) was very small, so it is possible that this current O-column could dip even lower. However, that will not affect this upcoming buying opportunity.

There is a theoretical long trade setup for Binance Coin price on its Point and Figure chart. The trade idea is to go long on the three-box reversal off of the current O-column; that theoretical buy entry would be at $435 at publishing. The stop loss is a four-box stop, and the profit target is $500.

BNB/USDT $5.00/3-box Reversal Point and Figure Chart

If Binance Coin price moves lower, the entry and the stop moves in tandem with the market – but the profit target at $500 remains the same. A two to three-box trailing stop would help protect any implied profit made after the entry is triggered.

The theoretical long trade for Binance Coin price is only invalidated if the BNB breaches the bull market trendline (blue diagonal line). However, downside pressure and risks should be limited to the $400 price level.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.