- Binance recently made commitment to transparency and published proof of reserves to enhance investor confidence.

- After publicizing details of its crypto wallet addresses, Binance hired an outside accounting firm to prepare a “proof of reserve report.”

- Crypto Twitter is abuzz with FUD and experts argue Binance is only 97% collateralized.

Binance, the world’s largest exchange by trade volume, witnessed a spike in fear, uncertainty and doubt (FUD) surrounding its proof of reserves report published in the aftermath of the FTX collapse. While the exchange attempts to shore up investors' confidence, crypto Twitter buzzes with speculation that Binance is less than 100% collateralized, a red flag for the exchange’s solvency.

Also read: SEC order attempts to assess health of crypto industry after FTX exchange fallout

Binance tries to calm investors after FUD on crypto Twitter

Binance ranks on the list of cryptocurrency exchanges that released information of its reserves where customer assets are held, as a move to win crypto investors’ confidence after FTX exchange collapsed. More recently the exchange reiterated its commitment to transparency.

Patrick Hillmann, Chief Strategy Officer of Binance told the Wall Street Journal on December 10,

It’s important for us to show users that the coffers are not bare, like at FTX.

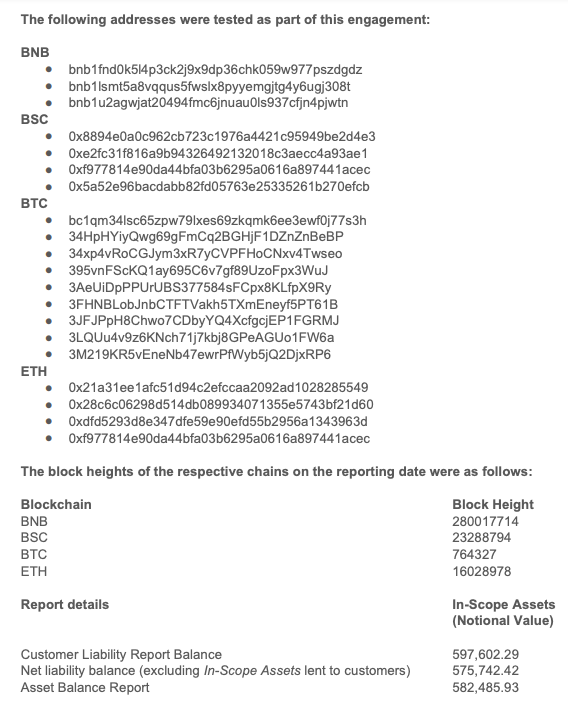

In November 2022, Binance published details of its crypto wallet addresses and hired former Donald Trump auditors Mazars to prepare a “proof of reserve report.” This report covered a portion of Binance’s assets and liabilities, including some data about the exchange’s finances.

On the exchange’s website, Binance explains that proof of reserves specifically refers to assets held in custody for users. The report is evidence that Binance has funds to cover all of their user assets 1:1, as well as some reserves.

Crypto Twitter is abuzz with experts alleging that Binance’s audit was fake, however, and that the auditors actually believe the exchange is 97% collateralized. John Reed Stark, Former Chief at SEC Office of Internet Enforcement commented on Binance’s proof of reserves in a recent tweet:

Binance’s “proof of reserve” report doesn’t address effectiveness of internal financial controls, doesn’t express an opinion or assurance conclusion and doesn’t vouch for the numbers. I worked at SEC Enforcement for 18+ yrs. This is how I define a red flag.

Jesse Powell, co-founder and CEO of Kraken exchange, Binance’s competitor, believes that the platform made an attempt to prove collateral rather than reserves in its report. Powell believes Binance is insolvent and admits to the same with regard to actual assets owed v. tokens controlled. The Kraken co-founder argued that the bankrupt FTX exchange played solvent through the “collateral” accounting trick.

Binance’s controversial proof of reserves report

Douglas Carmichael, an accounting professor at Baruch college in New York said,

I can’t imagine it (Binance’s proof of reserves report) answers all the questions an investor would have about the sufficiency of collateralization. That’s the main thing it seems to speak to.

The reserve report is a five-page letter from a partner at a South African affiliate of Mazars. It contains three key numbers. The firm’s letter, however, was not a full audit report and didn’t address the effectiveness of the company’s internal financial-reporting controls.

Binance proof of reserves report by Mazars

Mazars said it performed its work using “agreed-upon procedures” requested by Binance and made no representation regarding the appropriateness of the procedures. The letter was addressed to a Binance entity called Binance Capital Management Co. Ltd., which is based in the British Virgin Islands. Investors are unclear whether customer assets are held by this entity or by Binance International or Binance US.

It remains unclear whether all the assets of Binance Capital Management Co. Ltd. are included in the report as the scope was limited to Bitcoin assets and liabilities. Binance assured traders that it would begin releasing information about other crypto tokens in the coming weeks.

The following numbers in the report raised questions about Binance’s solvency and its ability to meet financial obligations to customers.

- For example, the customer liability report balance showed 597,602 BTC and asset balance report read 582,486 BTC

- Total Bitcoin liabilities cited in the accounting firm’s letter were 3% greater than BTC assets in the scope of the report. Binance didn’t meet the 1:1 ratio of customer reserves to customer assets.

- Net liability balance (excluding in-scope assets lent to customers) showed a figure that was adjusted downward by about 21,860 BTC as it was loaned to customers.

Mazars stated that Binance is 101% collateralized on an adjusted basis and 97% collateralized when using larger liabilities numbers for the calculation. This has raised a red flag for experts on crypto Twitter.

Binance spokesperson clears the air, limited scope of report responsible for FUD

Jessica Jung, Binance spokesperson said that the collateral for Bitcoin loans of 21,860 BTC is in other cryptocurrencies, which fall outside the scope of the Mazars report. If Binance had not provided these loans, it would be 101% collateralized.

Mazars report focused exclusively on Bitcoin and excluded other cryptocurrencies held by the exchange as collateral, therefore raising the red flag among investors on crypto Twitter.

Will Binance’s Secure Asset Fund for Users (SAFU) cover a shortfall?

Binance established an emergency insurance fund in 2018, called the Secure Asset Fund for Users (SAFU). The exchange informed users on November 9 that SAFU balance was topped back to $1 billion.

The fund is made up of Bitcoin and two tokens created by Binance. Binance’s stablecoin pegged to the US Dollar (BUSD) and the platform’s native token Binance Coin (BNB). Binance has not released financial statements for the fund showing its assets and liabilities, but the website informs users that “the value of the fund will fluctuate based on the market.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.