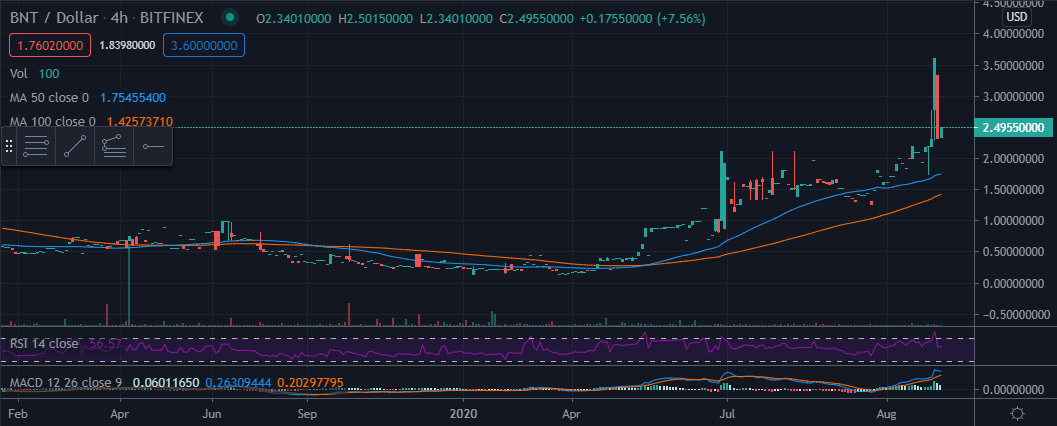

Bancor Price Forecast: BNT/USD blasts 23% into the sky, piercing $3.50 critical level

- Bancor recovers from support at the 50 SMA but stalls at $2.50.

- BNT/USD eyes $3.00 especially if the resistance at $2.50 is brought down.

In the last seven days, Bancor has gained at least 78% while wrecking in 23% in the last 24 hours. Following the crash in March, this digital asset has remained mainly bullish with gains breaking above several barriers including $0.5, $1.00 and $2.50. The impressive price action above $3.50 occurred in the first week of August with a monthly high traded at $3.62.

At the time of writing, BNT/USD is recovering from a retreat from the support at the 50 SMA. The price is dancing at $2.49 but all the effort and attention are focused on bringing down the resistance at $3.00.

Technically, BNT is out of danger and currently nurturing an uptrend. The bullish grip is highlighted by the RSI at 54.90 and the MACD at 0.2029. A bullish divergence puts emphasis on increasing buyer dominance in the market. Similarly, the RSI is moving upwards, also emphasizing the increasing buying pressure. Therefore, a break above $2.50 would encourage buyers to increase their entries, pulling the price above $3.00.

BNT/USD 4-hour chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren