- The US SEC disclosed chat records between Binance staff to support its charges against the exchange and its CEO.

- Changpeng Zhao has issued a letter to company staff, cautioning them about investigators asking them for their chat logs.

- According to CZ, the logs detail conversations between disgruntled employees going back five years ago.

- The crypto executive has urged Binancians to focus on work, specifically developing value-adding products.

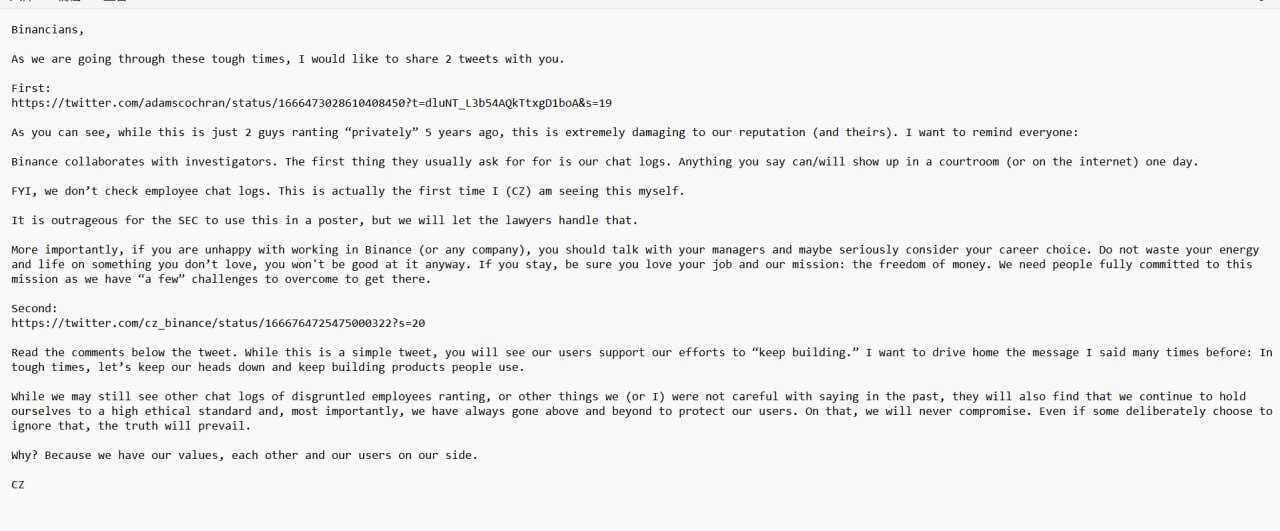

Binance CEO Changpeng Zhao has issued an internal address to company staff, asking them to focus on work and developing products people can use. The internal memo comes after the United States Securities and Exchange Commission (SEC) disclosed chat records between Binance employees in an attempt to support its case against the largest crypto exchange by trading volume.

Also Read: Two key dates over the SEC request to freeze Binance assets

Leaked chats between Binance staff

Binance CEO CZ has minimized the pieces of alleged evidence issued by the US SEC in chat conversations, terming the chatter among "disgruntled and ranting" employees from five years ago. In one of the screen captures, one of the employees alluded to Binance operating as an unlicensed securities exchange in the USA.

1/15

— Adam Cochran (adamscochran.eth) (@adamscochran) June 7, 2023

Evidence from SEC case against Binance including internal chat logs, first between Sam Lin (former compliance lead at Binance) and Alivn (previously head of BD)

First is their convo about equity bonuses where Sam talks about risks of holding BNB pic.twitter.com/96IfwJEUOT

The conversation escalates to one telling the other to "take his BNB and dump it into USDT," the Tether stablecoin, adding, "It would be dumb to hold BNB." According to one of the persons in the conversation, the exchange's compliance side was a "sinking ship," akin to the Titanic, with an imbalanced risk vs. reward ratio.

For this reason, an individual selected for Chief Compliance Officer (CCO) candidacy even refused to sign off on Binance's Office of Foreign Assets Control (OFAC) compliance despite an offer for a 100% salary increase. For the layperson reader, OFAC bears the authority to permit certain transactions that would otherwise be prohibited under its regulations. Further, he notes that the then CFO, Wei Zhou, and CZ were cognizant of why no one wanted to be responsible for the OFAC reporting.

Citing Binance's head of compliance at the time:

There is no … way we are clean. I have seen NOTHING to prove we are.

Reportedly, Changpeng Zhao actively taught people "how to circumvent procedures, and how business priorities supersede any compliance training," adding that the BNB strategy is to survive for two years and then chuck.

Based on the revelations, "a translated recording of CZ specifically noted the 2019 blocking of US users and how they should approach slowly getting US users to use foreign KYC and ignore the IP addresses, and slow the roll-out of the news." Further, the regulator also claims to be in possession of internal conversations during the launch of Binance US, where Binance executives planned to allow access to US users through purchased KYC and VPNs.

The most damning, however, is alleged evidence pointing to loopholes supported by CZ where organizations can be "on-boarded through the US exchange but trade via .com with a special setup." Notably, this provision is meant to favor whales, with the tweet noting that it was the nature of their business.

Binance CEO pens an address to company staff

Acknowledging that the logs tarnished the company's reputation, CZ has urged Binance staff to focus on work even as the possibility of the regulator approaching them for information remains. The crypto billionaire has articulated that the company does not peruse staff chat logs, unlike the investigators, as it was their job. In a manner of speech (not direct), CZ cautioned employees that whatever they say in private via text could one day come to light and be used in a court of law.

Notwithstanding, the CEO has asked anyone unhappy with their job to consider a change of employment or employer. Further, he asserts that while there may be more embarrassing leaks to come, he and the company live in the present, where they continue to hold themselves to high ethical standards.

Further, Zhao underscores his commitment, and that of the company, toward protecting Binance users.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.