- “The amount of crypto-asset investment is not really big, compared with other equity markets...” reads BOK report.

- The 100 SMA will prevent declines above the stronger support zone at $6,600.

The central bank of South Korea finds cryptocurrency effect on the local financial market to be a drop in the ocean. This is according to the latest report that took into account the balance of digital assets in the commercial banks in the country. By the end of 2017, the domestic banks had the balance at $1.79 billion. The Bank of Korea (BOK) considers this figure to be too small to cause any significant impact on the financial market. Therefore, the report suggests that virtual currencies do not pose any risks at the moment. A section of the report reads:

“The amount of crypto-asset investment is not really big, compared with other equity markets, and local financial institutions' exposure to possible risks of digital assets is insignificant. Against this backdrop, we expect crypto-assets to have a limited impact on the South Korean financial market."

It is also vital to note that the report took into account the surge that had Bitcoin trade almost at $20,000 in December 2017. In the same week the report was released, the Korean Financial Services Commission (FSC) said that it was open to the virtual currencies and is going to align itself with the vision of the G20 group of nations to come up with “unified” regulations for the industry.

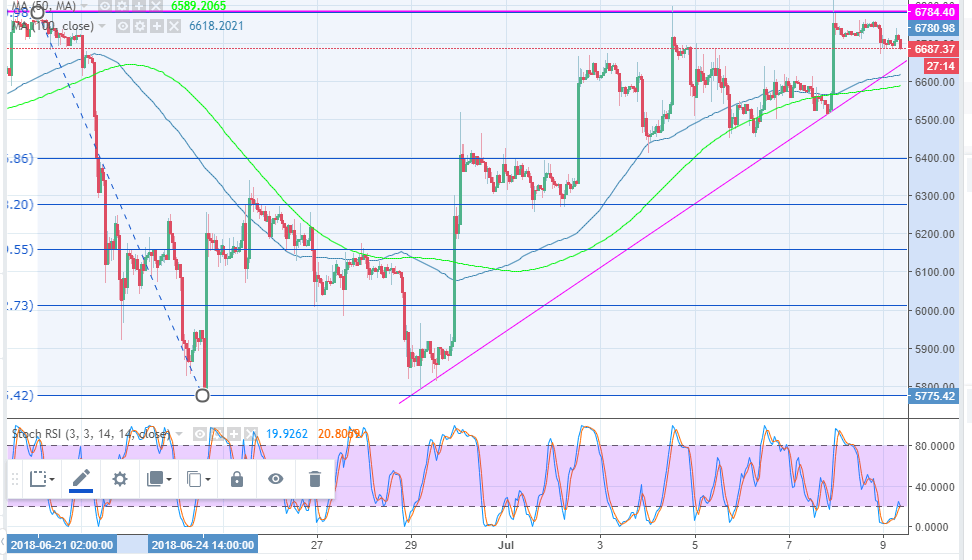

Bitcoin price is trading a classic rising wedge pattern with the upside capped below $6,784. The price has been recording higher highs and higher lows since it recovered from the trip downstream below $6,000. It is, however, lacking enough momentum to overcome the resistance at $6,800 before attacking the critical level at $7,000.

The Bears appear to have the control on Monday, besides, Bitcoin price has broken the short-term support at $6,700. The stochastic RSI has changed direction downwards to show the presence of selling activity. The 100 SMA will prevent declines above the stronger support zone at $6,600. The 61.8% Fib retracement level with previous high at $6,784 and a low of 5,775 is highlighted as another support area.

BTC/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Traders discuss Solana futures and Ethereum Hoodi update as Bitcoin price stalls at $83,000

Amid a 2% decrease in market capitalization, crypto trading volume surges 42% to $87.2 billion in the last 24 hours, signalling active capital rotation. Bitcoin price stagnates below $85,000 as Gold enters a record rally to $3,000 ahead of the US Fed rate decision.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, XRP gain as MicroStrategy buys $10.7 million BTC

Bitcoin (BTC) daily price chart shows signs of recovery in the largest cryptocurrency. Strategy, one of the largest corporate holders of Bitcoin, acquired another 130 BTC last week, according to an announcement on Monday.

Top Formula 1 crypto sponsors rally, racing fans gain from Binance Coin, OKB, ApeCoin and Crypto.com

The 2025 Formula 1 season kicked off in Australia last week with a lineup of crypto sponsors for half of the teams. Racing giants are powered by sponsors like crypto exchanges Binance, OKX, ApeCoin, and Crypto.com, among other NFT and trading platforms.

SEC pumps brakes on altcoin ETFs, institutional interest remains

The US SEC postponed its decisions on several spot altcoin ETF applications this week, including those for Litecoin, XRP and Solana. A K33 Research report shows there is consensus but the agency is waiting the confirmation of Trump’s nominee for SEC Chair.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.