Binance Coin likely to outperform competitors as Wrapped Beacon ETH gets warm welcome

- Binance has shifted its focus with the launch of its Ether-Wrapped Beacon ETH token in a pool on Curve Finance.

- The pool ranks eighth among liquid staking derivatives, amassing $129.9 million in total value since its release in late April.

- Binance Coin, the native token of Binance, could outperform competitors with its rising dominance in the DeFi landscape.

The largest cryptocurrency exchange by trade volume, Binance, is gearing up to establish its dominance in the DeFi landscape with the launch of Ethereum-wrapped Beacon Ether (ETH-wBETH) liquidity pool on Curve Finance.

Binance is incentivizing users with staked Ether rather than native tokens like other protocols. This has helped the pool amass $129.9 million in Total Value Locked (TVL) since its launch on April 27.

Also read: Bitcoin mining difficulty hits record high, signals likely influx of selling pressure on BTC

Binance ETH-wBETH pool on Curve Finance gains $129 million TVL in two weeks

The wrapped Beacon Ethereum (wBETH) token was launched on April 27 and Binance introduced it in an ETH-wBETH liquidity pool on Curve Finance. Each wBETH represents one Beacon Ether and the accrued staking rewards from the Beacon Chain at the rate of conversion of 1.002.

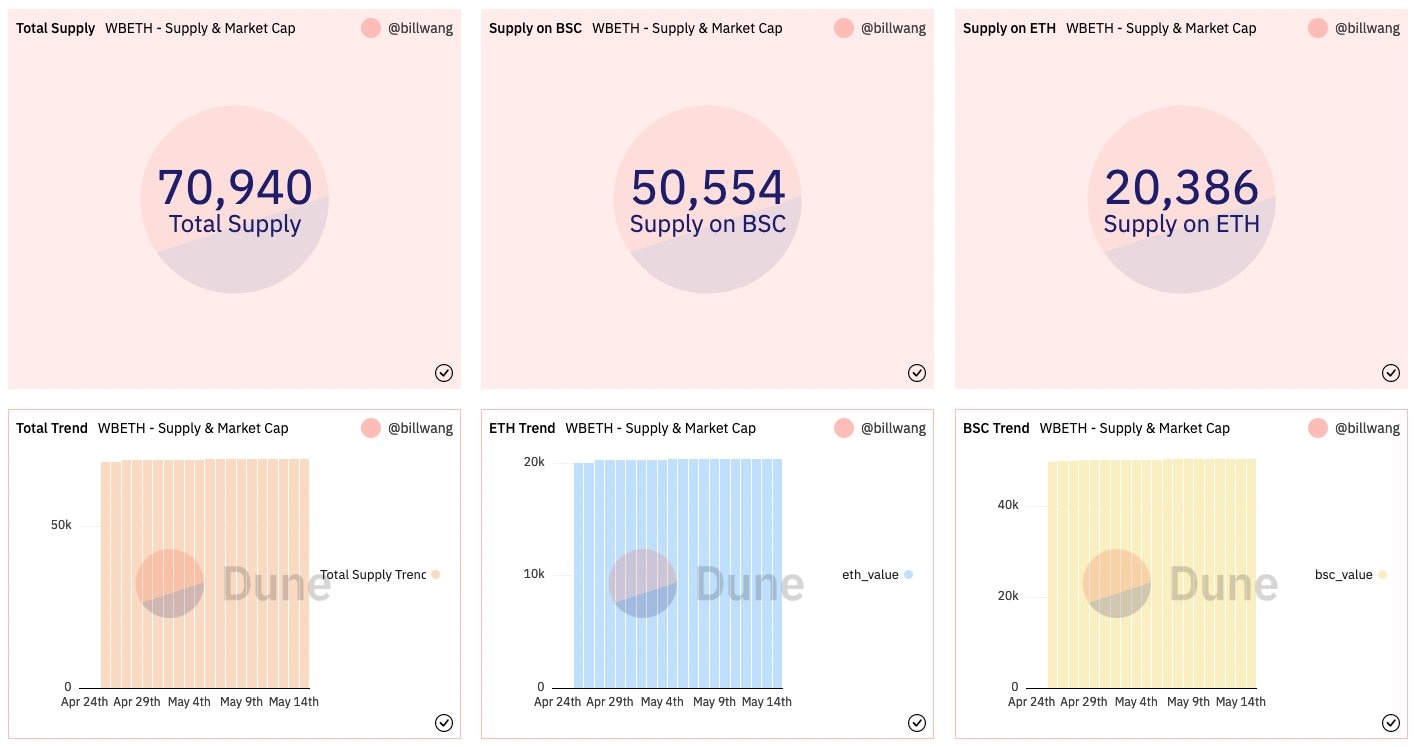

Within two weeks, 70.9K wBETH tokens have been minted and the current TVL is $129.9 million. wBETH ranks eighth among Liquid Staking Derivatives.

wBETH statistics

Binance can gain an edge over its competitors by inviting users to deepen the liquidity of the ETH-wBETH pool. In order to make this possible, the largest exchange by trade volume needs voting rights and needs to lock Convex Finance (CVX) tokens.

The exchange is currently incentivizing vlCVX (vote locking CVX) holders with 11.381 wBETH, instead of a native protocol token. This opens up an opportunity for vlCVX token holders to gain staked Ether instead of other tokens like wstETH (wrapped staked Ether) offered by Lido Finance that need to be exchanged further for unlocked staked ETH.

Binance’s dominance in DeFi could fuel BNB price recovery

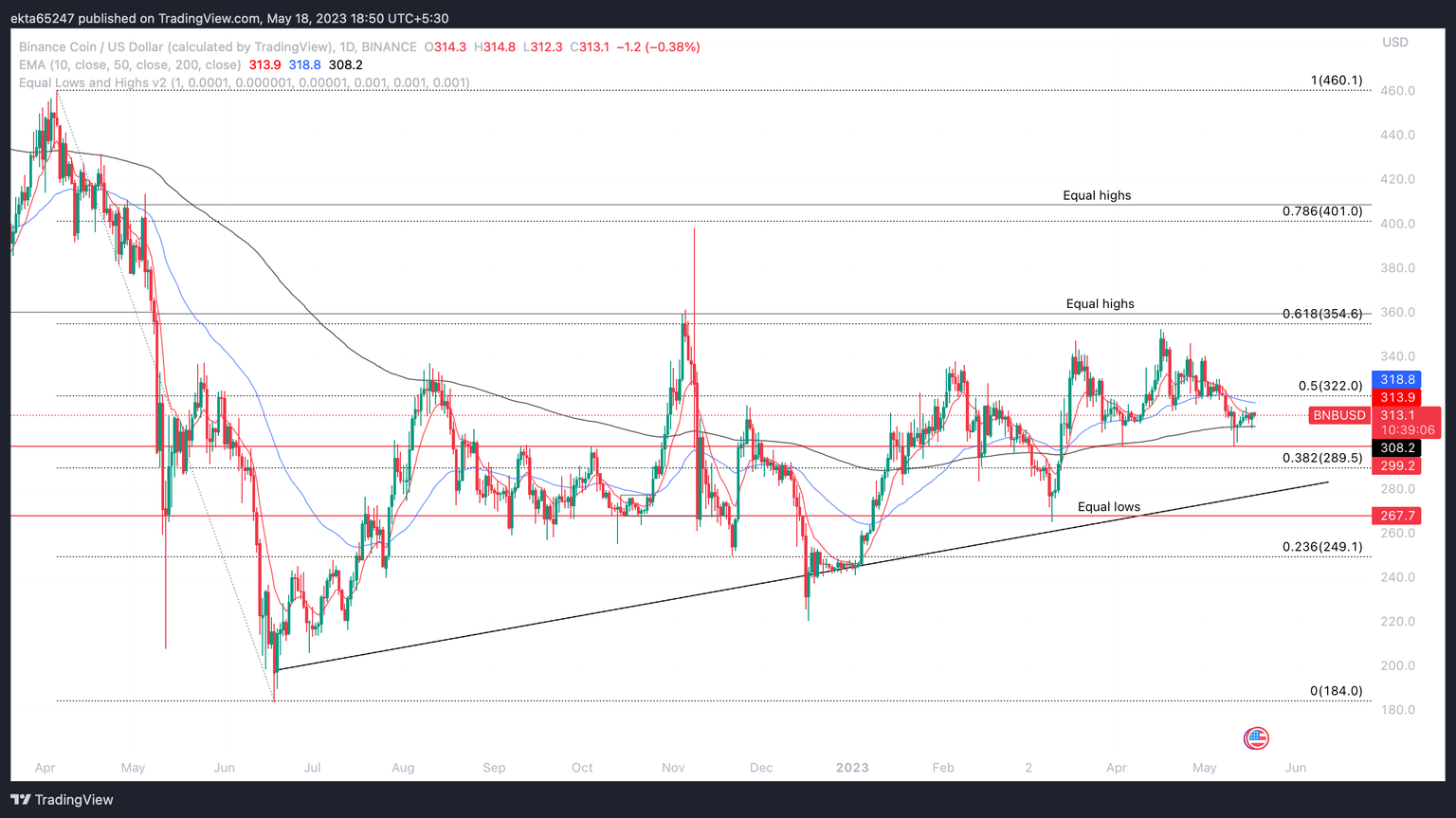

The exchange’s native token BNB benefits from Binance’s dominance in the DeFi landscape. BNB is in an upward trend that started in mid-June 2022 and Binance’s native token is on track to break past the 50% Fibonacci retracement (of the decline from April 2022 highs of $460 to June lows of $184) at $322.

The 50-day Exponential Moving Average at $318.80 is the immediate resistance for BNB in its upward trend.

BNB/USD one-day price chart

In the event of a price decline, the 38.2% Fibonacci level at $289.50 would be key. A drop below this level could invalidate the bullish thesis for Binance Coin. Equal low at $267.7 is likely to act as support for BNB in the event of a decline in the native token of the exchange.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.