Axie Infinity set to reclaim $85-handle in a bullish wave

- Axie Infinity sees investors returning with significant interest.

- AXS sees broad inflow from both investors and retail as Russians are looking for alternative means of payment.

- Expect to see momentum building, resulting in news highs for 2022.

Axie Infinity (AXS) is on the front foot again as investors have jumped into the price action since Monday. It's a bit counterintuitive as global markets had one of their worst days yet, but cryptocurrencies saw inflows from both investors and retail as people in Russia seek alternative forms of payment that are not being sanctioned. With that, demand is thickening in AXS and could see a massive blowout towards $85.00, making new highs for 2022.

AXS bulls set to make new highs for the year

Axie Infinity is back in good shape as the past two days' inflow has come from investors and everyday individuals pouring into the cryptocurrency space and putting AXS on the front foot. Investors are starting to look beyond the scope of Russia and Ukraine and are looking further down the line when cryptocurrencies will come on the front foot. It is a different story for the retail input, where several crypto exchanges are seeing overall demand from Russia as people look for alternative means of payment to bypass current sanctions to buy food and pay their bills.

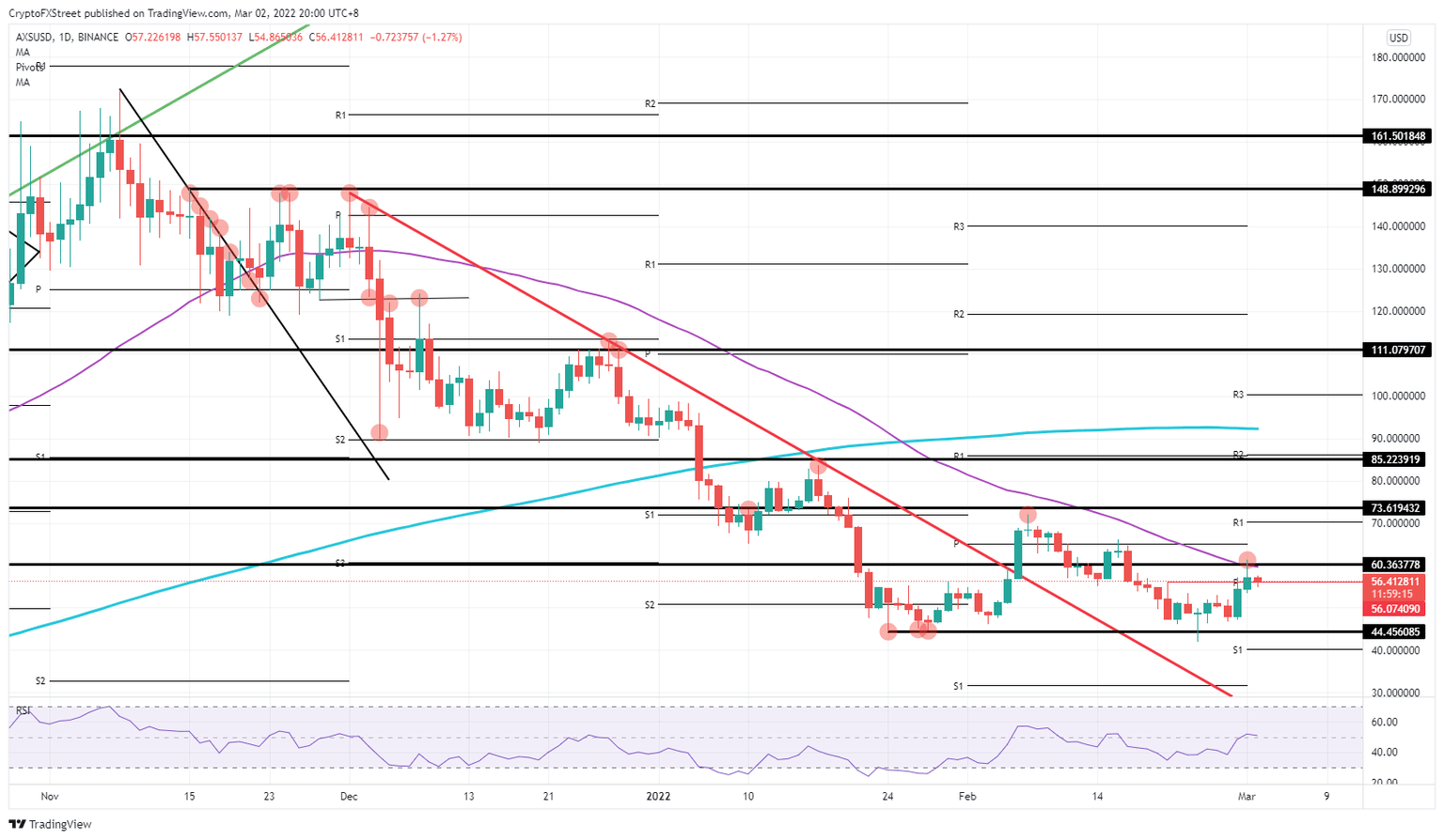

With that trifecta of double inflows into AXS price action, expect to see some more upticks unfold in the coming days. Once the 55-day Simple Moving Average (SMA) at $60.36 gets broken together with the old pivotal level, expect to see a sharp rise towards $70.00 - $ 73.62. With that move, a new high for 2022 will be printed, and with the persistent demand for cryptocurrencies out of Russia, expect to see even $85.22 and the R2 resistance level for this month to be toppled by bulls ramping up AXS price action.

AXS/USD daily chart

Still making headlines is the massive deployment of Russian troops into Ukraine with several media reporting that Kyiv is getting surrounded and cut off from the rest of Ukraine. With another possible failure in peace talks, expect further ramping up of the violence, which would push AXS back to supportive levels at $44.45. Bears may weigh on that heavily to push price action below that level towards $40.00 and the monthly S1 support level.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.