Band Protocol strategic partnership with NEAR for sharding technology could bolster BAND price toward $20

- Band Protocol collaboration with NEAR to increase transaction throughput and scaling.

- Developers will have access to decentralized oracle solutions for their Open Finance and Open Web needs.

- BAND has been listed on hitBTC, a move that is likely to jumpstart upswing toward $20.

Band Protocol has announced a new partnership with NEAR, one of the leading decentralized application projects that execute on the 'sharding' technology. This collaboration will see a higher throughput and scaling for Band Protocol.

Band Protocol and NEAR partnership gives developers access to Oracle solutions

Band Protocol plans on bringing "critical oracle infrastructure to secure a decentralized application platform designed to manage high-value assets like money or identity." The collaboration's main aim is to a platform that offers flexibility to developers desiring to build on Open Finance and Open Web. According to the co-founder at NEAR, Illia Polosukhin:

Secure and decentralized oracle systems are critical for enabling Open Web. The integration of NEAR with Band Protocol will offer developers a scalable decentralized oracle solution which is extendable to create custom oracle scripts for any external data source or API.

Band Protocol battles rising selling pressure

HitBTC has added support for Band Protocol as a trading asset. The trading pair will be BAND/BTC. Support on exchanges always has a positive impact on an asset because it results in higher trading volume, pushing the price higher.

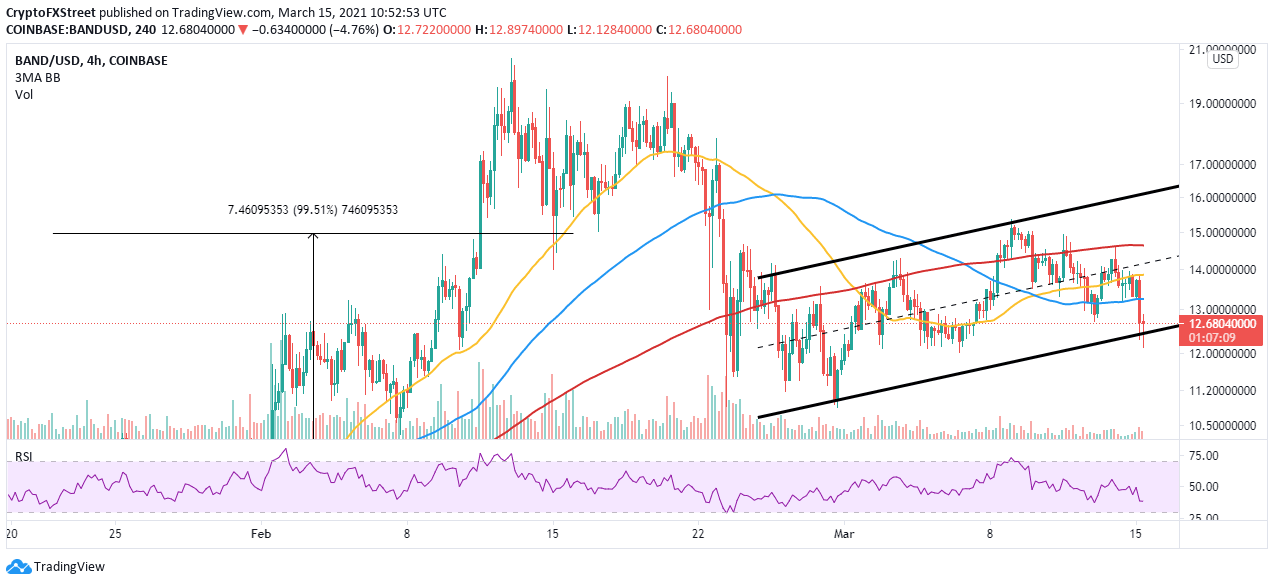

In the meantime, BAND faces increased overhead pressure, leaving the ascending parallel channel lower boundary support vulnerable to losses. The declines are not unique to Band Protocol, but the crypto market is reacting to the news that India is revisiting the proposed bill on banning cryptocurrencies.

The news of the strategic partnership and the support on HitBTC could change the Band Protocol course in the near term as fundamentals become stronger. Recovery above the 50 Simple Moving Average (SMA) would encourage more buyers to join the market. Moreover, gains above the channel's middle boundary will pave the way for gains eyeing $20.

BAND/USD 4-hour chart

It is worth noting that if the channel's lower edge's immediate support is broken, Band Protocol may abandon the upswing toward $20 and continue with the breakdown to $10.5. The Relative Strength Index (RSI) shows that sellers still have the most control over the price.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren