Binance CEO CZ addresses stablecoin FUD as BNB gears up for 46% upside

- Binance Coin is close to peak Fear, Uncertainty and Doubt surrounding Binance-pegged tokens.

- Changpeng Zhao addressed the uncertainty and affirmed that all Binance-pegged tokens including stablecoin BUSD are 100% collateralized.

- If CZ successfully steers Binance through the crisis situation, BNB price could see 46% upside and a resumption of its uptrend.

Binance, the world’s largest cryptocurrency exchange by volume, is currently tackling a crisis situation. The Fear, Uncertainty and Doubt (FUD) surrounding the exchange’s Binance-pegged tokens has plagued crypto market participants.

CEO Changpeng Zhao addressed the concerns of Binance-pegged token holders and affirmed that the assets including BUSD are 100% collateralized. The recent turn of events has presented a 46% upside in BNB/BTC.

Also read: TRON revenue doubles, will this trigger a rally in TRX price?

Binance battles FUD as BNB gears up for massive gains against Bitcoin

Binance is battling peak FUD in the current market cycle. The largest exchange by volume is tackling the US financial regulator’s attack on Paxos-issued stablecoin Binance USD (BUSD). CEO Changpeng Zhao alleviated the concerns of the crypto community through an affirmation of the 100% collateralization of Binance-pegged tokens, including BNB.

BUSD collateralized at 100%

Following CZ’s affirmation, an investment research firm Ouroboros Capital announced the purchase of BNB against BTC at 13,412. The analysts at the firm argue that CZ has proven time and again that Binance can avert crises and recover from FUD.

1/N: Buying BNB here. Think we're close to peak FUD and the BNB/BTC ratio shows it. @cz_binance and @binance has proven time and time again how they sail through storms to re-emerge stronger and I doubt it will be any different this time. Not investment advise, views are my own. pic.twitter.com/0bZWDFpK4q

— Ouroboros Capital (@OuroborosCap8) February 15, 2023

BNB/BTC presents a buying opportunity for these reasons

BNB/BTC ratio is in the range that started in August 2022, post the Terra LUNA collapse and traded within the same throughout the FTX exchange collapse. The implosion of Samuel Bankman-Fried’s exchange resulted in an increase in Binance’s market share and the exchange’s share of Bitcoin Open Interest climbed from 30% pre-FTX to 38% now.

Share of OI across Bitcoin Futures

The BNB/BTC ratio is 10% away from the breakout of the post 2021 highs and analysts at Ouroboros Capital believe that the market has heavily discounted Binance’s progress in the last two years.

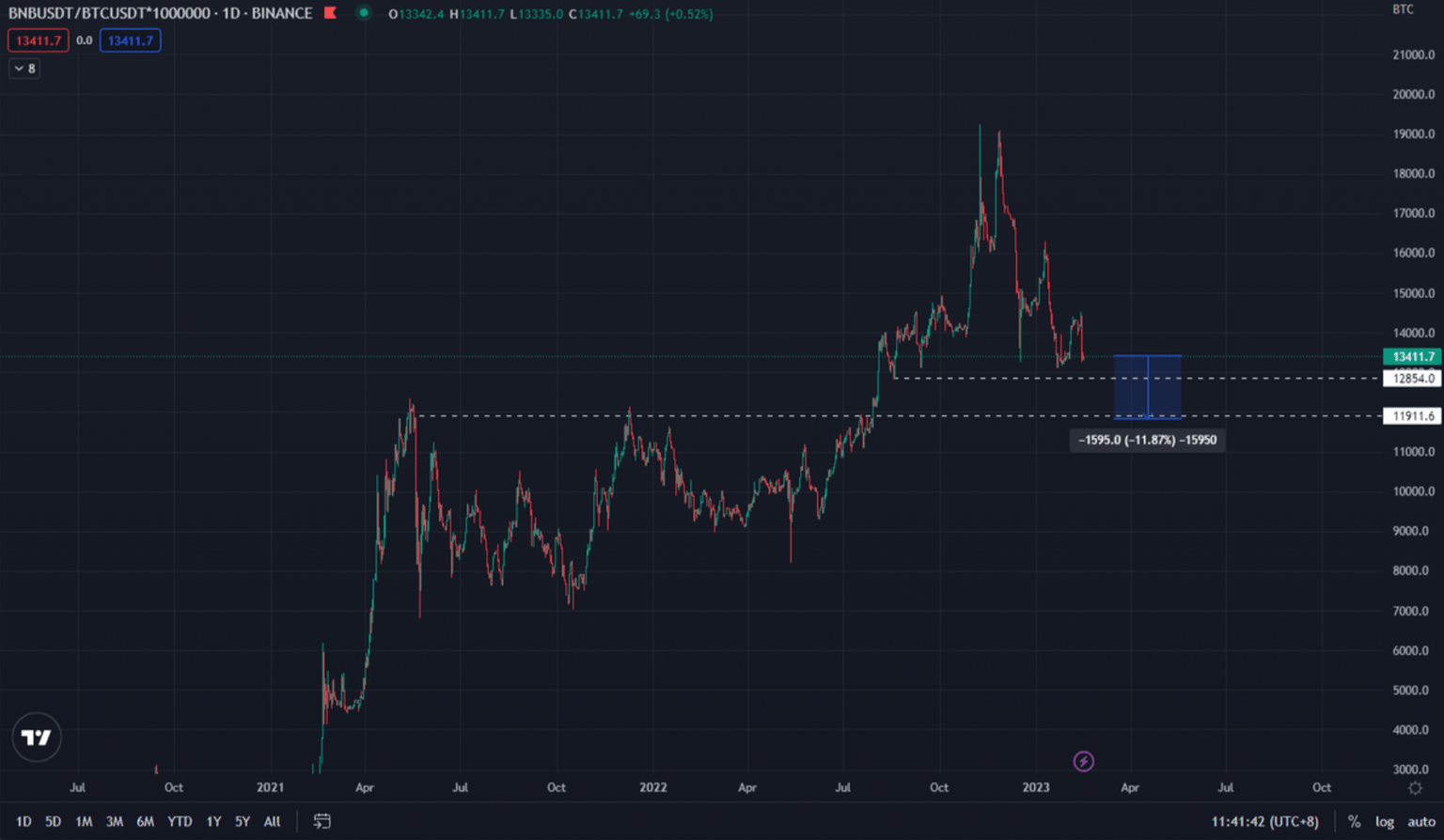

BNB/BTC price chart

The exchange battled allegations and handled investigations by law enforcement agencies and financial regulators, in addition to FUD surrounding Binance’s staking product, insurance fund SAFU and Binance-pegged tokens.

CZ seized the opportunity to turn crises into opportunities throughout 2022 and increased Binance’s market share and users over the past year.

Alongside the progress in its centralized platform, the exchange made considerable headway on the non-CEX side with BNB Chain. Binance Chain continues to enjoy high daily active users (DAU). This metric is key as it represents the utility of a product/ service for market participants, therefore acts as a measure of the protocol’s growth. According to Token Terminal’s data BNB Chain has the largest DAU count, with 17% growth since January 14.

BNB Chain massive growth in DAU

Will BNB price witness 10% downside or 46% upside?

The risk/reward for the BNB/BTC trade looks rewarding at a 10% downside, if the pair breaks below the 2021 highs and a 46% upside if it resumes its uptrend in the channel that started in Q4 2021.

BNB/BTC price chart

As seen in the chart above, the BNB/BTC pair is currently trading at 13,412 and remains undervalued despite recent developments.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.