Balancer Labs launches Boosted Pools with Aave to increase capital efficiency for DeFi yields

- Balancer Labs has joined forces with Aave to tackle decreased capital efficiency of yields deposited into AMM pools.

- Since traders typically use 10% of liquidity available in AMM pools.

- The new solution allows for the remaining unused liquidity to be deposited in lending protocols for more yield to be earned.

Balancer Labs has just announced the launch of Boosted Pools on decentralized finance (DeFi) lending protocol Aave. Users can now deposit a portion of unused liquidity in automated market maker (AMM) pools onto Aave to earn an additional yield.

Boosted Pools to provide higher yields

Automated portfolio and liquidity provider Balance Labs has collaborated with Aave to launch Boosted Pools aimed to solve the issue of decreased capital efficiency with yields on tokens deposited into AMM pools.

Traders usually only utilize 10% of the liquidity available on AMM pools given that trade sizes are smaller than the available liquidity. According to Balancer, with Boosted Pools, the idle remaining liquidity can be deposited into lending protocols for additional yield to be earned.

In order to provide higher capital efficiency, AMM Pools typically hold wrapped tokens of yield-bearing assets such as aDAI instead of DAI to improve the overall pool yield. However, wrapping and unwrapping tokens requires to be processed with a relayer and is not cost efficient if it is done during a swap.

The new Boosted Pools provides a solution for the issue of high cost of wrapping and unwrapping tokens during a swap, leaving the task to arbitrageurs, who are incentivized to perform the task.

Fernando Martinello, the co-founder and CEO of Balancer Labs stated that there are various levels of Boosted Pool innovations that lead to “concrete results, deeper liquidity, more efficient integrations for liquidity and higher yields.”

Balancer price bounces 13%

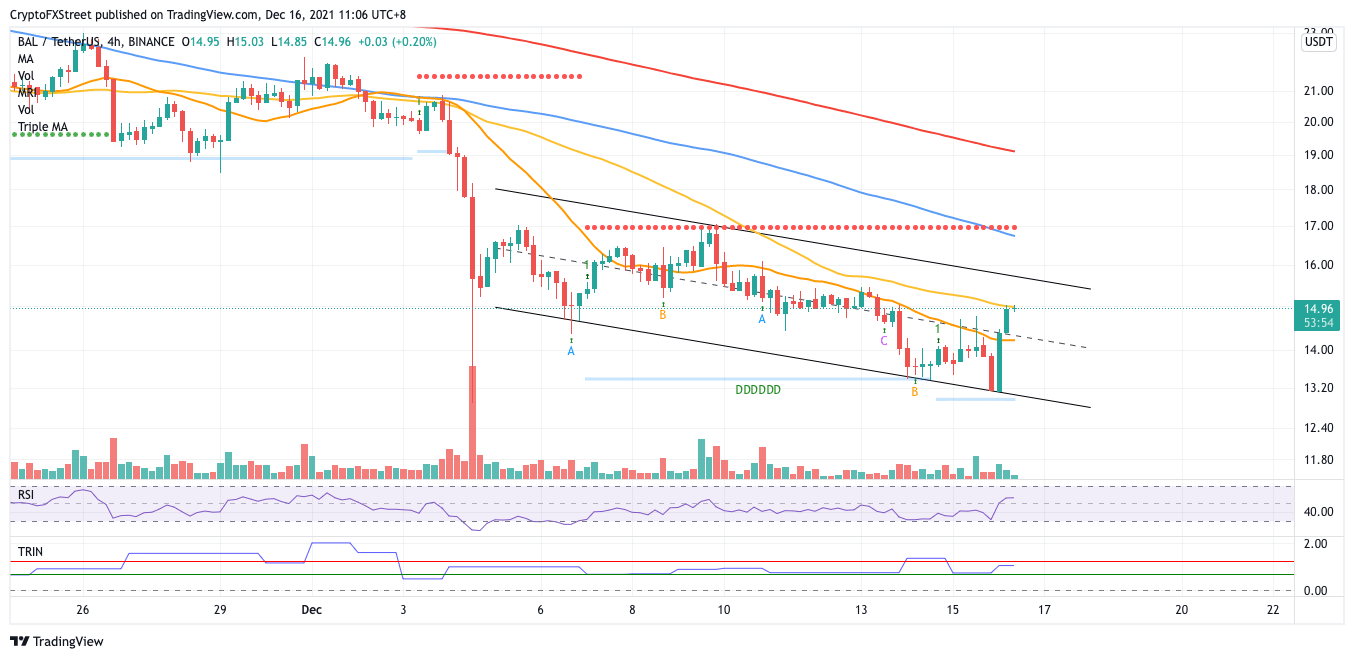

Balancer price has climbed 13% following the announcement on the launch of Boosted Pools. However, BAL continues to be sealed within a descending parallel channel, suggesting that the overall trend is still leaning bearish.

In order for Balancer price to escape the prevailing downtrend, BAL must climb above the 50 four-hour Simple Moving Average (SMA) at $15.04, then the upper boundary of the governing technical pattern at $15.61. Additional resistance may emerge at the 100 four-hour SMA at $16.76.

BAL/USDT 4-hour chart

If selling pressure increases, Balancer price may drop toward the 21 four-hour SMA at $14.24, coinciding with the middle boundary of the parallel channel.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.