- BTC/USD still on its path, money comes in the $8400 mark

- Binance denies the claims that Japanese regulator (FSA) has inquired them

Asian trading has opened with news coming from Nikkei about the FSA (Japanese financial regulator) warning Binance of irregular activities in Japan. Less than two hours later, the company has denied having received any notification from the FSA, accusing Nikkei of publishing fake news. Such announcement has triggered a 4% dip in the BTC/USD, towards the $8350.

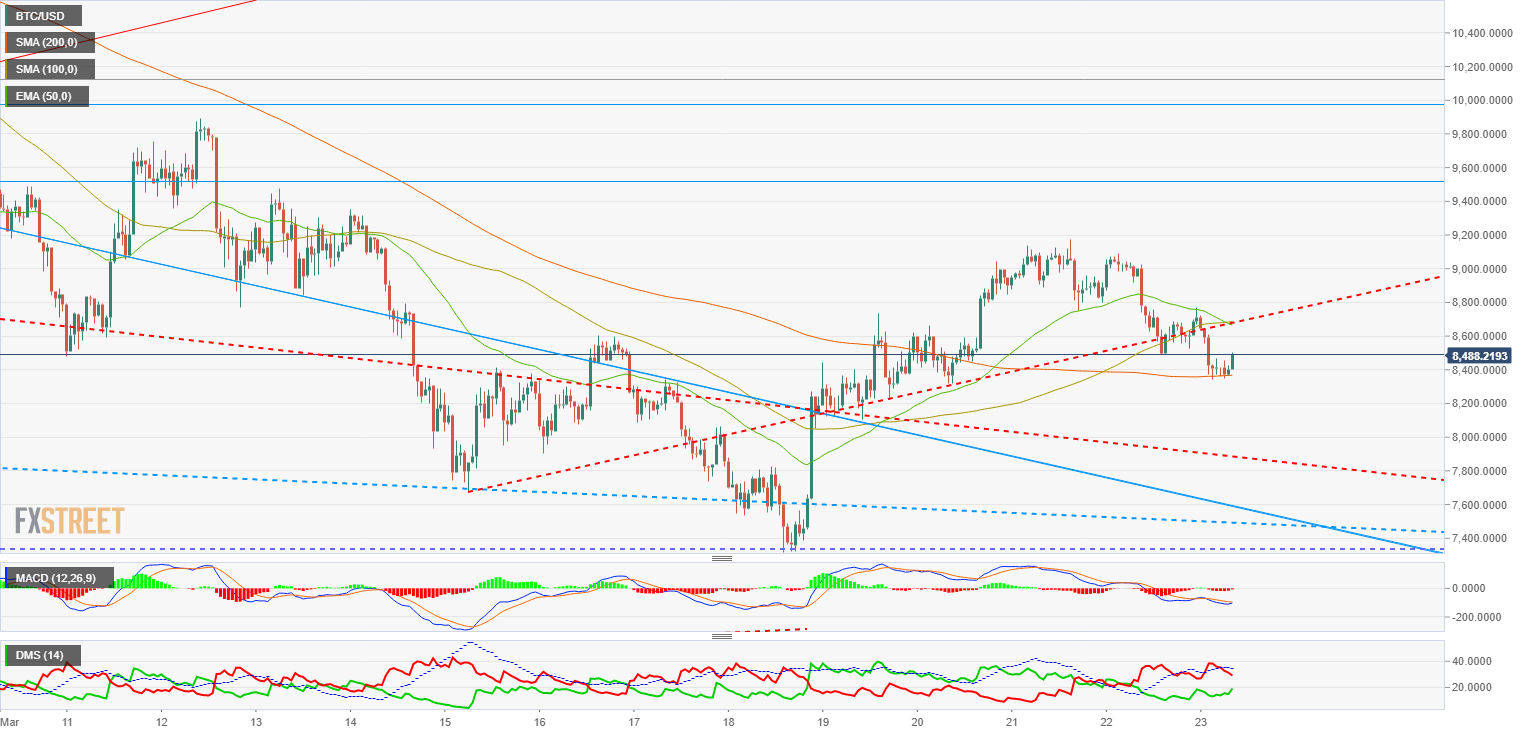

BTC/USD 1H chart

Our Bitcoin analysis starts with the 1-hour chart, where the price action shows a pretty standard setup. BTC/USD has traded lower down to where the 200-SMA is sitting, reversing its path to the upside there. Such respect for a meaningful support is positive for the main Cryptocurrency. Main moving averages are converging, which is tightening the price range and triggering short-term moves.

As we can see in the chart, the 100-SMA has a clearly positive slope, while the 200-SMA has started turning to the upside, a profile not shown since last March 3rd. Bitcoin price action and moving averages are developing around a trendline that comes from March 15th and that now rules the bullish move.

In the short-term, Bitcoin finds support in the mentioned 200-SMA, around the $8350 mark, and only if that level is broken it would go back to the $8100 area, the support from previous trading sessions.

On the bullish side, the 100-SMA and the 50-EMA are trading between $8600 and $8750, so in case of breaking above, that price area could generate some volatility. Morevoer, the trendline that rules the action is also found in that area, so BTC/USD should not go back to a clearly bullish profile in such time frame until it breaks above $8800.

MACD in the Bitcoin 1-hour chart is configured to cross to the upside, but still below the 0 line. The small distance to such level confirms a scenario of a bull-bear tug of war in the short-term, meeting the existing resistances.

Directional Movement Index shows a certain buying interest, in the attempt to break above the 50-EMA before the yesterday's close and the 200-SMA support. Sellers have retrated in the last hours and are not backing the movement.

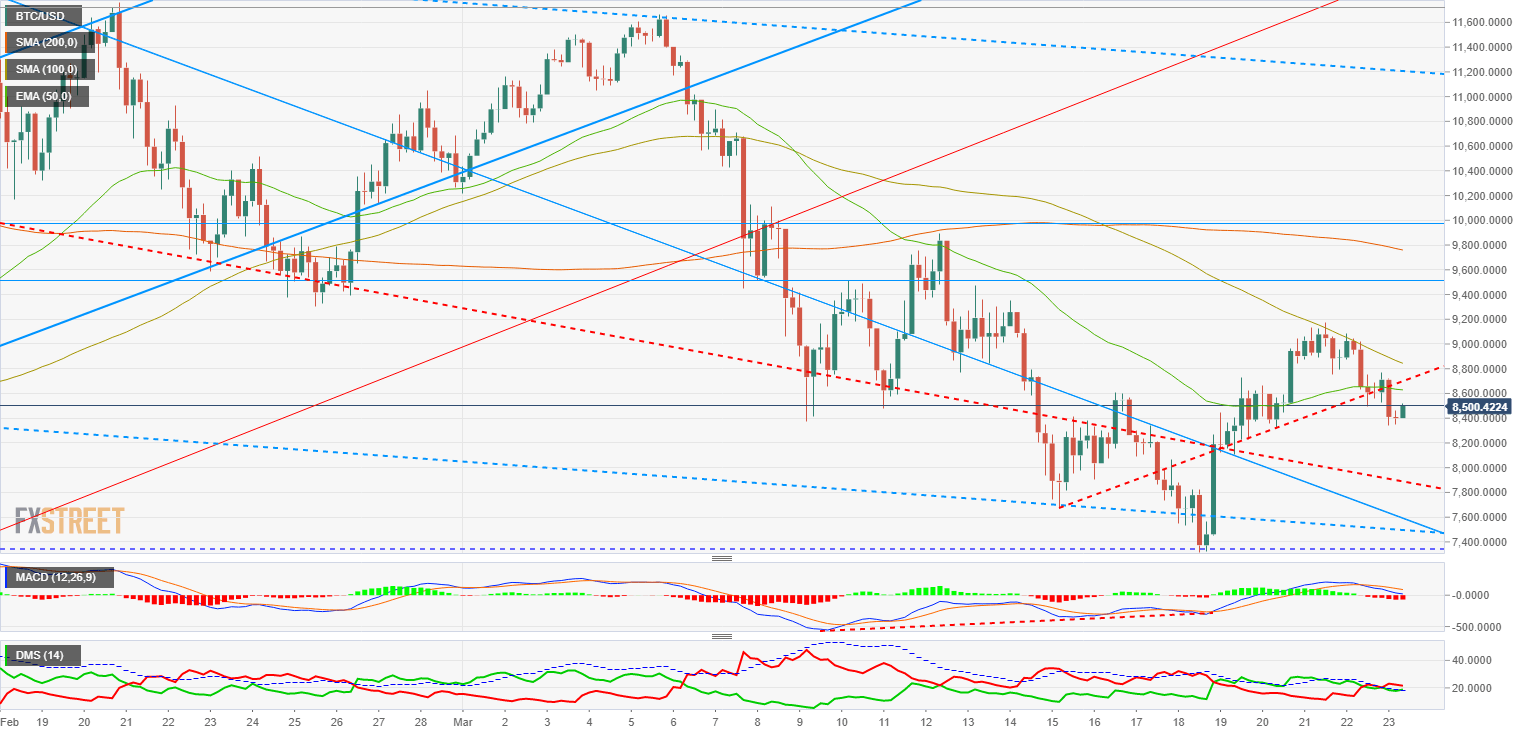

BTC/USD 4H chart

Bitcoin in the 4-hour chart has seen how the bullish profile diminishes, with just the technical indicators backing a bullish scenario. BTC price has left a Doji candle in the $8400, from where it has turned to the upside, developing an early bullish candle that should close at $8720 to draw a meaningful figure. Expect BTC/USD to meet the 50-EMA on its way to $8620.

To the upside, if that exponential average is broken, next stop will be at $8770, where BTC/USD will meet the 100-SMA and the trendline that rules the current movement. Further way up, resistances are at $8550 and the 200-SMA at the $9780.

The most important support is located at the $8400 mark. If that one is tested and fails, price would go back to the $8200 at first, to later continue on its way down to $7800 and $7450.

MACD in the Bitcoin 4-hour chart is trading above the equilibrium line, where it will probably turn to the upside if the 1-hour timeframe analysis weighs in notably.

Directional Movement Index is not showing the short-term reactions that we can see in the 1-hour chart. That time-frame shows equilibrium, with sellers slightly above buyers and the ADX just below the 20 level that indicates trend strength.

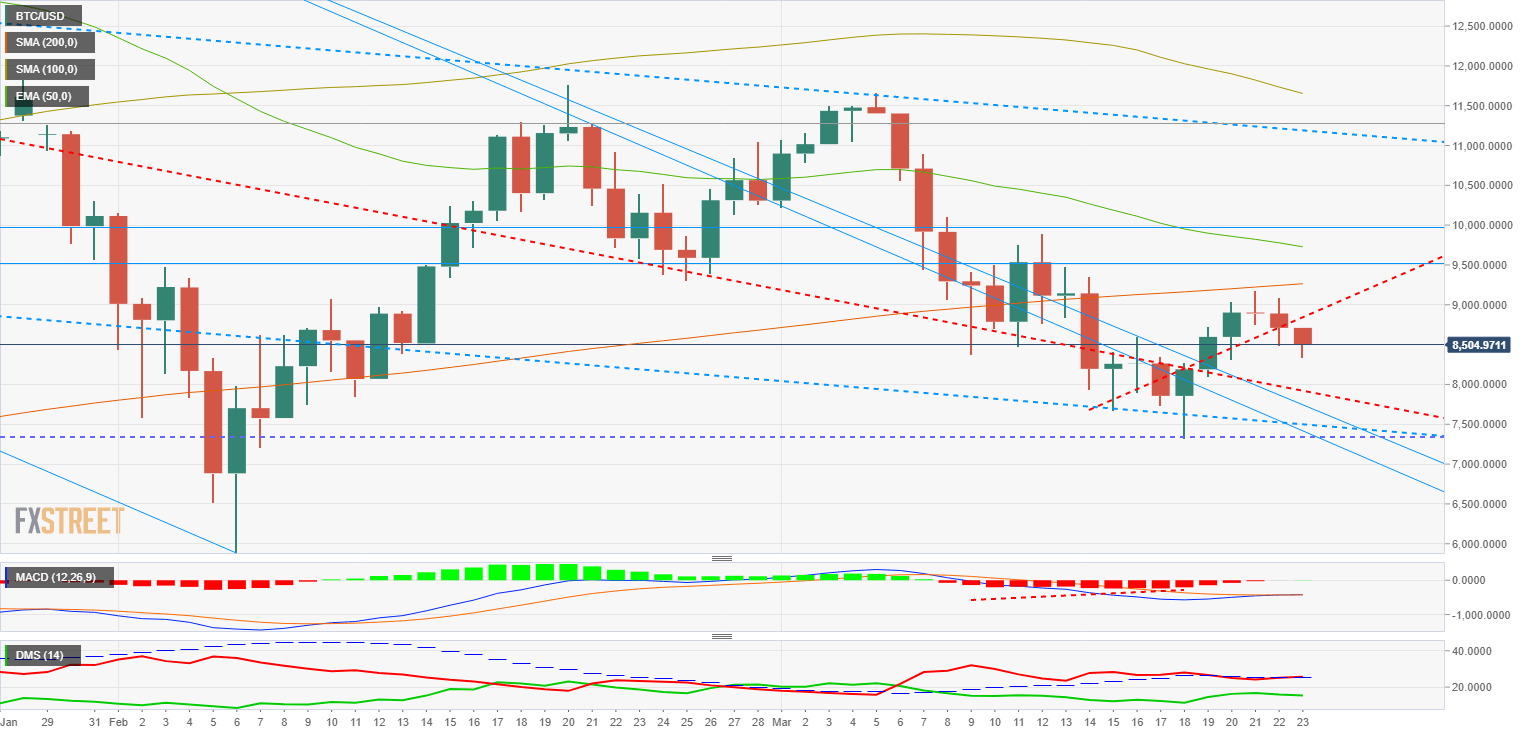

BTC/USD Daily chart

The daily chart shows a completely different profile, where the bearish bias dominates the scene. Bitcoin price has room to fall with no supports until the $7950 and $8000. If that price area is lost, multiple lines are drawn to the $6500 level. Another key level to watch is at $7340.

MACD in the Bitcoin daily chart shows a profile with barely any inclination, with the moving averages and the signal clustered in the same levels. That does not bring input about the direction, so it could be solved both to the upside and the downside.

Directional Movement Index in the daily chart shows the sellers in similar levels to the last trading sessions, while buyers are showing a rise from the lows of March 18th.

Conclusion

Bitcoin price looks to the upside, with probable rises that could impact the technical outlook in the 4-hour chart. More time and more bullish rides are needed to turn the daily chart from its current bearish setup, so the most probable scenario is one of moderate short-term rises that could trigger a bullish leg for some days. The retracement from that leg could be the one that decides the outlook of BTC/USD in the daily chart.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.