- BASE reported a failure early on Wednesday, in which no new blocks were added to the network within 45 minutes.

- Coinbase Layer 2 chain’s team confirmed that a fix was deployed, block production has returned to normal.

- The total value of assets locked in BASE dropped $4.02 million this week as the hype surrounding the Layer 2 chain declines.

BASE, a Layer-2 chain created by Coinbase, reported a block failure incident early on Wednesday. The team behind BASE explained that no new block was created for nearly 45 minutes and a fix was deployed to bring production to normal.

BASE mainnet gained popularity among users since its launch, and the failure incident added to the deterrents for the Layer 2 chain’s users.

Also read: These five oversold altcoins might explode soon: DODO, GALA, MAGIC, MASK and SRM

BASE block outage incident

BASE suffered a major outage for the first time since its mainnet launch on August 9. No new blocks were produced on the chain, and developers reported that production was “stalled” at 9:36 pm UTC.

The team behind BASE continued to monitor the chain and released a fix. Block production returned to normal within 45 minutes of the outage. The crypto community is familiar with similar outages as they have affected blockchains like Solana.

Earlier today we had a delay in block production due in part to our internal infrastructure requiring a refresh.

— Base ️ (@BuildOnBase) September 5, 2023

The issue has been identified and remediated. No funds are at risk.

To stay updated, check https://t.co/ipa94DPBLq

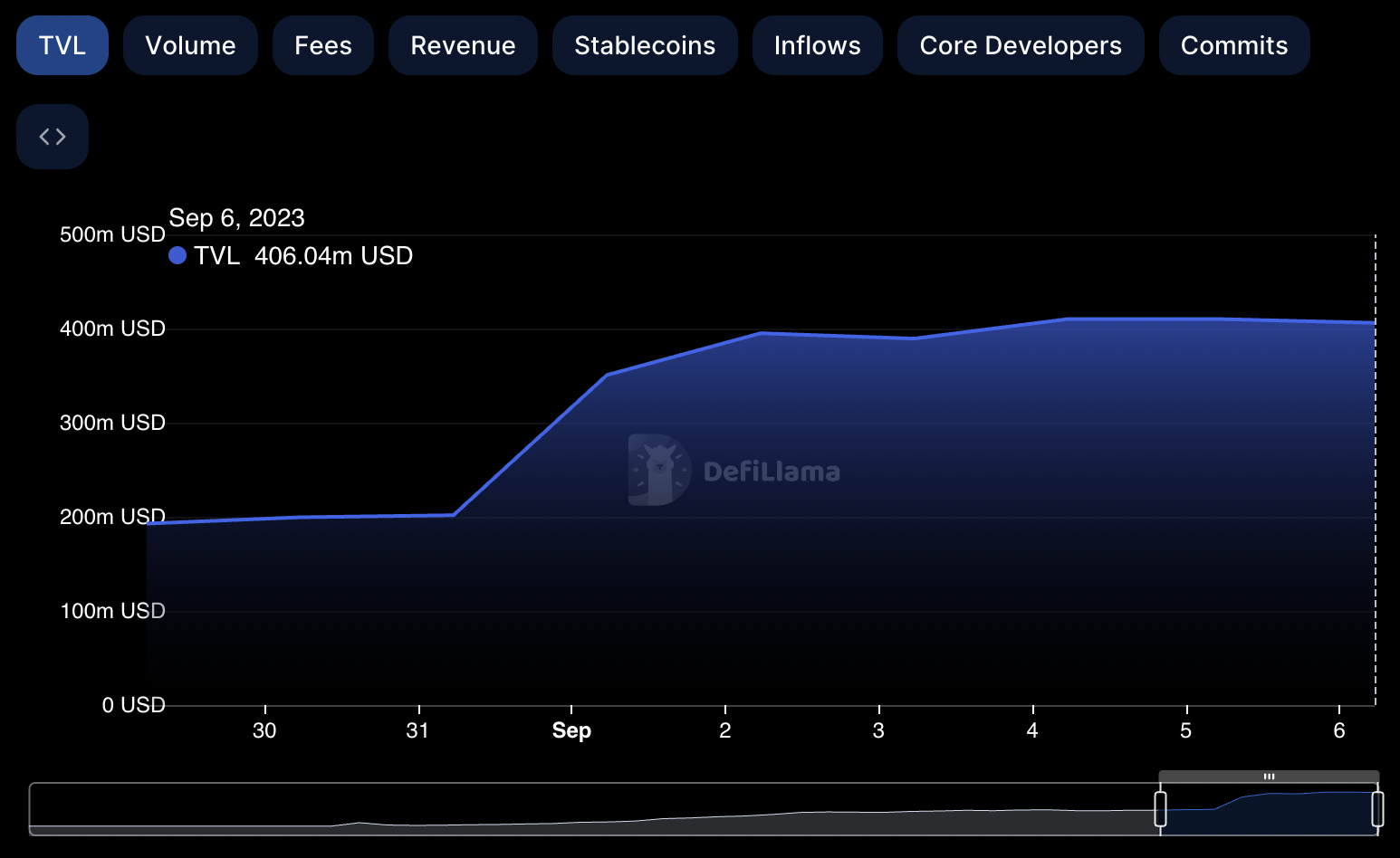

The hype surrounding BASE has slowly declined this week, and this is evident from the total value of assets locked by users on the Layer 2 chain.

BASE hype dies as TVL declines this week

The Layer 2 chain has noted a decline in the total value of assets locked on its blockchain from $410.06 million on Monday to $406.04 million early on Wednesday. This can be considered indicative of a declining interest from market participants.

BASE chain TVL on DeFiLlama

Several critics in crypto have called out BASE for its centralization, attributing the recent outage to the same. The crypto analyst behind the Twitter handle @LucidCIC commented on BASE’s outage and said centralized Layer 2 chains are not perfect.

Base has experienced its first "Stall"!

— Lucid (@LucidCiC) September 5, 2023

Coinbase is a good crypto company from what I have experienced but blockchain technology is complicated! When it comes to securing people's value these systems need to be perfect. Centralized EVM L2 is not perfect.

Staying on Cardano ♂️

Justin Bons, founder & CIO of Cyber Capital, said that all major Layer 2 chains have admin keys and that this makes them susceptible to theft or loss of funds. Bons states that Optimism, Arbitrum, zkSync, dYdX and BASE are being considered a replacement for Layer 1 chains, however, centralization of Layer 2 chains compromises their security.

1/6) All major L2s have admin keys; over $9B of user funds can be stolen right now!

— Justin Bons (@Justin_Bons) August 31, 2023

This includes Optimism, Arbitrum, zkSync, dYdX & Base

That this is seen as an adequate replacement for L1 scaling is a travesty

They promise this will change, but centralization tends to stick:

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.