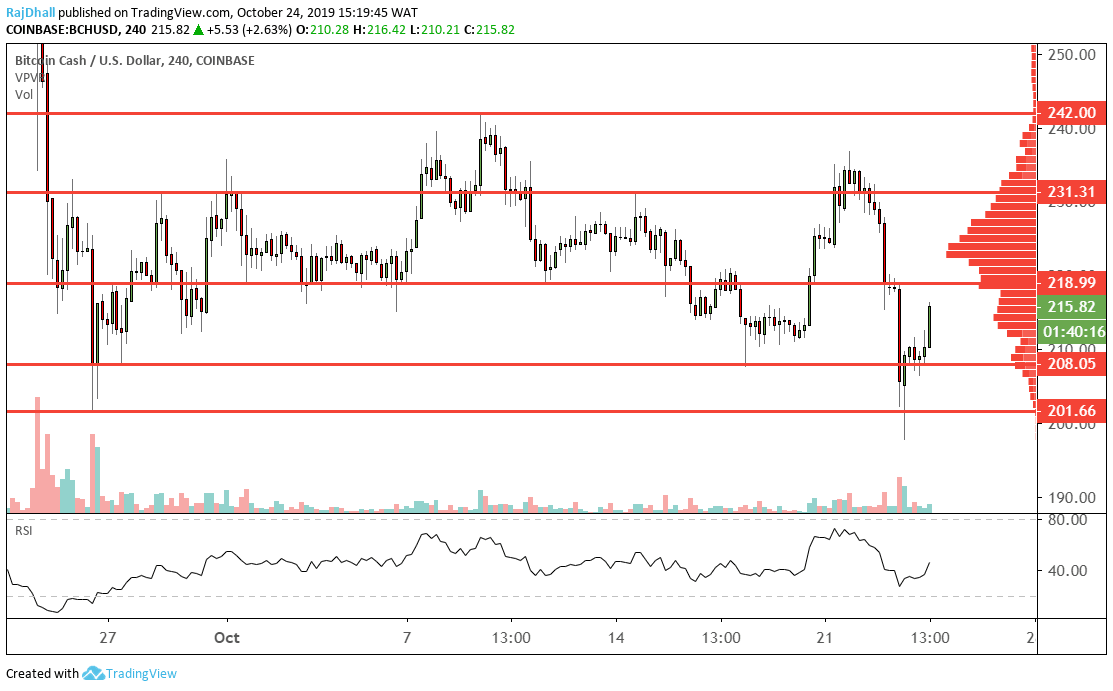

BCH/USD technical analysis: Bitcoin Cash bulls win the fight for the 200.00 level

- During Wednesday's price crash the price just dipped below 200.00

- Today the RSI has turned up as the bulls have come back to push the price higher.

Bitcoin Cash trades 2.63% higher today after crashing below the psychological 200.00 level during Wednesday's crypto market crash.

The level is quite a significant one and it does count as being broken as the price printed below, but the bulls were not ready to give up.

The overall trend is still lower but it is a gallant effort and the 218.99 resistance level looks like a firm one.

The RSI indicator has ticked up and I will be watching carefully what happens at the 50 mid-point.

On the daily chart, there was a resistance point at 200.00 on 21st December 2018. This shows how important historical levels are in technical analysis.

The four-hour chart below is more of a short term view and it clearly confirms the mass volume is on the sell-side.

Author

Rajan Dhall, MSTA

FX Daily

Rajan Dhall is an experienced market analyst, who has been trading professionally since 2007 managing various funds producing exceptional returns.