Binance CEO CZ may not return to the UAE before sentencing

- Binance CEO Changpeng Zhao pleaded guilty to charges levied by the US DoJ, but was released on $175 million bond.

- However, he may not be able to return to his residence on Dubai, UAE, as US prosecutors petition the federal judge.

- The prosecution pushes that CZ does not return to the UAE until after sentencing in February 2024.

Binance CEO Changpeng Zhao (CZ) capitulated to the US Department of Justice (DoJ) on November 22, agreeing to a fine of $50 million for himself while the largest cryptocurrency exchange by trading volume parts with up to $4.3 billion in settlement fees. CZ was also released on bond, parting with an additional $175 million even as he faces up to 18 months in prison, narrowly missing a 10-year sentence. With this, he stepped down as CEO.

Also Read: Binance settles with US DoJ as markets anticipate official announcement, CZ steps down as CEO

Binance CEO may not return to the UAE

Binance CEO Changpeng Zhao may not return to his residence in Dubai, UAE after his release on bond. Recent reports indicate that the US prosecutors have appealed to the judge, asking that CZ remain in the US until his sentencing.

US PROSECUTORS ASK FEDERAL JUDGE TO PREVENT BINANCE FOUNDER CHANGPENG ZHAO FROM RETURNING TO UAE BEFORE SENTENCING -FILING - RTRS

— Tree News (@News_Of_Alpha) November 22, 2023

If the court approves, CZ could be in the US for almost three months, as his sentencing has been slated for some time in February 2024.

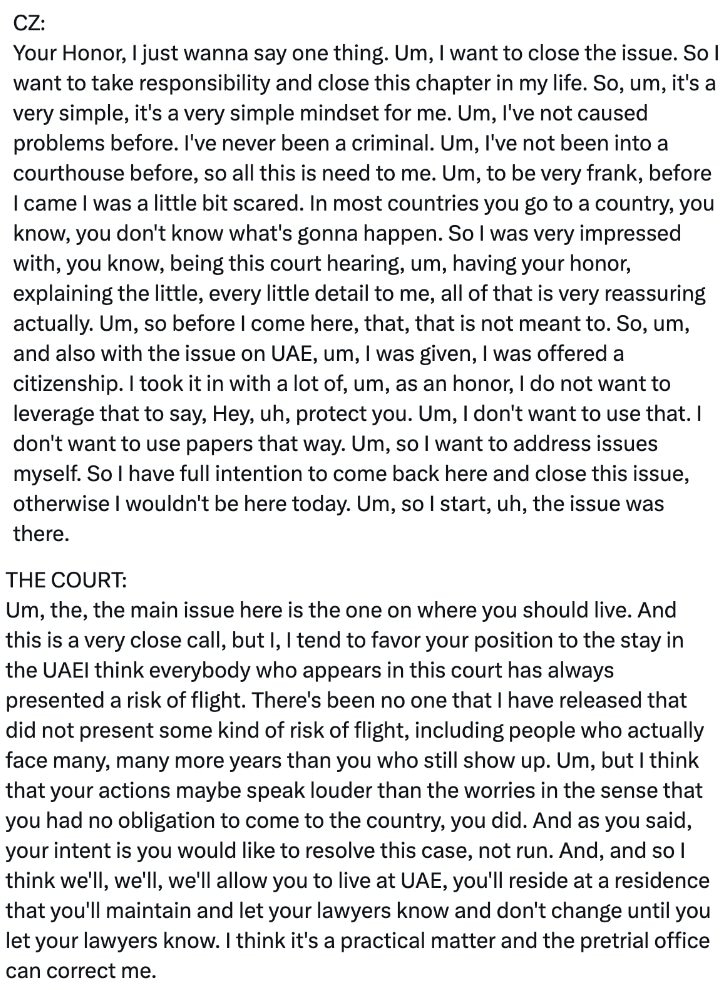

Part of the reason for the court approving his release was a touching message. CZ told the court that he had never been to court, adding that while he was scared, he wanted to resolve the issue. He also indicated that he had not taken advantage of his UAE citizenship, where there are no extradition laws. The judge appreciated his attitude, acknowledging that he had no obligation to come to the US, but did.

CZ message to the court

CZ could address the town hall meeting at 9 PM HKT today. This will be at 1 PM GMT or 8 AM EST. This will undoubtedly be of interest to many.

FXStreet team will bring you updates.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.