- BNB price stabilized above $634 on Monday, down 6% since the Bybit hack sparked bearish sentiment toward centralized exchanges.

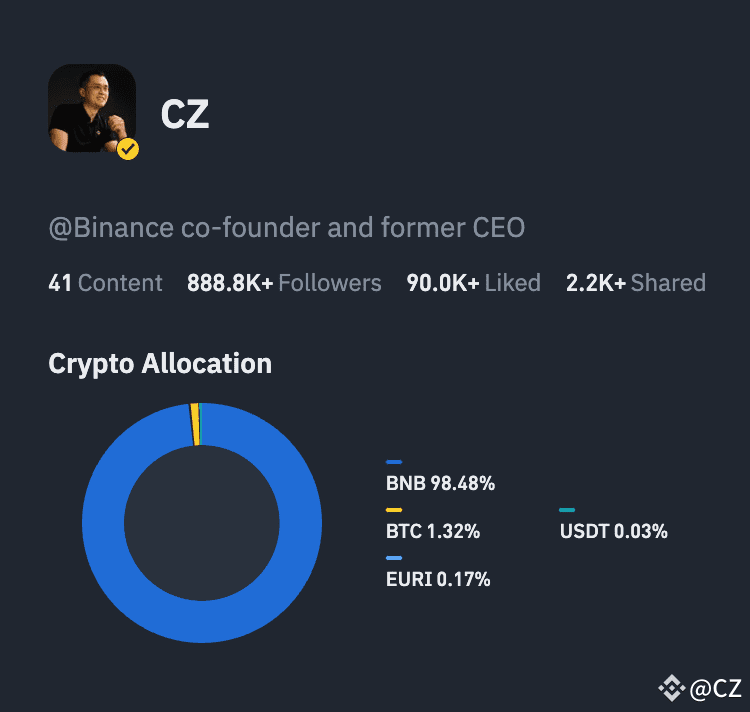

- Changpeng Zhao revealed his crypto investment portfolio, holding 98.48% in BNB and 1.32% in BTC.

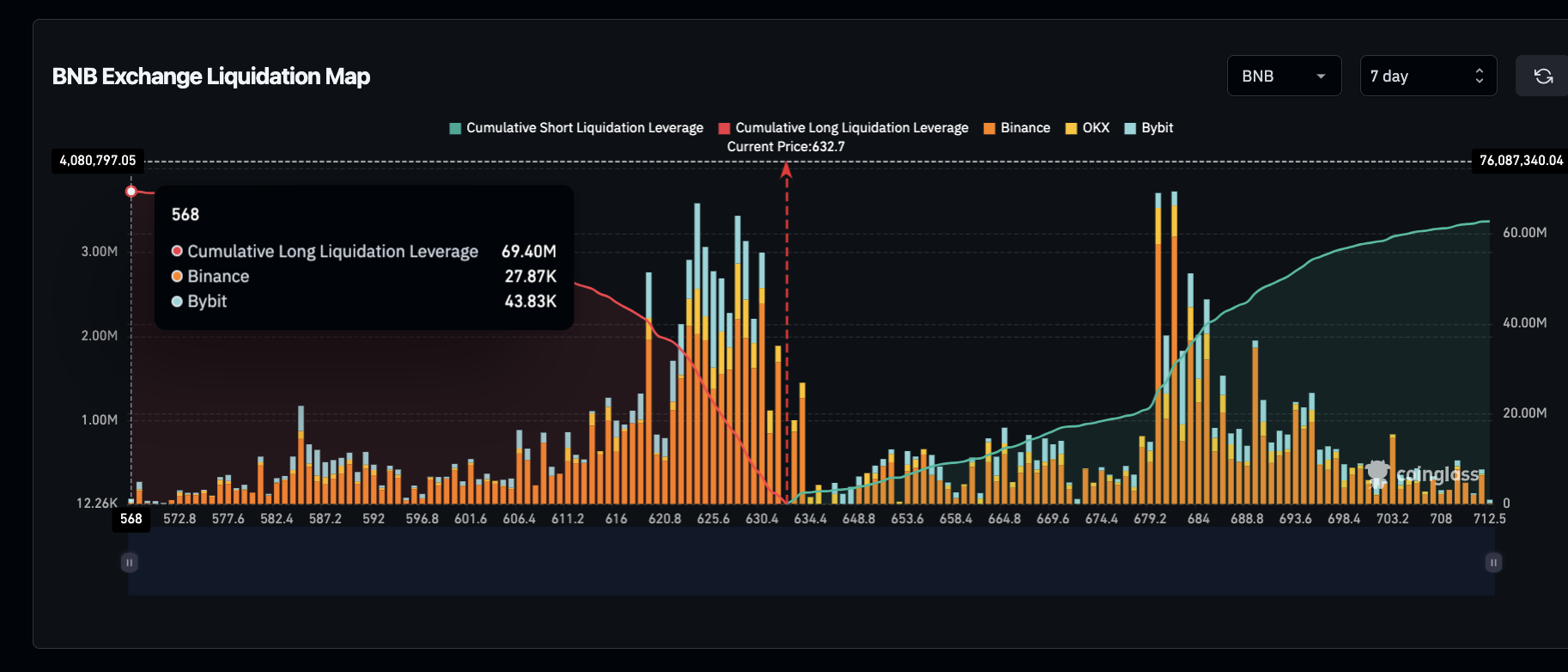

- Bull traders maintain dominance in the derivatives markets, with $69.7 million in active long leverage positions over the past week.

Binance Coin (BNB) price stabilized above the $634 mark on Monday, down 6% since the Bybit hack sparked bearish sentiment toward centralized exchanges. A recent update from Binance ex-CEO Changpeng Zhao could trigger an early rebound.

Why is Binance Coin (BNB) price going down?

BNB price has remained on a downtrend since Friday, even as top altcoins like Ethereum (ETH), Hedera (HBAR) and Tron (TRX) posted notable recovery gains.

As seen below, BNB’s price has dropped 5% in the last 48 hours, falling from $679 on Saturday to a local bottom at $630 on Monday.

Binance Coin (BNB) Price Action | Source: TradingView

Binance Coin (BNB) Price Action | Source: TradingView

The Binance exchange's native token may be under pressure following the fallout from Bybit’s $1.4 billion exploit on Friday.

Initially, BNB’s price reacted positively, rising 3.3% to hit $679 after Binance and Bitget transferred over 50,000 ETH in emergency support funds to Bybit within hours of the attack, easing market panic.

However, on Sunday, the analytics platform Wu Blockchain detected the hacker making a series of suspicious transactions, laundering funds through memecoins minted on Solana's Pump.fun.

With the likelihood of full fund recovery diminishing it raises concerns about the impact of the hack on Binance’s reserves and bottom line.

Consequently, customers have continued shifting funds off centralized exchanges, including Binance.

This has reduced daily transactions, impacting BNB’s value accrual through staking and trading fee incentives.

Changpeng Zhao reveals 98% BNB portfolio, emphasizing support for Binance

BNB price rebounded slightly to reclaim the $635 level at press time on Monday, signaling active efforts to defend the $630 psychological support.

However, a recent post from Binance co-founder and former CEO Changpeng Zhao has also lifted market sentiment.

CZ posted his crypto investment portfolio on Binance Square, the exchange’s native social media platform. The post revealed that BNB accounts for 98.48% of its investment portfolio, with BTC making up 1.32%.

Changpeng Zhao’s Investment Portfolio, Feb 24, 2025 | Source: Binance Square

With nearly all his holdings in Binance’s native token, CZ’s post reinforces his support and long-term confidence in the Binance and BNB Chain ecosystem.

Amid market uncertainty, this could improve sentiment, ease selling pressure and encourage the BNB Chain community to hold their positions.

This aligns with last week’s reports showing that Binance had sold a large portion of its BTC, ETH, and SOL reserves from operational profits.

BNB price forecast: The rebound phase could hit $680 before facing significant resistance

Bullish signals from key stakeholders like CZ and the swift rebound from $630 on Monday suggest that BNB’s price is poised to attempt a rebound towards $680.

Supporting this view, bullish traders have maintained dominance in BNB’s derivatives markets despite the 5% price dip.

Coinglass’s liquidation map compares total active long vs. short positions, providing real-time insights into speculative traders’ expectations.

The chart shows that bullish traders have amassed $69.7 million in active long leverage positions over the past week, outpacing the $67 million in total short positions.

Binance Coin (BNB) Liquidation Map, Feb 24, 2025 | Coinglass

When long leverage positions remain higher than shorts during a spot market downtrend—as seen with BNB—it signals that most bullish traders are holding rather than capitulating.

In this scenario, traders holding the $69.7 million in BNB long positions may start making covering spot purchases to avoid cascading liquidations.

A closer look at the chart shows that over 50% of total active short positions, amounting to $31 million, are concentrated around the $680 price level, while support is weaker at lower levels.

Given this setup, BNB could stage a rapid breakout toward $680 if market sentiment turns positive and investor interest returns.

On the downside, bulls risk losing over $40 million if prices slip below $620. However, with over 70% of active long positions deployed above this level, bears could struggle to push prices lower unless additional negative catalysts emerge.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.