New research by consumer data aggregator CivicScience has found that a growing number of investors are selling their shares to purchase more crypto.

The research questions were sent to people over 18 years old in the U.S. at varying times during 2021. The results were weighted by U.S. census data. Each question had between 1000 and 40,600 respondents.

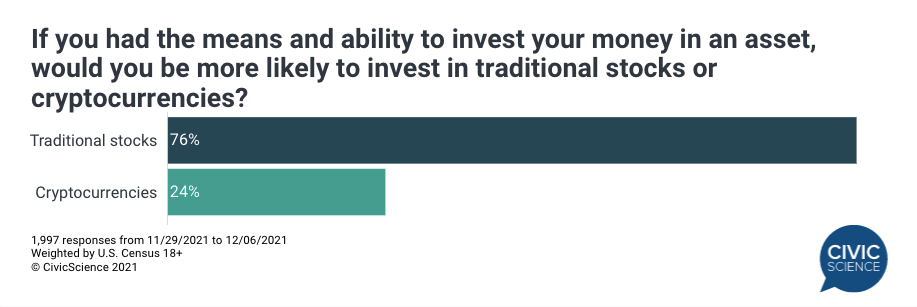

Out of 3,700 respondents surveyed, the number who said they would be more likely to invest their money in cryptocurrency than traditional stocks increased 140% in just five months.

Back in June, only 10% of respondents said they would be more likely to invest their money in cryptocurrency than traditional stocks, which rose to 24% in November.

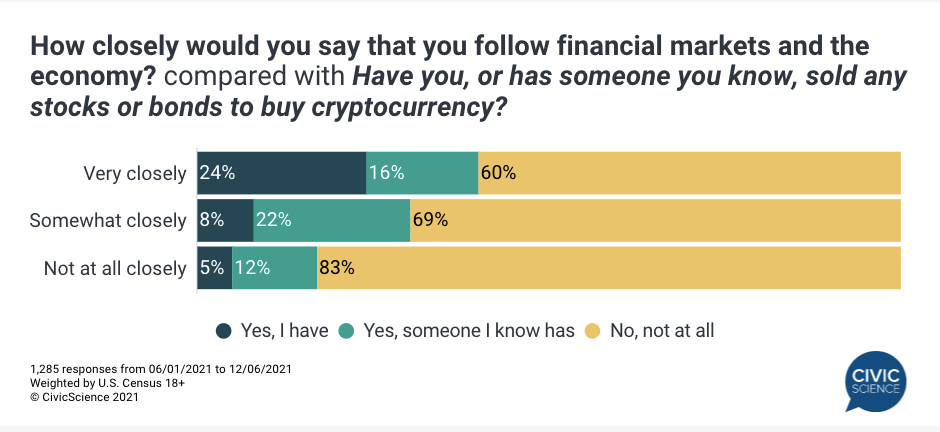

Interesting those who said they follow the financial market and economy “very closely” or “somewhat closely” were more likely to swap their traditional assets for crypto.

Out of the 1285 respondents who said they follow the market “very closely,” 40% said that they or someone they know has sold their traditional stocks to purchase crypto.

This percentage dropped to 30% for those who follow the market “somewhat closely,” and around 17% for those who said they followed the market “not closely at all.”

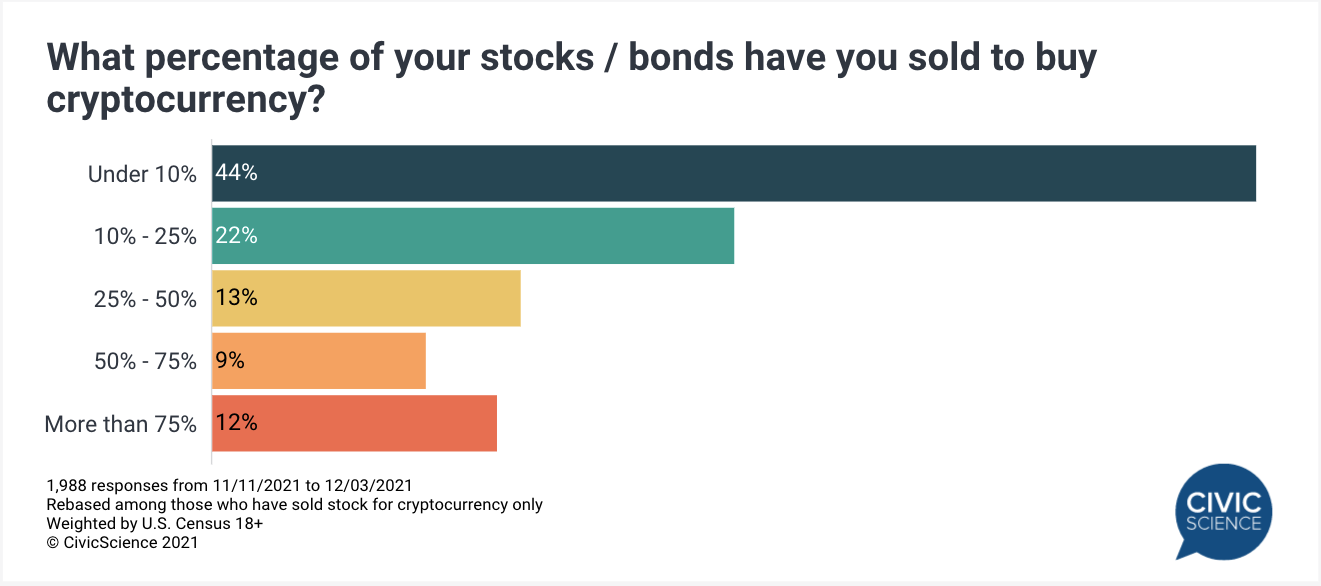

Around 44% of the 1,988 respondents who had sold stocks for crypto said they'd sold less than 10% of their portfolios.

But around one-fifth had sold over half of their stock assets to buy crypto which Zack Butovich from CivicScience described as a “shockingly significant number.” That might be pushing it, but it's certainly notable.

According to its website, CivicScience sources its data through digital and mobile content partnerships. Cointelegraph contacted CivicScience for more detail on its methodology and is awaiting a response.

CivicScience also found that those not interested in blockchain tech has continued to decline, from 80% in May of this year, to 68% currently based on 40,571 responses from May 1 to Dec. 6.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC holdings of large investors surges as Trump takes the Oval Office

Bitcoin trades in the green and hovers above $105,000 on Friday after hitting a new all-time high of $109,588 on Monday. CryptoQuant’s weekly report highlights that the demand for BTC from large investors surges as US President Donald Trump takes the Oval Office.

Dogelon Mars pumps more than 85%, whales dump 128 billion coins and realize a profit

Dogelon Mars price continues its rally on Friday after rallying more than 18% this week. On-chain data shows that ELON whale wallets realized profits during the recent surge. The technical outlook suggests a rally continuation of the dog-theme meme coin, targeting double-digit gains ahead.

XRP lose steam, risks 20% decline despite Donald Trump's presidential executive order

XRP investors realized over $500 million in profits in the past 48 hours. Short-term holders are responsible for most of the selling activity following CME's clarification on XRP futures. XRP could decline nearly 20% to $2.62 as bulls show signs of exhaustion.

Crypto market outlook 2025: PayFI report highlights AI and Memecoins as key sectors to watch

The global cryptocurrency market was sent agog this week as US President Donald Trump’s inauguration triggered a flurry of bullish catalysts. As traders navigate the volatile market trends, a Foresight ventures’ market outlook report shows key sectors to watch in the weeks ahead.

Bitcoin: BTC holdings of large investors surges as Trump takes the Oval Office

Bitcoin (BTC) trades in the green and hovers above $105,000 on Friday after hitting a new all-time high of $109,588 on Monday. CryptoQuant’s weekly report highlights that the demand for BTC from large investors surges as US President Donald Trump takes the Oval Office.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.