Binance and Huobi among exchanges warned in India for AML and CFT framework oversight

- India has warned Binance and Huobi, among seven other exchanges, for failing to register under the country’s AML and CFT framework.

- The country’s Financial Intelligence Unit wants their URLs blocked as part of compliance action.

- This comes after Binance exchange and the former CEO’s legal debacle over possible terrorism facilitation.

Terrorism facilitation among cryptocurrency exchanges has become a sensitive topic in the crypto scene after Binance and former CEO Changpeng Zhao (CZ) capitulated to the US Department of Justice (DoJ). The US Government called out the largest cryptocurrency exchange by trading volume over allegations of money laundering, bank fraud, and sanctions violations among other charges.

Also Read: Binance capitulation to DoJ harmed its case against the US SEC

Binance and Huobi among exchanges cited for AML and CFT framework infringement

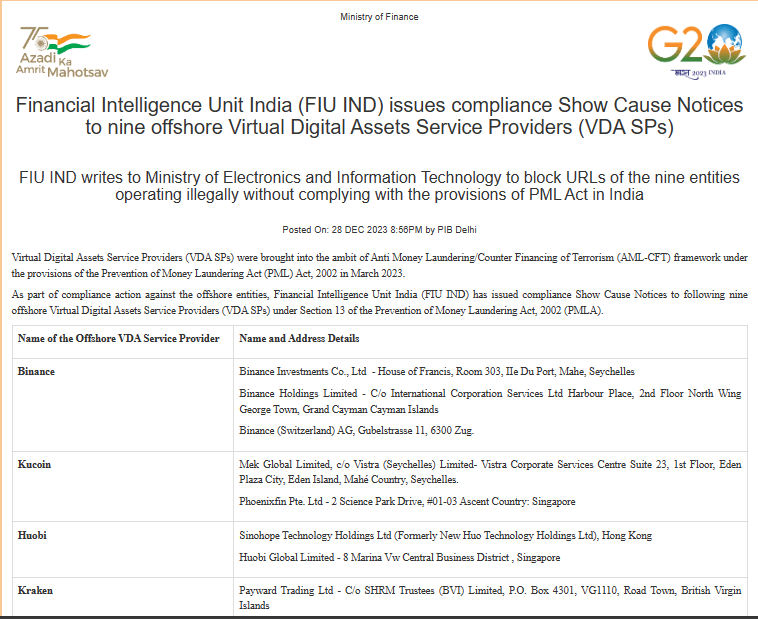

The Financial Intelligence Unit India (FIU IND) has issued compliance Show Cause Notices to nine offshore Virtual Digital Assets Service Providers (VDA SPs), or put simply, cryptocurrency exchanges.

The exchanges, comprising Binance, Kucoin, Huobi, Kraken, Gate, Bittrex, Bitstamp, MEXC and Bitfinex are not registered despite catering to a substantial part of Indian users.

In a letter addressed to the Secretary for the Ministry of Electronics and Information Technology, the Director of the FIU IND wants the exchanges’ URLs blocked for operating illegally without complying with the provisions of Prevention of Money Laundering Act (PML Act) in India.

FIU IND letter

Blocking the URL would mean users cannot access the site. Instead, they will come across a red page with a warning message either suggesting that the site does not exist, or that it is unavailable.

Under the provisions of the PML Act, 2002, Virtual Digital Assets Service Providers (VDA SPs) were put under the purview of India’s Anti Money Laundering/Counter Financing of Terrorism (AML-CFT) framework in March 2023. Both on-shore and off-shore VDA SPs fall under this ambit. The obligation is activity-based and is not contingent on physical presence in India.

This means that beyond virtual digital assets, activities such as “exchange between virtual digital assets and fiat currencies, transfer of virtual digital assets, safekeeping or administration of virtual digital assets or instruments enabling control over virtual digital assets etc.” are all covered here. They must register with FIU IND as Reporting Entity while at the same time maintaining compliance with obligations defined under PMLA 2002.

Terrorism financing among exchanges

For Binance, the topic is fresh out of the water after founder and former CEO CZ was charged with financial crimes including money laundering. The terrorism financing headline also extended to Tron, with a recent report on Reuters citing Tron for exceeding Binance for the same crime, illicit funding.

At the time, Tron founder Justin Sun challenged the allegation, saying, the top priority remains to maintain decentralization. His defense came as the allegation caused Tron stablecoin (TUSD) to destabilize and lose its peg by a tad margin. Circle, USDC stablecoin issuer also distanced itself from Sun in a letter, assuring that the company does not facilitate or finance any illicit actors directly or indirectly.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.