- Microsoft’s Bill Gates told Reuters that the call to pause AI won’t tackle the challenges that Musk and the others are concerned with.

- Artificial Intelligence coins narrative took a back seat with growing fears around democracy and transparency issues.

- AGIX, FET and RNDR wiped out their gains from the past week; it remains to be seen whether the AI coins will recover.

Artificial Intelligence (AI) narrative lost its relevance over the past few weeks with rising concerns surrounding democracy and transparency. Bill Gates, the founder of Microsoft recently refuted the open letter by Elon Musk and other influencers, requesting a pause on AI research.

Gates believes a pause on AI research may not solve the issues concerning its development and usage. It remains to be seen whether AGIX, FET and RNDR prices recover with recent developments in AI, and in response to Gates’ comments.

Also read: Shiba Inu themed meme coin rallies hit roadblock: SHIB, DOGE, FLOKI, ELON

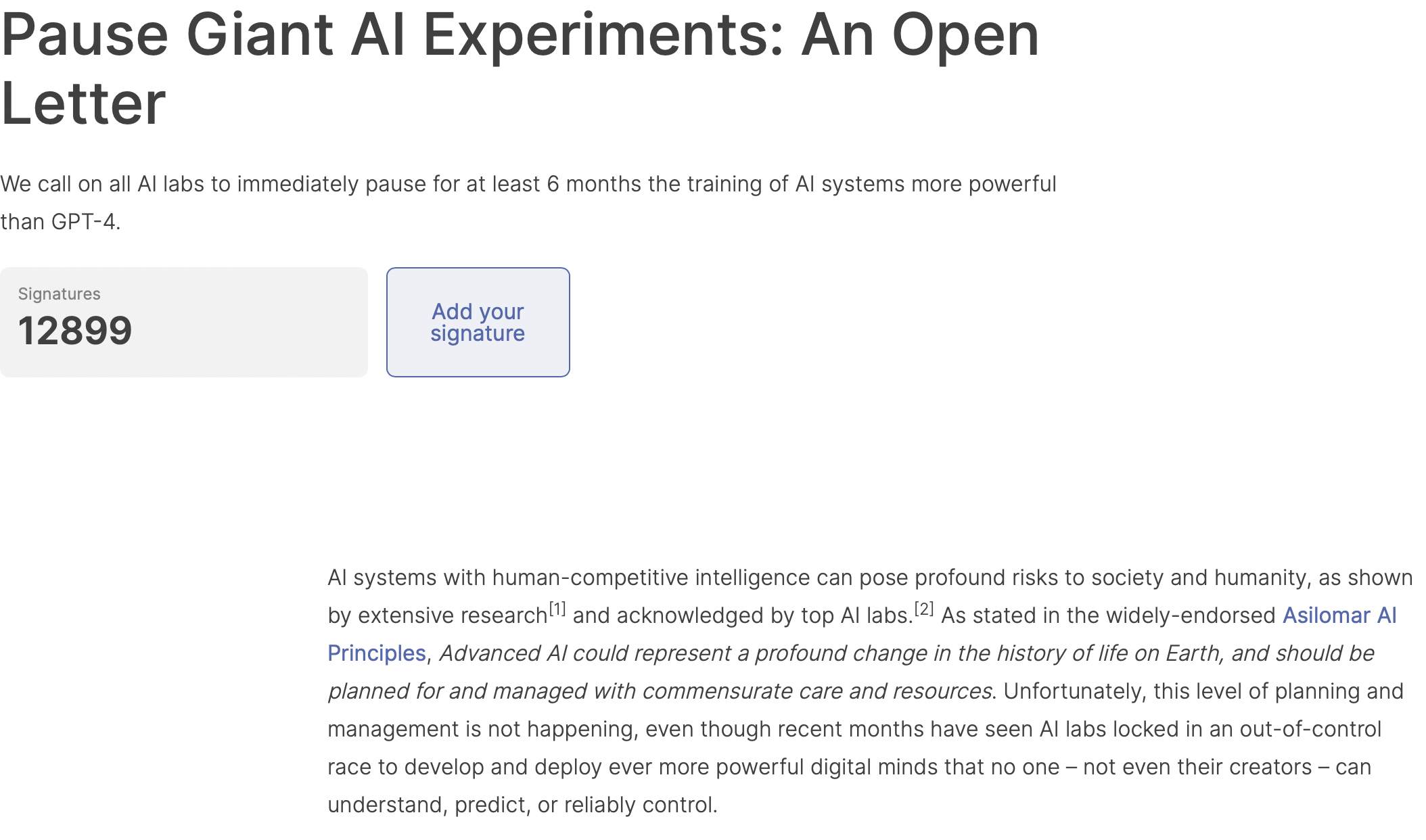

Elon Musk and a group of AI experts request pause on AI research

Elon Musk, the billionaire CEO of Tesla, alongside a group of AI experts called for a six-month pause on the development of AI systems superior to OpenAI’s GPT-4. The experts cited a risk to society, in their letter and expressed their concerns on the fast-paced development of AI systems.

Open Letter by Musk and experts

The letter has gathered 12,899 signatures for noteworthy personalities and influencers, calling for a pause on AI research and citing key issues and potential negative impact on civilization.

Bill Gates dimisses Musk’s concern, says “pause” won’t tackle AI issues

Bill Gates told Reuters that a pause in research would fail to suffice the concerns like democracy, transparency, among others, cited in the open letter. According to Gates, the age of AI has begun. The Microsoft co-founder was quoted as saying:

I don’t think asking one particular group to pause solves the challenges. Clearly there’s huge benefits to these things, what we need to do is identify the tricky areas.

Gates’ statements act as reassurance to the community of AI token holders awaiting further development in projects working in the Artificial Intelligence sector.

AI fears loom in Germany, France and Sweden

Gates’ statements may have failed to alleviate the concerns of regulators in European nations of Germany, France and Sweden. Italy recently announced an outright ban on AI chatbot ChatGPT and concerns among other countries continue mounting.

Regulators in Germany, France and Sweden have expressed concerns over democracy and transparency issues concerning AI. While regulators look for answers and solutions to the responsible use of AI chatbots and technology, an outright ban may not be the right answer in the long-term.

AI coins: AGIX, FET and RNDR

While the fate of future development and research in Artificial Intelligence hangs in the balance, AI token holders witnessed a negative impact on coin prices. SingularityNET (AGIX), Render (RNDR) and Fetch.ai (FET) have wiped out their gains over the past week and yielded losses for holders.

AGIX

Rutradebtc, a crypto analyst on Twitter shared his bearish thesis on AGIX price. The AI token nosedived 32% from its mid-March peak of $0.58. The analyst notes that SingularityNET’s token is respecting the bearish order flow in the four-hour timeframe, as seen in the chart.

$AGIX/USDT [UPDATE]

— CRAZY RUSSIAN (@rutradebtc) April 5, 2023

Clearly, Price respecting the 4HR time frame bearish order flow

Price mitigated the 4H supply and got a huge rejection and so far, price has dropped by 32%.

Gimme 100❤️ So that I can drop analyses on the next coin for huge gainshttps://t.co/jY8Pg49NiQ pic.twitter.com/jjLWGAXOsd

The analyst is awaiting the next round of gains in AGIX, and notes that currently the AI coin is facing rejection, and is in a short-term downtrend.

FET

FET started its downtrend in the first week of February 2023. The AI coin is currently sitting on support at $0.35. Goomba, a crypto analyst and trader believes there is a likelihood of a recovery in FET and the target is $0.60.

FET/ USDT price chart

According to the analyst, key targets on the upside are $0.60, $0.87, $1.1. A decline below support at $0.35 could invalidate the analyst’s bullish thesis for the AI coin.

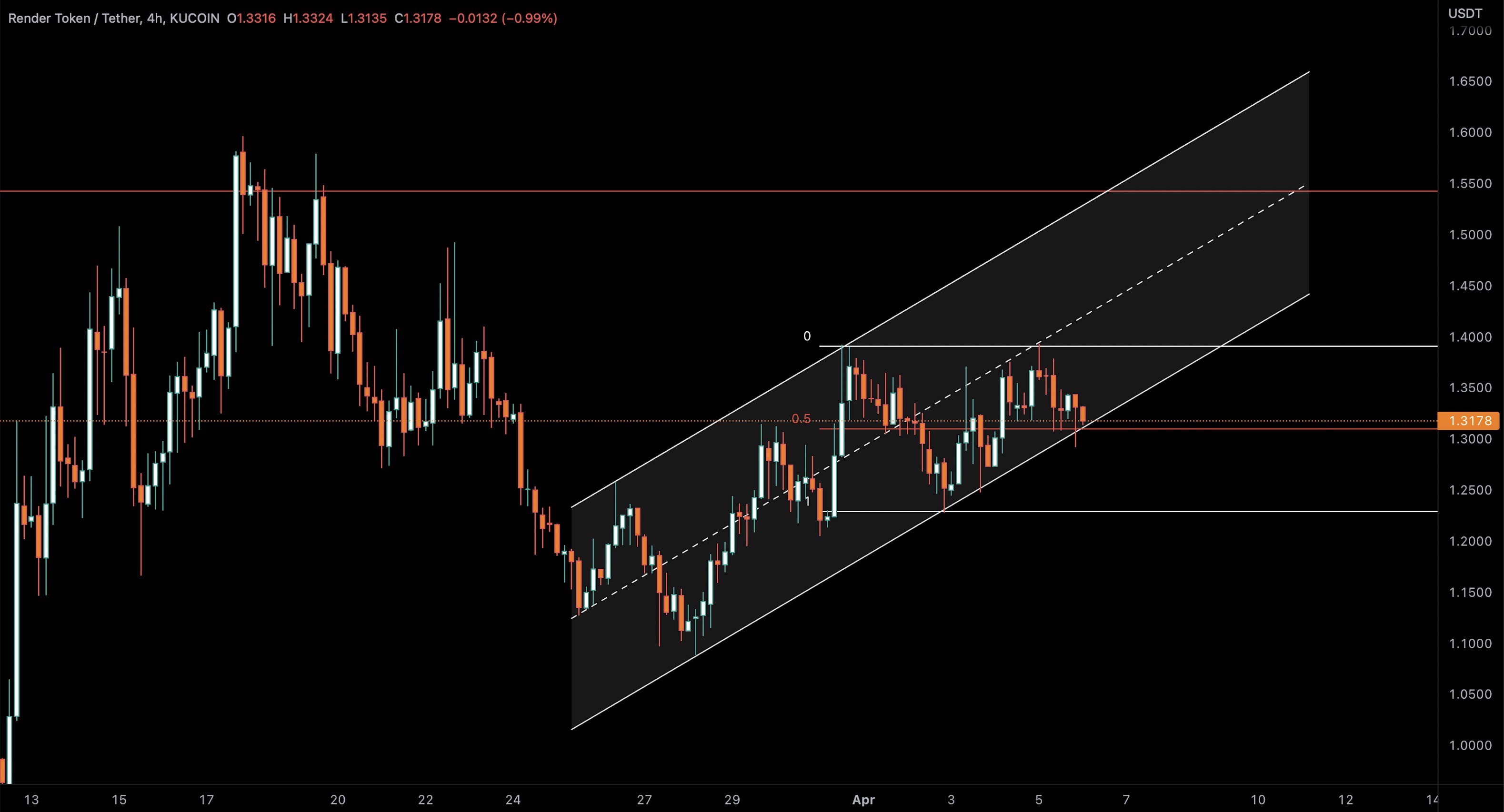

RNDR

BigCryptoT, a technical expert argues that RNDR is currently undervalued. The AI coin is in at the range equilibrium. According to BigCryptoT’s bearish thesis, RNDR is likely to nosedive or bounce from the range equilibrium and $1.3 is acting as support for the AI coin.

RNDR/USDT 4H price chart

RNDR is in an ascending parallel channel, therefore a decline below the lower trend line supports a bearish thesis for the asset.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Polygon joins forces with WSPN to expand stablecoin adoption

WSPN, a stablecoin infrastructure company based in Singapore, has teamed up with Polygon Labs to make its stablecoin, WUSD, more useful in payment and decentralized finance.

Coinbase envisages listing of more meme coins amid regulatory optimism

Donald Trump's expected return to the White House creates excitement in the cryptocurrency sector, especially at Coinbase, the largest US-based crypto exchange. The platform is optimistic that the new administration will focus on regulatory clarity, which could lead to more token listings, including popular meme coins.

Cardano's ADA leaps to 2.5-year high of 90 cents as whale holdings exceed $12B

As Bitcoin (BTC) gets closer to the $100,000 mark for the first time — it crossed $99,000 earlier Friday — capital is rotating into alternative cryptocurrencies, creating a buzz in the broader crypto market.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.