Base hits nearly $1.3 billion in total value locked, meme coins rally

- Base total value locked is $1.298 billion on Sunday, a new record for the chain.

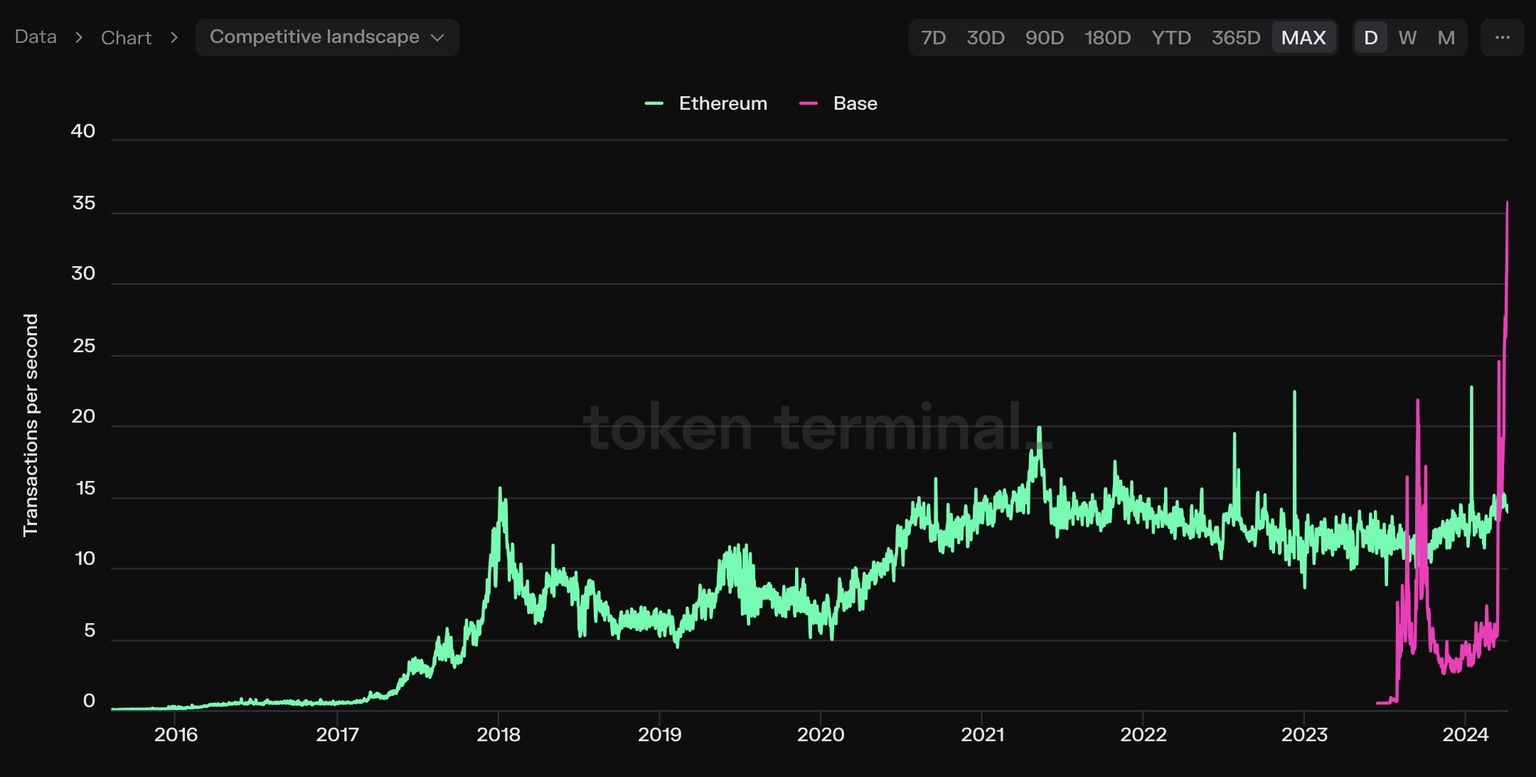

- On April 7, Base surpassed the Ethereum Layer 1 in transactions per second.

- Coinbase’s Layer 2 chain has seen a surge in prices of meme coins on Sunday.

Base chain, Coinbase’s Layer 2 chain hit two key milestones on Sunday, April 7. The chain surpassed the Ethereum Layer 1 in terms of transactions per second and hit a new milestone in total value of cryptocurrencies locked on Base.

With Bitcoin price hovering close to $70,000, meme coins on Base have seen a resurgence in popularity and yielded gains for holders on the daily timeframe.

Base hits important milestones in TVL and meme coin gains

According to data from DeFi tracker DeFiLlama, the total value of assets locked (TVL) on Base has climbed to $1.298 billion, a record high. The increase in TVL shows that market participants are likely rotating capital to projects on the Base chain.

Base TVL as seen on DeFiLlama

Data from IntoTheBlock shows that the rising volume and demand for the chain has seen Base cross Ethereum Layer 1 in transactions per second. 36 tps on Base against 14 tps on Ethereum.

Ethereum and base transactions per second

Meme coins on Base have seen a massive spike in their prices on Sunday, April 7. Brett (BRETT), Toshi (TOSHI), Normie (NORMIE), Doginme (DOGINME), Mochi (MOCHI), Base God (TYBG) prices have climbed between 8% and 40% respectively.

Base meme coin price change

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.