Biggest ever rug pull in Solana ecosystem steals nearly $10 million

- The Solana blockchain crossed $2 billion in total value locked earlier today before the biggest rug pull in the project's history.

- Luna Yield, an ecological liquidity farming project, deleted their website, Twitter and Telegram handles and withdrew nearly $10 million in liquidity.

- SolPad, Solana's finance launchpad, recently hosted Luna Yield IDO on their platform, and the team has reportedly contacted a third party to investigate further.

Solana's price rally has slowed down after a two-week-long bullrun. Users fear a rug pull and loss of nearly $10 million as Luna Yield goes dark on social media.

Rug pull from Luna Yield impacts traders in SOL ecosystem, users unable to "unstake" funds

Earlier today, when the Luna Yield team took down the website and went offline on all social media, Twitter and Telegram handles, users moved to "unstake" funds from liquidity pools on the project. This move was unsuccessful, and traders have lost nearly $10 million in the biggest rug pull on the Solana ecosystem.

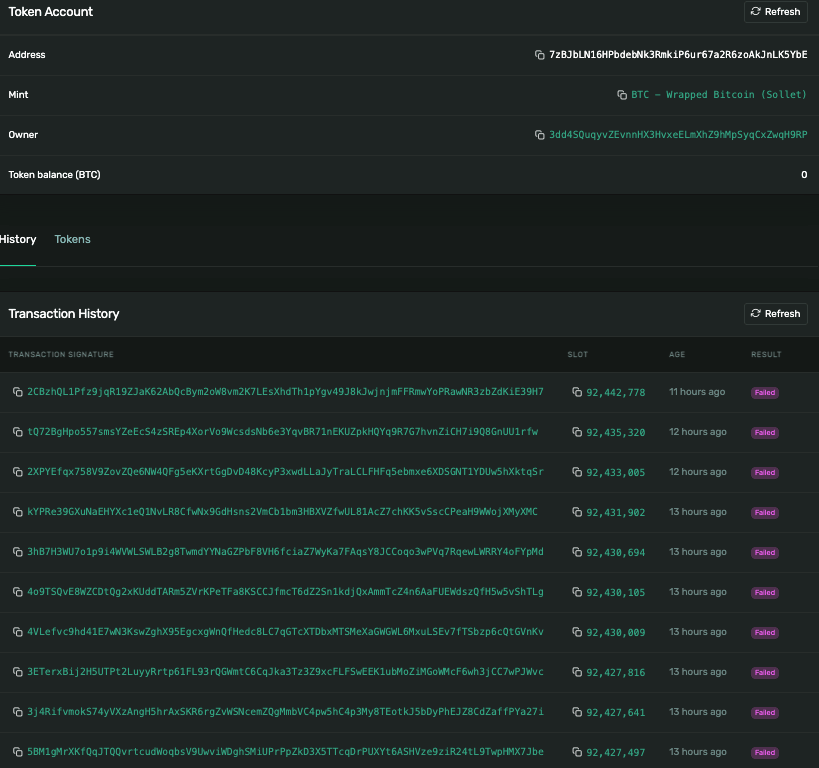

The following image shows documented failed attempts of a Luna Yield user on the Solana explorer.

A screenshot from a user who attempted to unstake funds from Luna Yield’s liquidity pool.

Though the user attempted to "unstake" funds, these attempts were unsuccessful due to zero balance in the pool. The Luna Yield team who set up the liquidity pool staking contract moved funds from the "pools" in which they were staked.

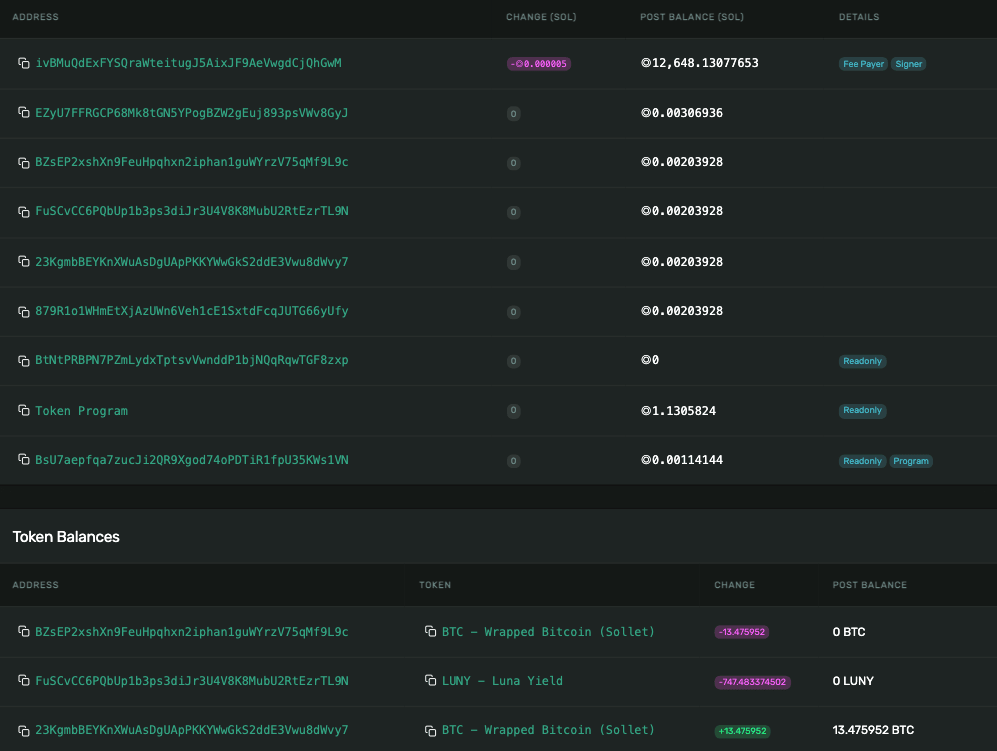

There is evidence of wrapped Bitcoin leaving the staking pools.

A screenshot of the address that allegedly authorized the rug pull transactions.

On further investigation, users in the community identified the address of the "owner" of the program, who approved the transactions leading up to the rug pull. The user with the address "ivBMuQdExFYSQraWteitugJ5AixJF9AeVwgdCjQhGwM" funded the mint authorization of the LUNY token (Luna Yield's native asset).

It is currently unclear whether the funds ended up on a centralized exchange or a bridge. Recently, the DeFi community has voiced concerns about the lack of transparency in the Solana ecosystem since several things continue to occur under closed source.

Luna Yield had an initial decentralized offering (IDO) on SolPAD, a launchpad on the Solana blockchain, on Tuesday. SolPad shared the news on Twitter.

Luna Yield, the latest IDO on our Launchpad, seems to have some problems. The Luna Yield Team took down their website and all other social media. They also withdraw all liquidity. SolPAD still can't reach Luna Yield Team to figure out what happened.

— SolPAD (@FinanceSolpad) August 19, 2021

The launchpad team claims to have contacted third parties to investigate the problem.

A developer building on the Solana network behind the Twitter handle @hoaktrades audited the rug pull incident and informed the community of critical details in a long thread

Ok... So I was going to attempt finishing the Serum library tests and stream it tonight but Luna Yield decided to rug pull and steal something like $~8M (can't attest atm)

— hoakegani (@hoaktrades) August 20, 2021

A THREAD to, hopefully, pill all of you degens on #Solana to pay attention to what you're doing.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.