- If Joe Biden becomes a president, BTC will grow.

- DeFi industry may feel the pain due to tough regulation.

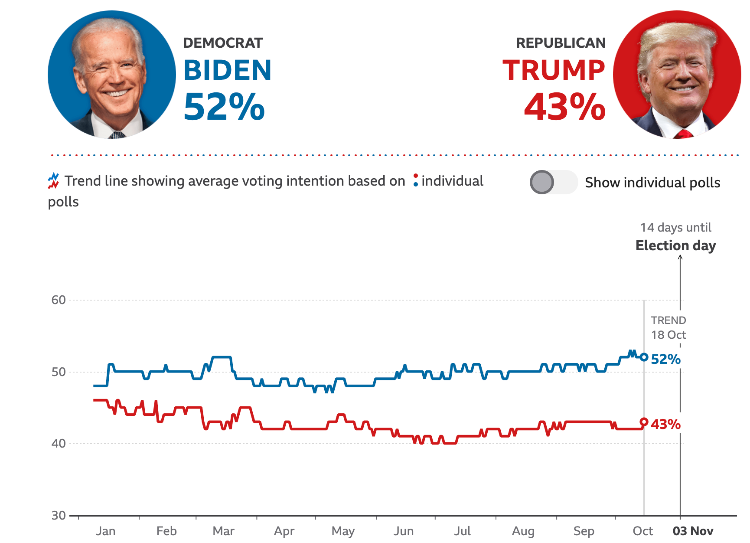

The presidential elections in the United States are just around the corner. While it is still hard to tell for sure who will secure the place in an Oval Cabinet, the most recent poll results show that Joe Biden, the Democratic presidential nominee, is leading the race.

At the time of writing, Biden is supported by 52% of the population, while Trump has gained 43%, according to the nationwide poll results.

Who's ahead in national polls

Source: BBC.com

It is worth noting that gaining the most votes doesn't always result in a victory due to an electoral college system in the US. That's what happened in 2016 Hillary Clinton when led in the polls with a significant majority of votes but lost the elections to Trump.

However, Joe Biden has been ahead of Donald Trump in most national polls since the start of the year. And the chances are that Trump won't make it to the second term. So it is probably high time to access the implications of Biden's presidency for the cryptocurrency industry.

Biden is to crack on DeFi

Joe Biden may be more preferable for the cryptocurrency industry as a whole, but the DeFi segment is set to suffer. The South Korean cryptocurrency exchange Bithumb believes that Biden's administration would take tough regulatory measures against the decentralized finance industry.

While Biden's victory may positively affect the cryptocurrency industry as a whole, he is expected to establish strict control over the DeFi market that has been booming recently with no limitations or oversight.

It seems that he will impose controls on decentralized finance (DeFi) that has grown rapidly during the absence of restrictions. The SEC has already included digital assets and financial technology (Fintech) as examination priorities in January. Judging from the fact that the SEC recently charged Abra, a cryptocurrency trading platform and wallet service provider, for supporting unregistered security-based swaps in digital assets and foreign currency, the SEC seems to put extensive scale controls, Bithumb writes.

Crypto ETF will get the green light

Simultaneously, the Democrat is known for promoting financial innovation, meaning that he will make way for several cryptocurrency-related policies that will encourage the approval of cryptocurrency exchange-traded funds (ETFs) with underlying assets such as Bitcoin and Ethereum.

Notably, the US Securities and Exchange Commission has already mentioned that it may be ready to give the green light to a crypto ETF some time in the future. Biden's presidency may speed up the process.

Bitcoin holders will rejoice

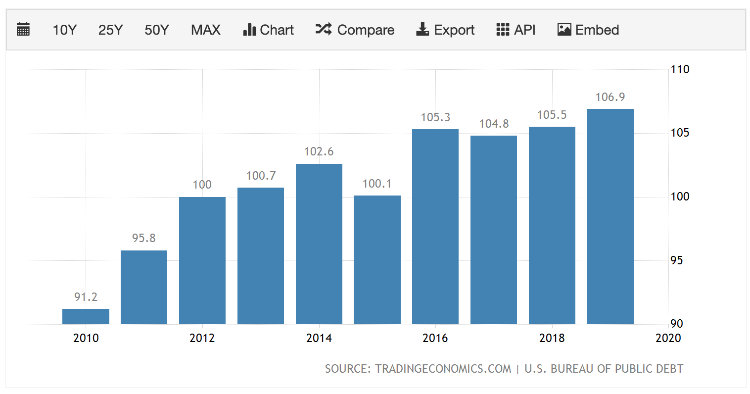

Also, Biden is an advocate of a more aggressive fiscal stimulus package than Donald Trump. If he gains power, he is sure to pump more money into the economy to pull the US out of recession. In this case, the US's national debt-to-GDP ratio would continue to grow, making a case for more panic selling on the traditional markets and diverting investors' attention to the digital assets.

US's national debt-to-GDP ratio

Source: Tradingeconomics.com

Apart from that, more QE from FED will increase the inflationary pressure on the US and allow BTC to surge to much higher levels as it is regarded as a hedge against inflation.

Furthermore, the Federal Reserve is still continuously conducting QE, which may substantially weaken the US dollar. Under these circumstances, the hash rate of Bitcoin is still showing an uptrend, so the price of Bitcoin will show increases for quite a long time.

Firstly, if Biden wins the presidency at the election after a neck-and-neck race, the defeated Trump may raise an objection and file for a lengthy legal battle. It will cause some considerable uncertainty, which might lead to the rise of Bitcoin's price once more due to a preference for safe assets.

To sum it up, Biden's victory is regarded as a positive event for the cryptocurrency industry that may send Bitcoin's price to the moon. However, the DeFi industry may feel the pain due to tighter regulation and control.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.