Axie Infinity shows promising upside potential, but watch out for AXS dead-cat bounce

- Axie Infinity price bounced off a weekly pivot level as it makes a roaring comeback.

- Following daily closes will be critical to determine if this recovery is solid.

- AXS’s price action will need to be monitored to avoid falling into a dead-cat bounce.

Axie Infinity price had difficulty recovering the past few weeks, and it was difficult for buyers to look for an entry as actual solid entry points were quite far off. The pick-up in current global market sentiment has shifted the price action in AXS to the upside.

Axie Infinity price looks promising to the upside, but is the entry point solid enough?

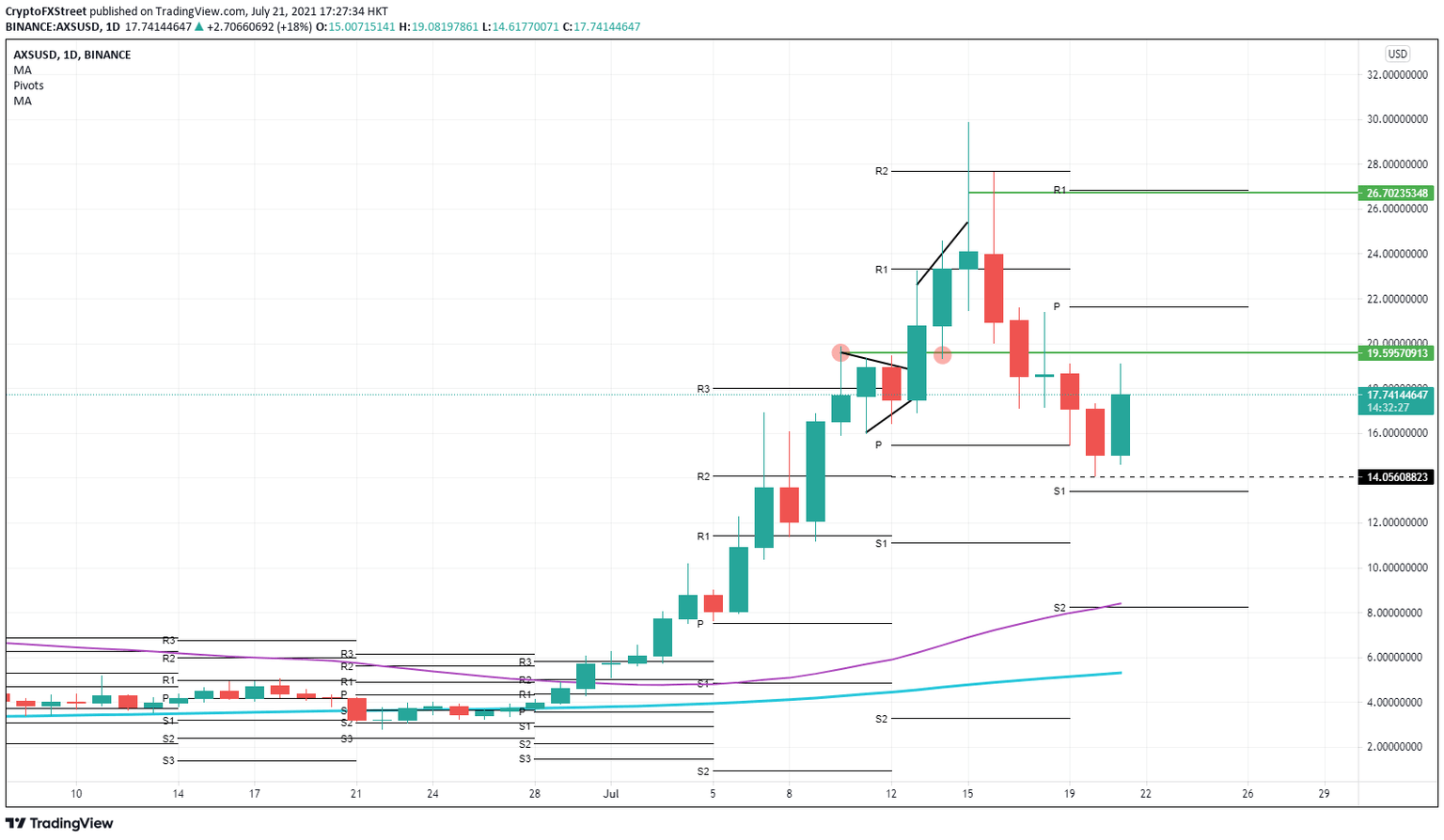

The main question in the rally unfolding today is if the entry-level is stable enough like other cryptocurrencies. Bitcoin, Ethereum and Polkadot, for example, had better entry levels. For Axie Infinity price, the previous R2 resistance pivot from two weeks ago at $14.05 was for buyers the cue to get long. It does look a fit feeble as a solid entry point for a long.

It will be essential to have a look at higher levels like $19.60, a critical resistance level that needs to be tested and monitored. If Axie Infinity price can close above and buyers withhold from taking any profit around that level, they can control the price action. This way, AXS short sellers will get squeezed out of their position and buyers keep control.

A close above $19.60 will thus be vital for the long positions being built. Should that level be rejected, Axie Infinity price could fall into a dead-cat bounce and dip lower toward $14.05 as it will prove too fragile for sellers to take over again in order to push price action to the downside.

In that last case, $14.05 will be tested again and might break even lower toward further downward levels where AXS buyers feel more comfortable stepping in.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.