Axie Infinity weakens, AXS to test $70 as support

- Axie Infinity price action and its overall trend remain the envy of most cryptocurrencies.

- Little signs of weakness or profit-taking on the daily chart.

- A move below the Kijun-Sen to test the Senkou Span B (strongest support) level is increasingly likely.

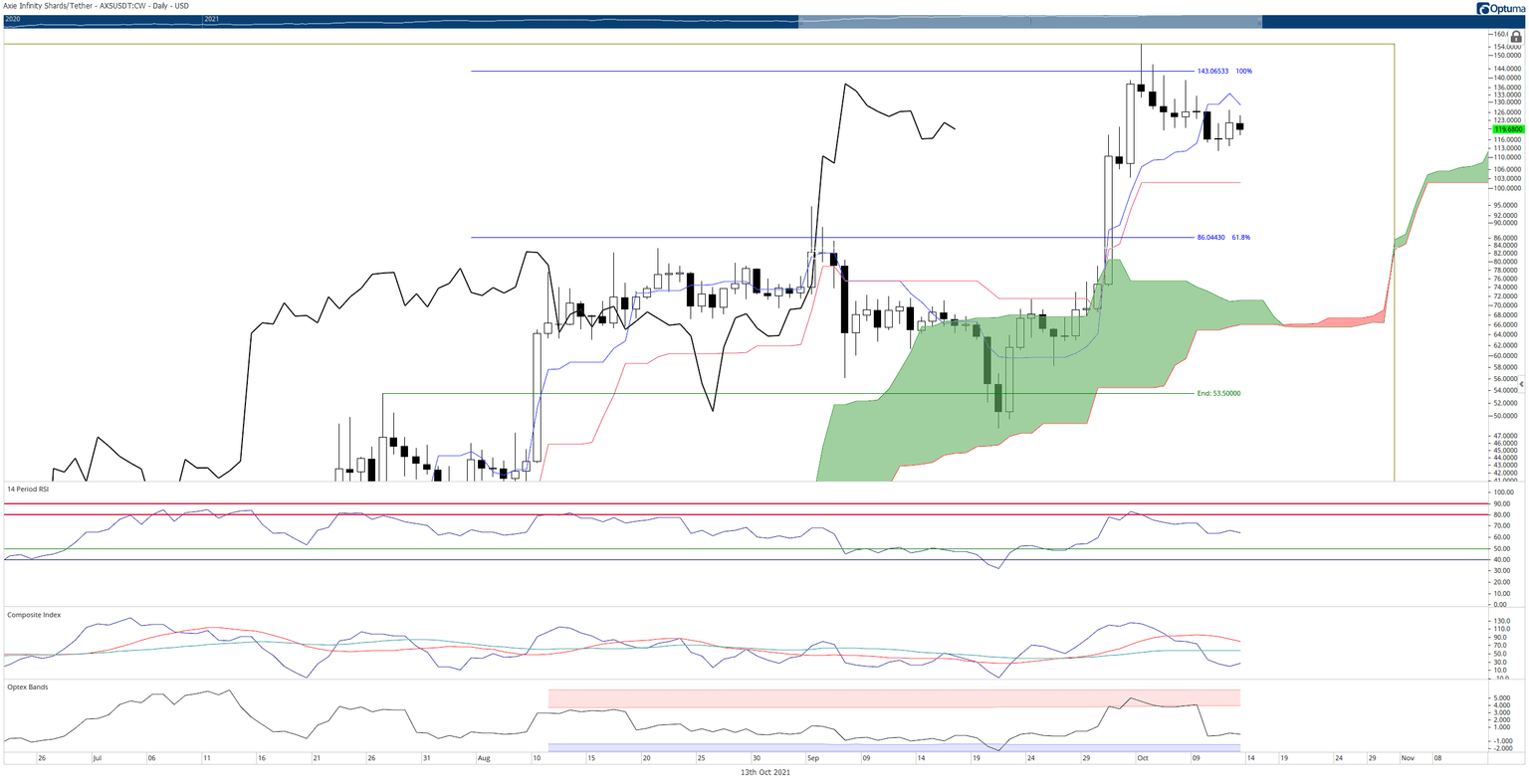

Axie Infinity price is little changed since hitting its new all-time high on October 4th. It has dropped below the Tenkan-Sen, but it remains above the Kijun-Sen and has found support against that level over the past two days.

Axie Infinity price enters consolidation; future buyers wait for a discount to re-enter

Axie Infinity price is nearing a vital time cycle within the Ichimoku Kinko Hyo system. The Kumo Twist (Future Span A crossing above/below Future Span B) occurs on October 15th. One of the phenomena of the Ichimoku system is the high probability of an instrument to find major or minor highs and lows near the Kumo Twist – especially if there has been a strong trend immediately preceding that date.

If Axie Infinity price were to experience a temporary move south, that would mean a likely break of the Kijun-Sen at $1.06. Below $106 is the most substantial support level in the Ichimoku system: Senkou Span B at $70. However, the Kumo Twist is an area where the Cloud is at its weakest and thinnest. Therefore, buyers will want to be careful of adding to Axie Infinity near the $70 level, especially if it is trading near the Kumo Twist itself. There is a threat that price could fall right through the Kumo Twist and move to the $50 range.

AXS/USDT Daily Ichimoku Chart

However, give the strength of Axie Infinity price and its resilience during the most recent weakness seen in the crypto market over the past couple of days, it is entirely probable that Axie Infinity would not see a drop. The Kijun-Sen is very flat, and that represents difficulty in moving price lower.

Bulls will want to watch for a move that positions Axie Infinity price above the Tenkan-Sen as this could trigger another upswing that would see Axie Infinity price make another move to new all-time highs – likely the $200 level.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.