Bearish crypto markets fear hawkish Powell at Jackson Hole: scenarios for Bitcoin

- Bitcoin suffered a sharp sell-off last week, sending BTC price to the $25,000 level.

- BTC price has typically reacted negatively to developments in the Jackson Hole Symposium over the past four years.

- With 88.3% of short-term Bitcoin holders sitting on unrealized losses, BTC price is likely to remain under pressure this week.

Federal Reserve (Fed) Chairman Jerome Powell’s speech at the Jackson Hole Symposium on Friday has the potential to trigger volatility for Bitcoin price and more broadly cryptocurrency markets, which have recently recorded sharp falls alongside other risk assets.

Bitcoin price sustains above the key $25,000 level, broadly unchanged since the sharp decline seen on August 18 as investors appear to be cautious ahead of the key meeting, to be held between Thursday and Saturday.

Papers shared in the symposium will shed light on the rapidly shifting monetary policy stance and the Fed’s policy response and its aftermath, in the context of the next decade. But the main focus will be on Powell’s speech, expected on Friday at 14:05 GMT. Fed Chairs generally use this meeting to signal policy shifts, but it is uncertain what Powell will do this time.

Bitcoin investors are expecting interest rates to be higher for longer, partly explaining the selling pressure on the asset and its struggle to recover to the key psychological level of $30,000. If Powell asserts a hawkish message and reinforces expectations for additional rate hikes, BTC price could plummet lower in response.

However, a scenario in which Powell welcomes the slowdown in inflation and signals that interest rates don’t need to be lifted any more, would likely increase demand for risk assets, including Bitcoin.

Still, minutes from the Federal Reserve’s two-day July meeting showed that a majority of officials are in favor of further interest rate hikes. This suggests that the Fed’s job isn’t done, supporting the thesis of a hawkish stance from Mr. Powell.

Also read: S&P Index edges lower as investors brace for Jackson Hole

Bitcoin doesn’t seem to like Jackson Hole

An historic analysis of Bitcoin price within a week of the symposium between 2018 and 2022 suggests that the Jackson Hole meeting strongly influences both S&P 500 and crypto prices.

Typically, Bitcoin price has reacted negatively to the symposium each year.

Bloomberg Intelligence put together a chart with Markets & Mayhem, showing a consistent increase in stock prices in the week following the symposium. However, in 2022, the S&P 500 marked its worst performance since 2001. This clear deviation from the regular response of the index has raised questions on what to expect in 2023.

Bloomberg Intelligence’s chart for reaction of S&P 500 to the symposium

Between 2019 and 2022, Bitcoin price has dropped between 3.5% to 10.5% in response to the developments in the symposium. In 2018, Bitcoin price yielded 7.72% gains, in positive correlation with the S&P 500 index.

Bitcoin’s reaction to Jackson Hole Symposium 2018-2022 on BTC/USDT one-day price chart

A hawkish stance from the Fed Chair’s and expectations of interest rate hikes tend to sting Bitcoin and cryptocurrency prices. While the S&P 500 has largely reacted positively to the Symposium over the past two decades, Bitcoin price wiped out its gains four out of five times in the week following the Policy Symposium.

Bitcoin price has sustained above $25,000 after suffering a massive drawdown from the $29,000 level.

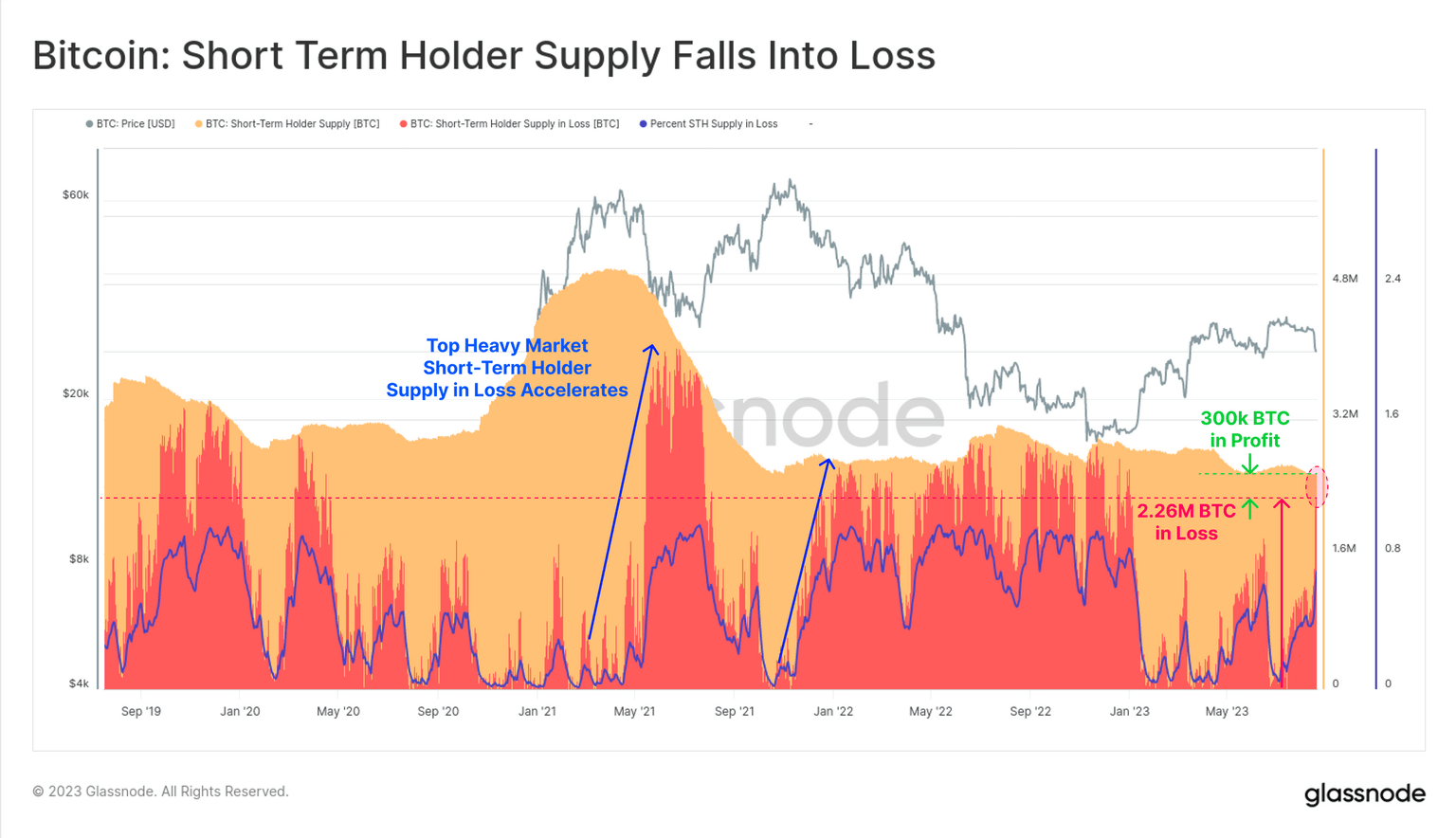

An on-chain metric that explains Bitcoin’s recent price decline is the profitability of BTC among the short-term holder cohort. The short-term holder cohort is key because it comprises traders and investors that are more price sensitive compared to long-term holders. Usually, these investors’ holdings are likely to be sent to exchanges more quickly to realize profits or losses.

In its recent report, on-chain analysts at the on-chain intelligence tracker, Glassnode, noted that 88.3% of BTC short-term holders are sitting on unrealized losses. This factor is likely to increase the selling pressure on BTC this week.

Bitcoin short-term holder supply as seen on Glassnode

An important question to answer

Crypto investors are likely to look for signs on whether high interest rates in the US are likely to stay for a long time or if the central bank has plans to cut rates in 2024. With the Bitcoin halving approaching in 2024, the crypto ecosystem is awaiting the start of a new price cycle for the asset.

A dovish stance from Powellcould act as a bullish catalyst for risk assets like Bitcoin and altcoins. An expectation of interest rate cuts in 2024 could further cement bullish hopes for the asset’s price rally post-halving.

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

What is Quantitative Easing (QE) and how does it impact USD?

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

What is Quantitative Tightening (QT) and how does it impact the US Dollar?

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.