Bitcoin bulls who still think the cycle peak has yet to come as retail investors haven’t piled in yet might be using an outdated playbook, according to a crypto executive.

“The idea that the cycle isn’t over just because onchain retail activity is absent needs reconsideration,” CryptoQuant founder and CEO Ki Young Ju said in a March 19 X post.

Ju said that those tracking retail movements using only onchain metrics will not have seen the full picture.

“Retail is likely entering through ETFs — the paper Bitcoin layer — which doesn’t show up onchain,” Ju said.

“This keeps the realized cap lower than if the funds were flowing directly to exchange deposit wallets,” he added, noting that 80% of spot Bitcoin exchange-traded fund (ETF) flows come from retail investors — a trend that Binance analysts already once observed in October last year.

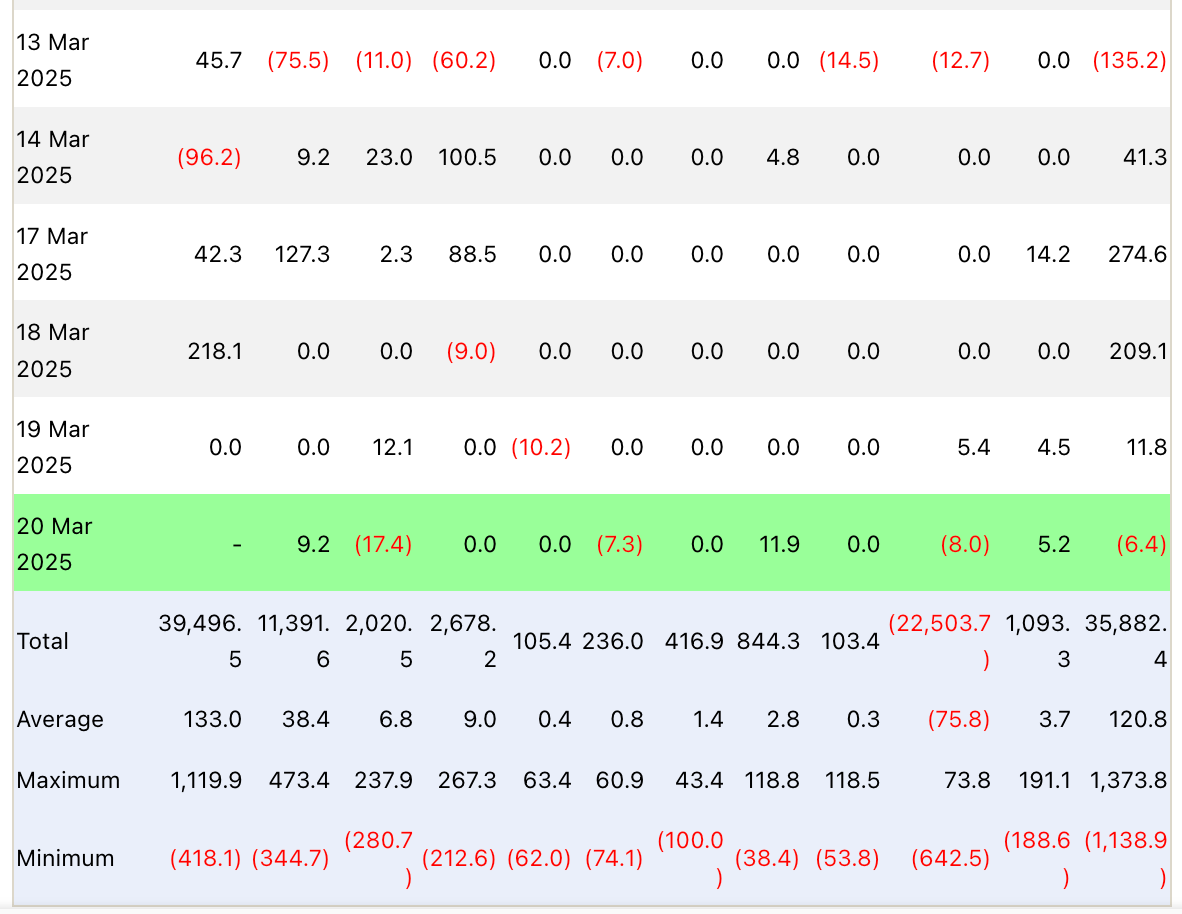

Since the launch of spot Bitcoin ETFs in January 2024, inflows have totaled around $35.88 billion. Source: Farside

At the time, the analysts said most of the ETF buying likely came from retail investors moving their holdings from wallets and exchanges into funds with more regulatory protection.

Ju was responding to counter-arguments over his earlier prediction on X that the “Bitcoin bull cycle is over” on March 17.

“I’ve been calling for a bull market over the past two years, even when indicators were borderline. Sorry to change my view, but it now looks pretty clear that we’re entering a bear market,” he said.

Ju explained that certain indicators are showing a lack of new liquidity, which is likely being driven by macro factors.

He also clarified when he said the bull cycle was over, he meant Bitcoin could take “6-12 months” to break its all-time high, not that it’s about to crash.

Traders often look at retail investor activity to spot signs of exhaustion or as a signal to start selling when the market appears overheated.

There are several sentiment indicators which help market participants understand the level of retail interest in the market. One of these is the Crypto Fear & Greed Index, which measures overall crypto market sentiment, reading a “Fear” score of 31, down 18 points from its “Neutral” score of 49 yesterday.

Other common signals used to track the level of retail interest in the crypto market include Google search trends for “crypto” and related keywords and the popularity of crypto applications in major app stores worldwide.

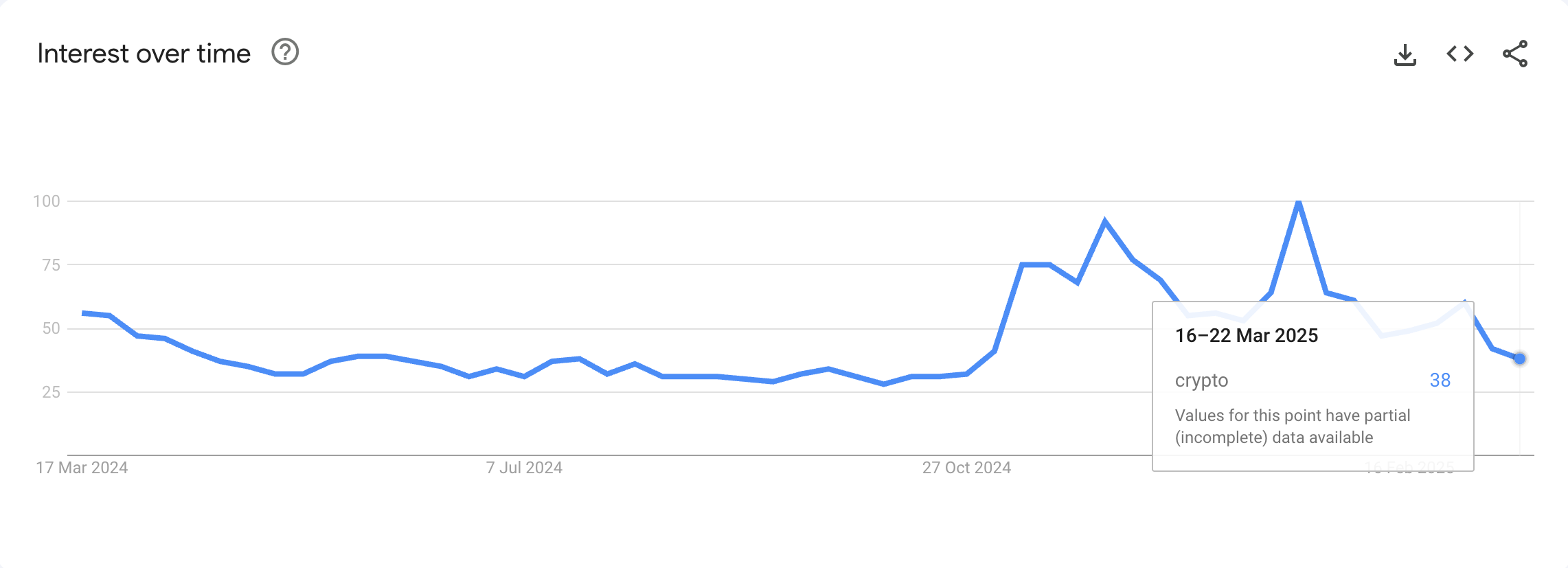

While the Google search score for “crypto” worldwide was at a score of 100 during the week of Jan. 19 - 25, when Bitcoin reached its all-time high of $109,000 and US President Donald Trump’s inauguration, it has since declined by almost 62%.

The amount of searches on Google for “crypto” has declined almost 62% since the end of January. Source: Google Trends

At the time of publication, the Google search score for “crypto” stands at 38, with Bitcoin trading 22% below its January all-time high.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum ETFs recorded net inflows of $104.1 million on Friday — their highest daily inflow since February 4, per SoSoValue data. As a result, the products saw a weekly net inflow of $157.1 million, which also marks their highest net buying activity since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation filed a registration statement with the Securities & Exchange Commission on Friday, signaling its intent to offer and sell a wide range of securities.

Bitwise hints at NEAR ETF following Delaware registration

The filing marks a crucial step before a firm submits an application for an ETF with the SEC. While Bitwise has not yet applied for a NEAR ETF with the SEC, similar actions preceded its previous XRP and Aptos ETF filings.

Bitcoin price could reach $285K by 2030 as Citigroup forecasts $1.6 trillion stablecoin inflows

Bitcoin price outlook strengthens as Citigroup projects $1.6 trillion stablecoin growth, calling them critical bridges between banks and blockchain.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.