Basic Attention Token Price Prediction: BAT explodes on Grayscale news, marches to $2

- Basic Attention Token price had a massive 30% explosion to $1.18.

- Grayscale announced five new products that included BAT.

- The digital asset is in price discovery mode and faces practically no resistance.

The largest cryptocurrency management firm, Grayscale, announced on March 17 the launch of five new products for their clients including BAT. The news pushed the price of the asset by more than 30% instantly.

Basic Attention Token price faces practically no resistance ahead

Thanks to the announcement, BAT quickly established a new all-time high at $1.379. The digital asset faces basically no real resistance above. Using the Fibonacci Retracement tool, we can find out some potential price targets in the future.

BAT/USD daily chart

A breakout above the previous high of $1.379 will drive BAT towards $1.69 at the 127.2% Fibonacci level. The next key point is the psychological level at $2 followed by $2.1 which is the 161.8% level.

BAT Sell Signals

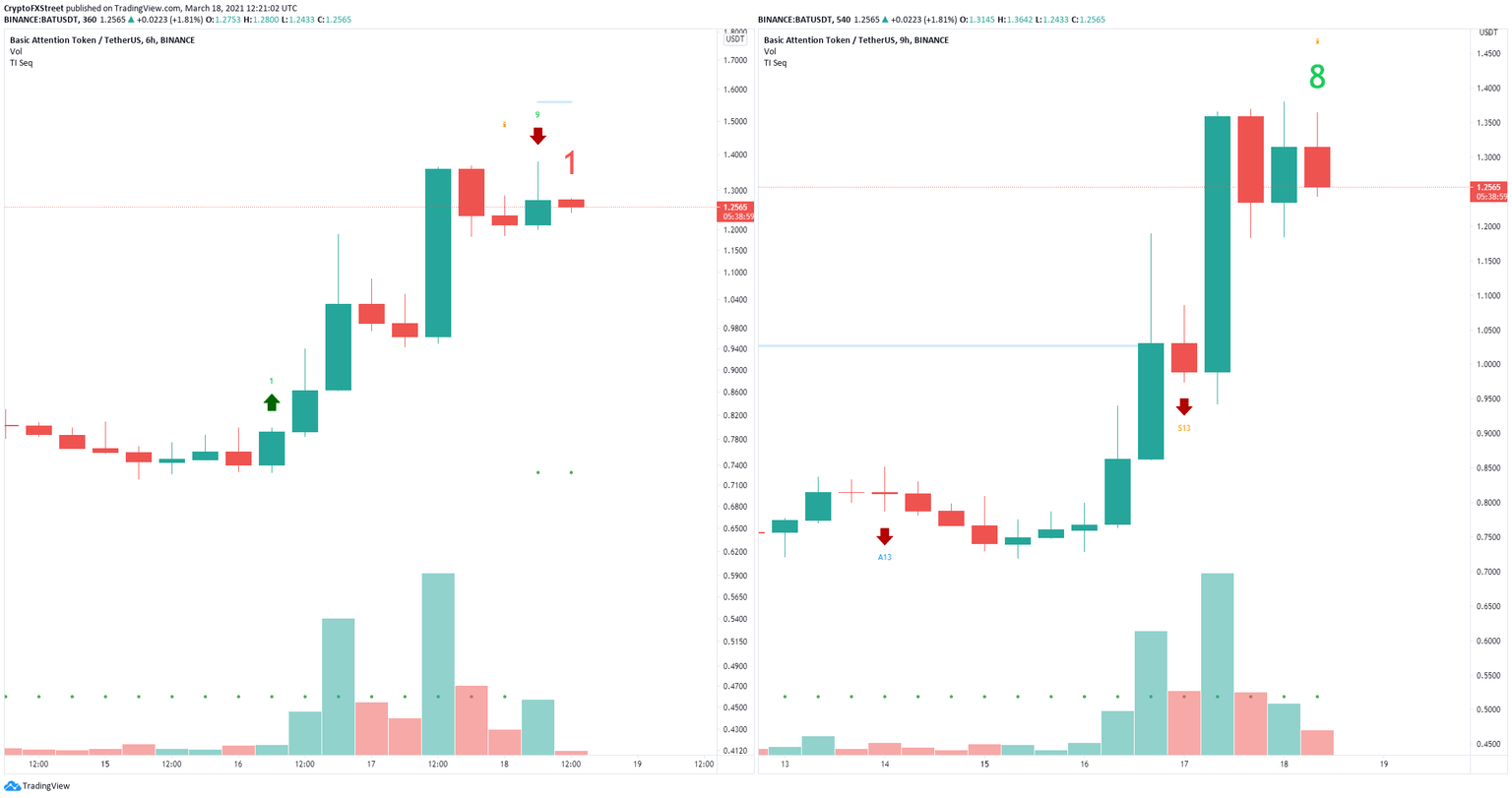

On the other hand, the TD Sequential indicator has just presented a sell signal on the 6-hour chart and it’s on the verge of doing the same on the 9-hour chart. Validation of both signals will quickly push Basic Attention Token down to $1.11 at the 78.6% Fibonacci level and as low as $0.913, at the 61.8% level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.