Band Protocol Price Prediction: BAND hints at a 40% lift-off to new highs soon

- Band Protocol price indicates an explosive leg up due to the breach of a bull-flag pattern.

- Achieving a 40% target from the breakout point would put BAND at a new all-time high of $25.

- IOMAP model shows almost no resistance ahead for the oracle platform token.

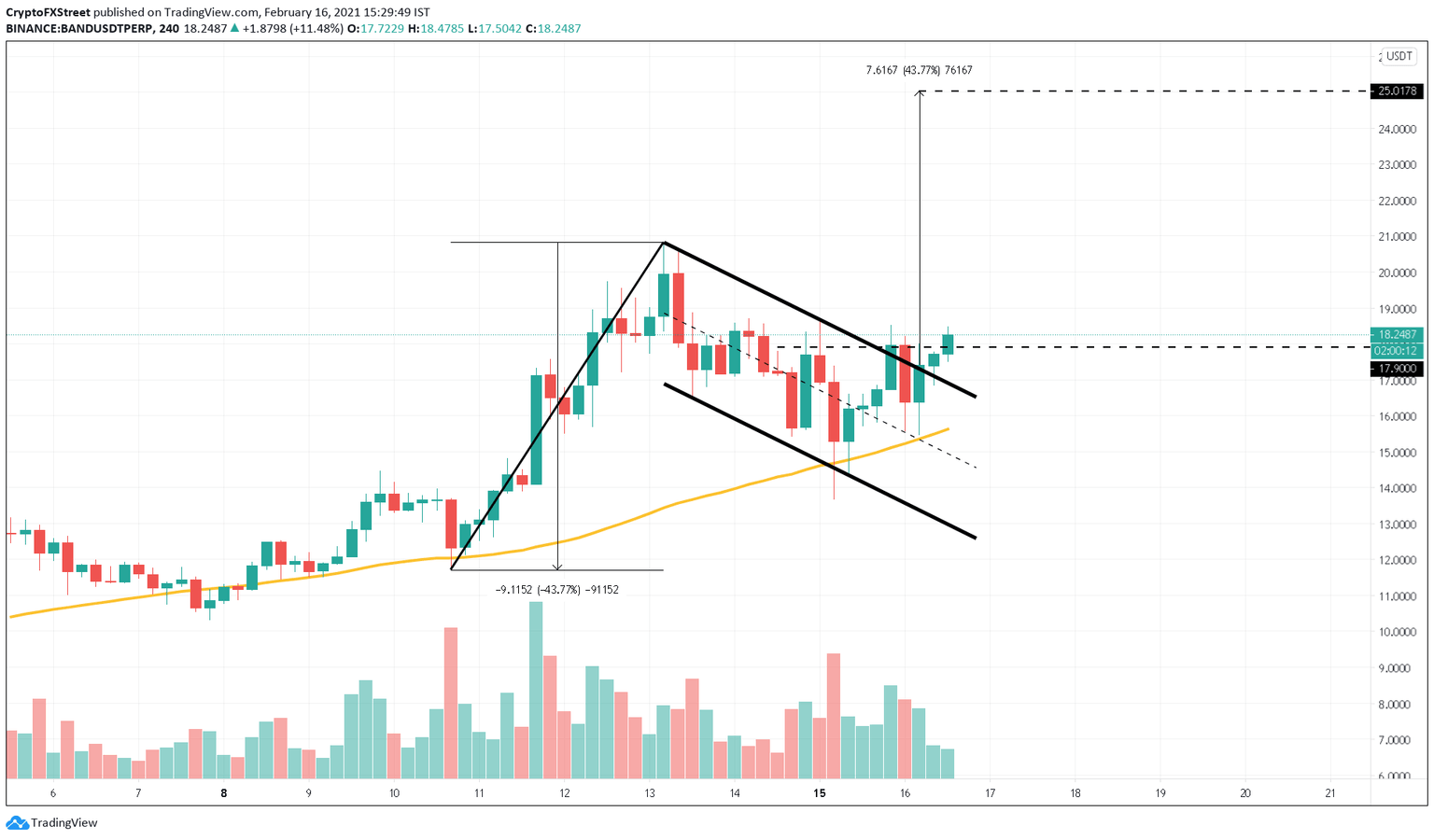

Band Protocol price underwent consolidation after hitting a new all-time high at $20.82 on February 13. However, the formation of higher highs and lower lows suggested that BAND is consolidating within a bull flag pattern.

Band Protocol price primed for a higher high

Band Protocol price breached the bull-flag pattern during Tuesday’s trading session. However, the 4-hour candlestick close at 16:00 UTC confirmed the breakout.

A bull-flag pattern is a continuation pattern, and hence, the breakout tends to follow the previous price trend.

The technical setup forecasts a 40% target equal to the flag pole’s height measured from the breakout point, which puts BAND at a new all-time high of $25.

BAND/USDT 4-hour chart

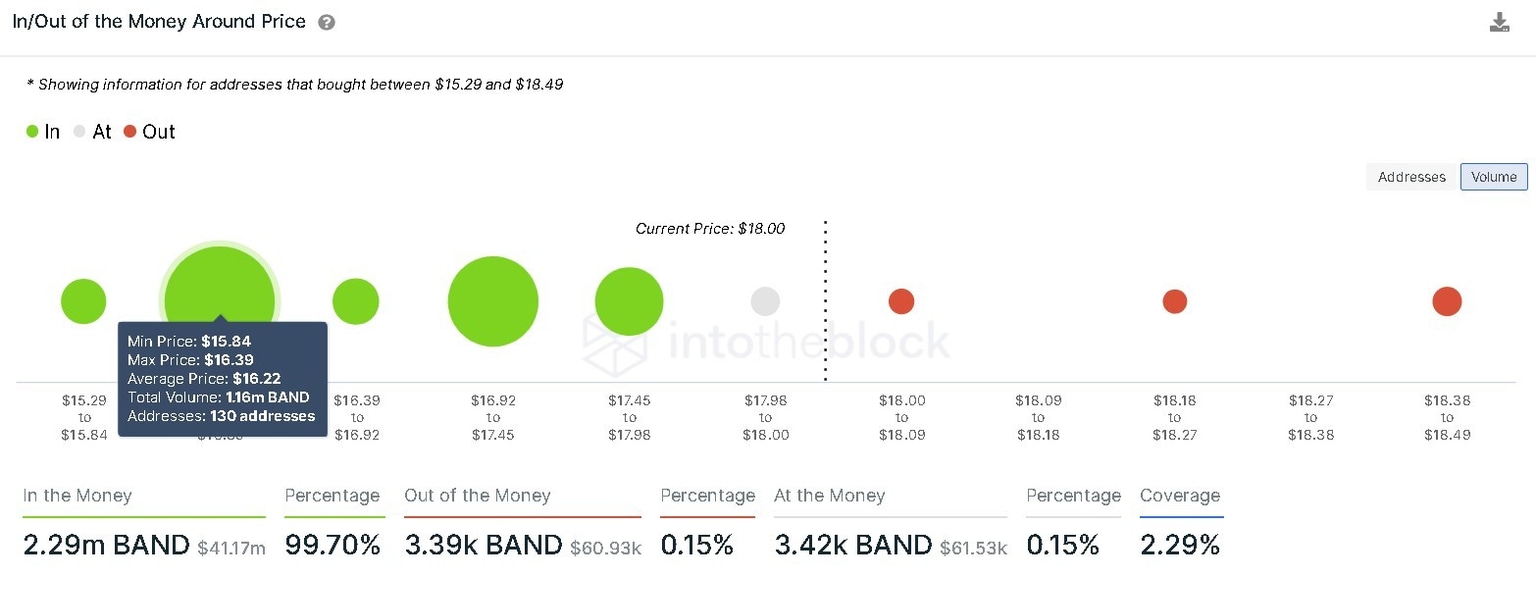

According to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, the oracle platform's upswing will be a walk in the park, as there is little resistance ahead of the coin.

Hence, it is likely that BAND will reach its new high without any selling pressure.

Regardless, investors need to remain cautious of a market-wide sell-off similar to the one witnessed on February 15.

If something similar was to happen, then Band Protocol might drop to its immediate support at $16.2, where 130 addresses hold around 1.16 million BAND.

Due to unforeseen events, if the price manages to slice through the above support level, then Global In/Out of the Money (IOMAP) indicates that $15.5 will be the next demand barrier, which coincides with the 50 four-hour moving average (MA).

Approximately 525 addresses previously purchased nearly 1.68 million BAND here.

Band IOMAP chart

Only a 4-hour candlestick close below the flag's lower trendline would invalidate Band Protocol's bullish outlook.

In this case, BAND could see a steep correction towards $11.55, where 1,900 addresses hold 2.4 million BAND

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.