Band Protocol Price Prediction: BAND is on the brink of a 42% explosion

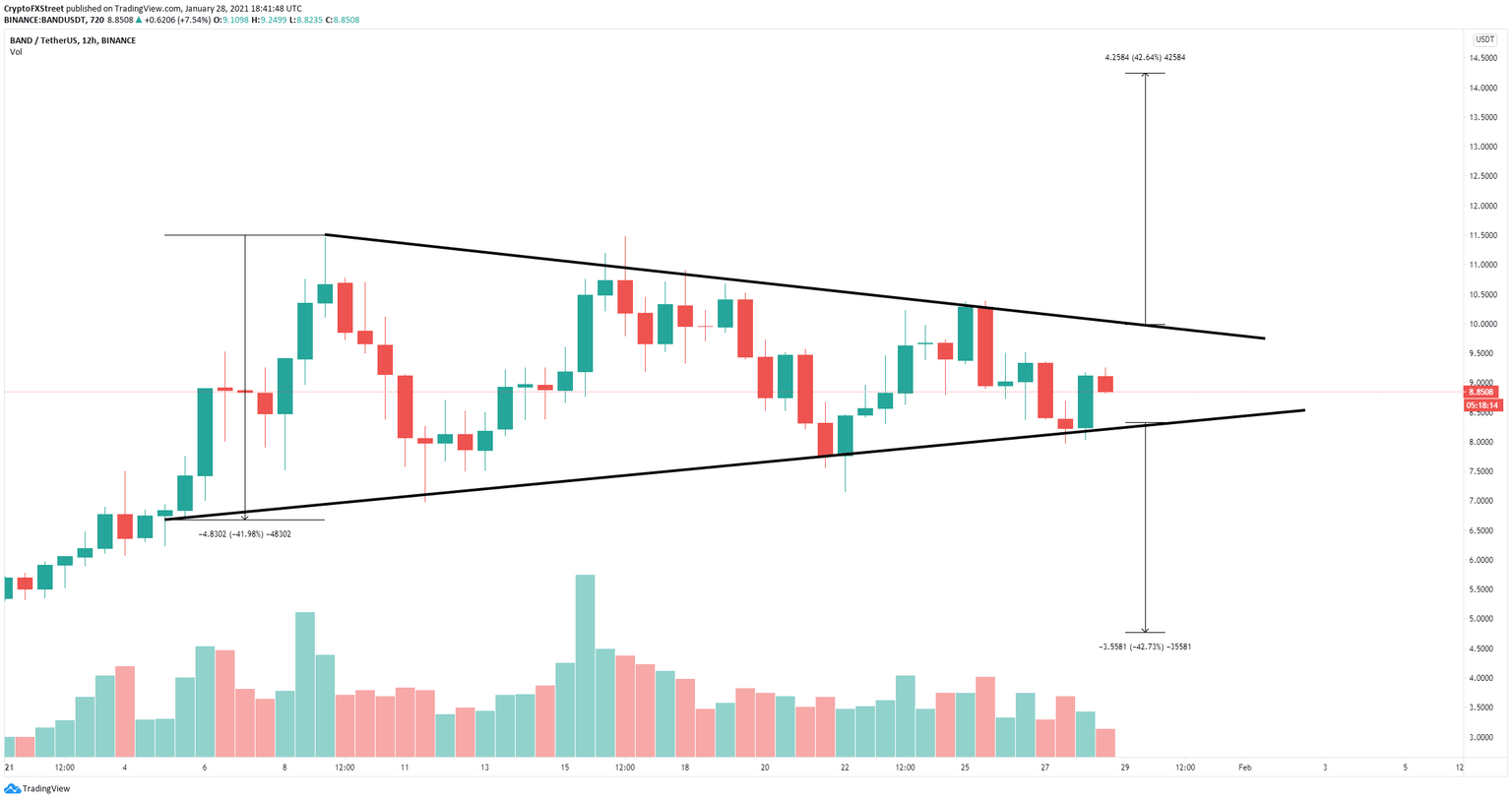

- Band Protocol price is contained inside a symmetrical triangle pattern on the 12-hour chart.

- A breakout or breakdown from this pattern will move the digital asset by up to 42%.

- It’s not clear in which direction Band is headed, but the bears seem to have the upper hand.

Band Protocol has been under consolidation for the past three weeks after topping out at $11.45 on January 9 and $11.48 on January 16, establishing a potential double top. Currently, BAND is right in the middle of the pattern and awaits a clear signal to move.

Band Protocol price could slip below $5 if this level cracks

On the 12-hour chart, the symmetrical triangle pattern has formed a support trendline at $8. Losing this level can quickly push Band Protocol price down to $4.7, a 42% move which is calculated using the maximum height of the pattern.

BAND/USD 12-hour chart

The In/Out of the Money Around Price (IOMAP) gives the upper hand to the bears as it shows a lot of resistance ahead. The most significant support area is located between $8.61 and $8.87 with 434,000 BAND in volume. Losing this range of support will push BAND through the $8 support level and below.

BAND IOMAP chart

The resistance area between $9.15 and $9.41 has 1.4 million BAND in volume, which is substantially higher than the support range below. However, a breakout above this point would be notable and likely drive Band Protocol towards $10 as there is weaker resistance ahead. Cracking this level will also push BAND price by 42% towards $14.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.