Bancor struggles to recover, but BNT on-chain metrics scream buy

- Bancor is one of the most oversold tokens according to on-chain metrics.

- BNT needs to recover above $0.7 to improve the technical picture.

Bancor is an on-chain liquidity protocol made up of a series of smart contracts that pool liquidity and enable the operation of decentralized exchange on various blockchains. Bancor (BNT) is not the primary focus of ordinary cryptocurrency trading. The token sits on 150th place in the global rating with the current market capitalization of $38 million and an average daily trading volume of $26 million. However, the on-chain metrics say that the token is grossly oversold and may be ready for an impressive rally.

At the time of writing, BNT/USD is changing hands at $0.54, having gained over 5% in the past 24 hours.

BNT whales stock the tokens

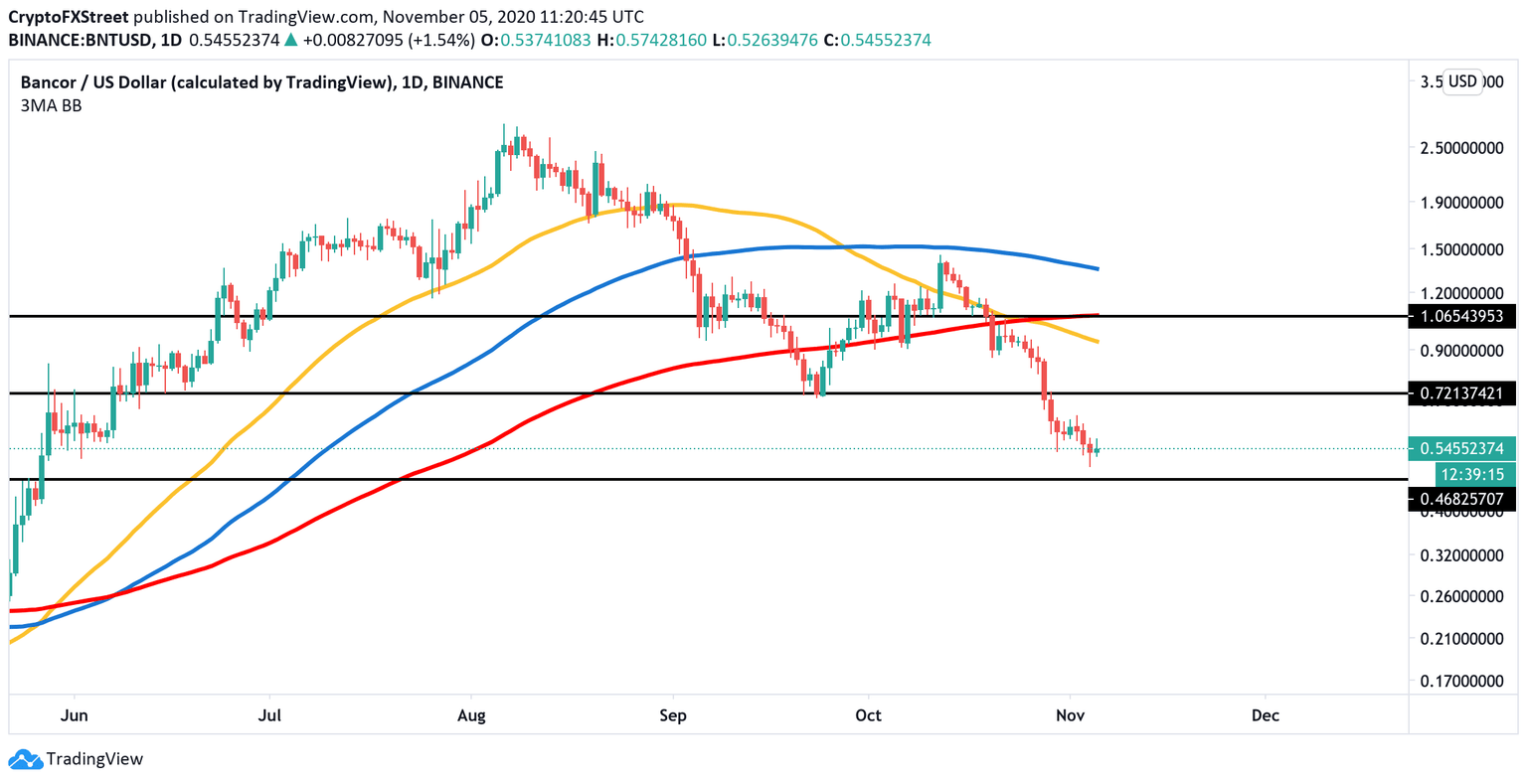

BNT created a local top on October 12 at $1.43 and has been losing ground ever since. In less than a month, the token surrendered the psychologically significant barrier of $1 and shed over 60% of its value. The dead cross – a technical situation when a fast MA crosses a slow MA from top downward – adds dark colours to the technical picture.

BNT/USD daily chart

However, the on-chain metrics imply that the price is ready to reverse and stage a sustainable recovery. In a recent report, the behavioural analytics company Santiment affirmed that Bancor whales have been accumulating the coin ever since the sell-off. The data shows that the BNT liquidity on the cryptocurrency exchanges dropped dramatically and continued to decline together with the price. Usually, the decreasing supply on the exchanges slows down the selling pressure and eventually leads to the correction, and the demand starts exceeding supply.

BNT supply on the exchanges

This development coincided with the sharp increase in the number of tokens held by top non-exchange addresses, meaning that whales were taking BNT tokens from the exchanges to their wallets.

BNT held by top non-exchange addresses

It is worth mentioning that the first resistance area comes at $0.7. Based on IntoTheBlock's "In/Out of the Money " model, over 2,300 addresses previously purchased over 26 million BNT tokens between $0.61 and $0.72. Notably, this supply wall coincides with the former support that limited the decline at the end of September and July. If the breakthrough is confirmed and buy orders continue to pile up, BNT may quickly move towards $1 with little resistance on the way.

BNT In/Out of the Money

On the other hand, a sudden spike in the selling pressure can push the price towards the recent low of $0.49. A sustainable move below this area will invalidate the bullish scenario. Under such circumstances, BNT price could drop towards the next local hurdle of $0.34.

Author

Tanya Abrosimova

Independent Analyst

%20%5B14.07.53%2C%2005%20Nov%2C%202020%5D-637401723754219982.png&w=1536&q=95)

%20%5B14.10.21%2C%2005%20Nov%2C%202020%5D-637401723502156033.png&w=1536&q=95)

%20Analytics%20and%20Charts-637401724700393385.png&w=1536&q=95)